Alternergy Holdings Corp., a company focused on renewable energy, plans to conduct an initial public offering (IPO) on March 24. The company aims to raise up to P1.87 billion from the sale of up to 1.15 billion common shares, with an option for an additional 115 million shares. The offer price is set at a maximum of P1.48 per share, which could result in gross proceeds of up to P1.70 billion from the sale of the firm’s shares. This is a lower number of common shares than the company previously announced in June 2022, which was set at 1.28 billion shares, with an overallotment option of up to 192.22 million.

Prospectus and Disclosures: https://www.alternergy.com/company-disclosures

The estimated net proceeds from the IPO amount to P1.62 billion, and the company plans to allocate the funds accordingly. Approximately 35% or P564 million will be used for the construction of ongoing projects, while 32% or P522.19 million will go towards the payment of shares from the recently acquired Kirahon Solar Energy Corp. About 21% or P340 million will be used for the pre-development expenses of pipeline projects.

Alternergy has planned to commence the Solana solar project and early works for the Lamut hydropower project in the first quarter of 2023 for projects under development.

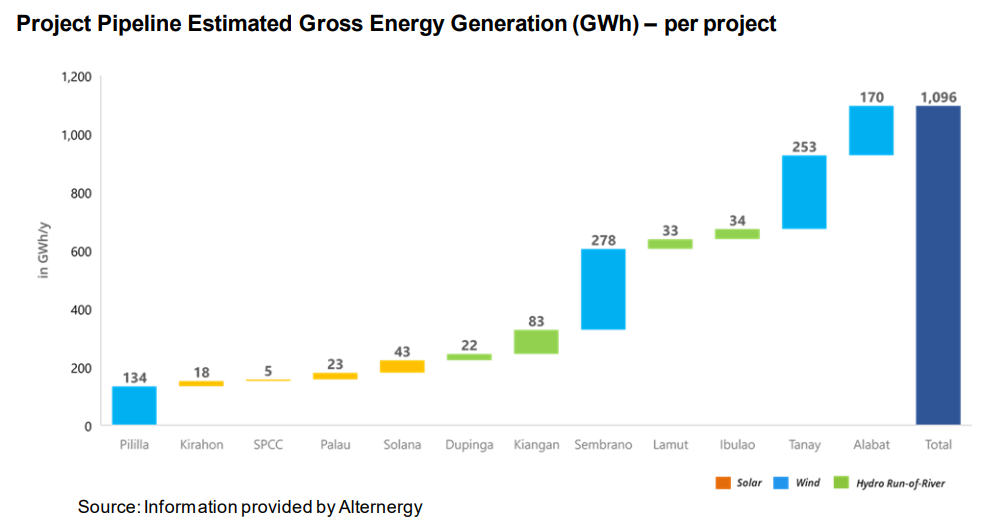

The IPO is expected to finance the pre-development activities of other projects, such as the Ibulao hydropower project, Tanay wind project, Alabat wind project, and offshore wind projects with an estimated capacity of 1,000 megawatts.

Alternergy Holdings Corp. has updated its prospectus as of February 14, 2023, and has scheduled the listing of its shares under the ticker symbol ALTER on the main board of the Philippine Stock Exchange (PSE) on March 24. The offer period for the IPO is expected to take place from March 13 to 17, subject to approval by the PSE and the Securities and Exchange Commission.

The Owner

Vicente Pérez, is the current Chairman and Founder of Alternergy Holdings Corporation. He previously held the position of Philippine Energy Secretary from June 2001 to March 2005, during which time he promoted clean energy and created a ten-year renewable energy policy framework. He was instrumental in establishing strategic energy partnerships with several countries, including the UK, USA, and various Asian nations.

Before his government service, Vince gained 17 years of experience in emerging markets, specifically in debt restructuring, capital markets, and private equity. He began his career at Mellon Bank in Pittsburgh as a Latin American credit analyst and Mexico desk officer. In 1987, he joined Lazard Brothers’ debt trading team in London and formed its emerging markets team the following year. He became the first Asian General Partner at Lazard Frères at the age of 35, and from 1995 to 1997, he served as Managing Director of Lazard Asia.

Vince founded Next Century Partners, a private equity firm, in 1997. He also launched the Philippine Discovery Fund and the Asian Conservation Company, a venture philanthropy organization that acquired El Nido Resorts in the Palawan province, an eco-tourism destination. He assisted several investee companies with their Singapore Stock Exchange listings and was Chairman of Merritt Partners, an energy advisory firm focused on Asia.

Vince has served as an independent director of Energy Development Corporation and SM Investments. He is currently an independent director of Banco de Oro Universal Bank and Double Dragon Properties. He is also on the advisory boards of Pictet Clean Energy Fund and Yale Center for Business in the Environment. Vince was Chairman of WWF-Philippines and trustee of WWF-International. He was Vice Chairman of the National Renewable Energy Board from 2009 to 2010. He obtained an MBA from the Wharton Business School of the University of Pennsylvania and a Bachelor’s Degree in Business Economics from the University of the Philippines. He was a World Fellow at Yale University and has lectured an MBA class on renewable energy in emerging countries.

The Company

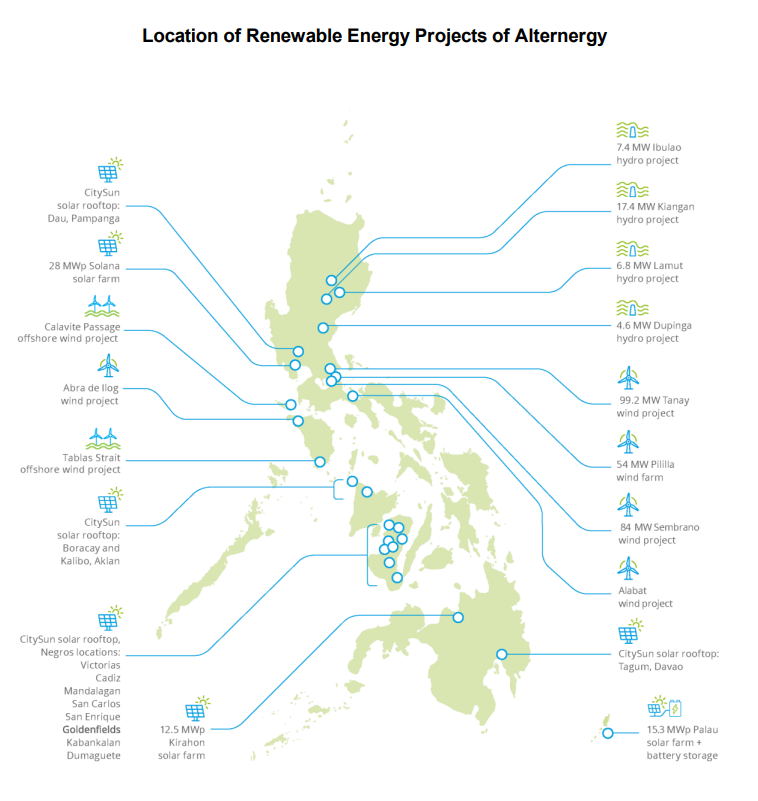

Alternergy Holdings Corporation is a renewable energy holding company in the Philippines. Its portfolio includes investee companies working on various renewable energy projects, including wind, solar, hydro, floating solar, and battery storage power projects. The company aims to be a leading renewable energy firm in the Philippines and promote a sustainable future for the next generation.

The company was founded by a management team, led by former Philippine Energy Secretary Vicente Pérez, who was involved in the development of the 33 MW Bangui Bay wind farm in North Luzon, the first commercial wind farm in Southeast Asia. Three of Alternergy’s founding partners were also involved in the project and later came together to create Alternergy, applying their experience to break new ground on more renewable energy projects.

The management team has extensive experience in power development, energy policy, and emerging markets, and has pioneered wind power in Southeast Asia. Since 2008, they have developed 67.24 MW of operating assets in wind and solar, with a pipeline of assets under development that could potentially have an installed capacity of up to 1,369 MW of renewable energy, including hydro, wind, and solar projects.

Alternergy’s investee companies are committed to promoting sustainable energy solutions and contributing to the growth of the renewable energy industry in the Philippines.

Before the establishment of Alternergy, one of the company’s founding partners held an individual share in NorthWind Power Development Corporation. This corporation commenced the operational activities of the 25 MW Bangui Bay wind farm in Ilocos Norte in 2005, which was the first commercial wind farm in both the Philippines and Southeast Asia.

Alternergy Holdings Corporation has achieved several noteworthy accomplishments throughout its history. Some of these “firsts” include:

- Receiving some of the first contracts from the Philippines Department of Energy for wind power in 2008, which allowed Alternergy to conduct wind resource assessment studies in six potential sites.

- Securing the first non-recourse project financing for a wind project without corporate guarantee through Alternergy Wind One Corporation’s Pililla Rizal wind farm. This innovative financing, which involved three domestic banks, was recognized with a Sustainable Finance award by the International Finance Corporation.

- Obtaining the first bilateral solar contract approved by ERC for the Kirahon Solar project. In the process, Alternergy educated regulators on the unique attributes of solar power and paved the way for an appropriate approval process for future bilateral solar contracts as solar projects become more prevalent.

- Securing financing for eight commercial mall solar rooftops under a single facility, thus creating the first multi-site solar rooftop portfolio under one project financing facility through Solar Pacific CitySun Corporation.

- Developing the first solar PV and battery energy storage hybrid project in the Republic of Palau, which represents the largest solar hybrid project in the western Pacific and the first battery energy storage system in the region.

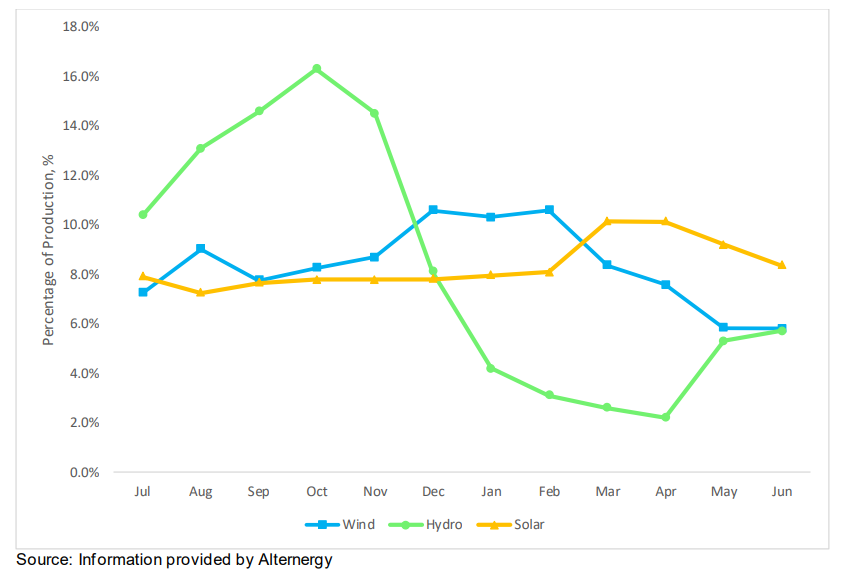

Alternergy prides itself on being one of the few renewable energy developers that have a diversified “Triple Play” portfolio, covering most of the key renewable energy resources. This portfolio consists of solar, wind, and run-of-river hydro, and battery storage plants. By having this diversified mix of complementary power generation revenues, the Group is able to mitigate the risks associated with overreliance on a single type of energy source. This approach ensures that the Group can achieve a stable and consistent revenue stream throughout the year, irrespective of any seasonal variations in energy generation.

To provide a clear picture of how this portfolio works, the company has designed a chart that presents the complementary seasonal generation of the “Triple Play” renewable energy portfolio. The chart highlights the different energy generation patterns of the three energy sources throughout the year. It shows how the solar and run-of-river hydro plants generate more power during the dry season, while the wind farm produces more power during the rainy season. With the addition of battery storage plants, the Group is able to store excess energy generated during the peak season and use it during the off-season when energy demand is high.

This “Triple Play” approach to renewable energy is a testament to the Alternergy’s commitment to providing sustainable and reliable power to its customers. By utilizing a diversified mix of renewable energy resources, the company is well-positioned to meet the ever-increasing demand for clean energy, while also contributing to the overall goal of reducing carbon emissions and creating a more sustainable future for all.

Summary

Renewable energy has been gaining attention in the Philippines in recent years due to various factors, including the country’s vulnerability to climate change, its high energy costs, and the need to diversify its energy mix. In response to these challenges, the government has been implementing policies and initiatives aimed at promoting the development of renewable energy in the country.

One of the key initiatives is the Renewable Energy Act of 2008, which provides incentives to encourage the development and use of renewable energy sources, including solar, wind, hydro, geothermal, and biomass. The government also established the Department of Energy’s Renewable Energy Management Bureau to oversee the implementation of the Act and facilitate the development of renewable energy projects in the country.

The Philippines is experiencing a growing demand for electricity due to a rapidly increasing population and a booming economy. With a population of over 110 million people, the demand for energy continues to rise as more households, businesses, and industries require electricity to operate. In addition, the country’s economic growth has spurred the development of new commercial and industrial areas, which require more power to operate.

I strongly support the development of renewable energy in the Philippines. Recently, some companies such as SPNEC, CREIT, and ASLAG have been listed in the stock market, offering opportunities to invest in the transition from oil and coal to renewables. Alternergy, with its Triple Play strategy of wind, solar, and hydro, has an edge in the market, thanks to its experienced team. However, the company’s operations are currently limited to the Philippines. During an investor briefing, Alternergy announced that it is bidding on renewable projects outside the country, which could offer new investment opportunities. Investing in Alternergy and other renewable energy companies can help in securing a sustainable future for the Philippines and the world.