The most frequently asked questions about the stock market answered “When is the best time to Buy and Sell Stocks?”. This question probably belongs in the top 5 questions investors asked when they start their investing journey. If this is the first time you are buying into the market I highly suggest reading the following articles first as this will give you basics about investing, stock market, and trading:

The first thing we need to ask ourselves before buying a stock is our objective, are we in it for the long term savings or medium-term or quick trade? We cannot simply answer the question with one answer it always depends on your strategy on how will you grow your portfolio.

Essentially, we want to buy stocks when they are cheap and the market is down. We are on a unique phase, as I write this post(August of 2020), we are on the early stage of the Coronaconomy and the markets are heavily battered by the pandemic and the question everyone is asking is ‘When will hit the bottom?’. Honestly speaking, knows the answer and if you try to time the market, you’re just as likely to miss out on buying opportunities as you are to get a good deal by waiting.

Best day to Buy Stocks

Monday, Others believe that certain days offer better returns than others, but over the long run, there is very little evidence for such a market-wide effect. Most investors and traders believe that the first day of the workweek is always the best. It’s called the Monday Effect. For decades, the stock market has had a tendency to drop on Mondays, on average.

Studies have attributed this to a significant amount of bad news that is often released over the weekend so normally if there’s bad news, the sellers will flood the market on Mondays. So if you are a long term investor that buys stocks once a month, better do it on a Monday and potentially snapping up a discount.

Best day to Sell Stocks

Friday, did you guessed it right? Monday may be the best day of the week to buy stocks, it follows that Friday is probably the best day to sell the stock. Alternatively, because stocks tend to be priced higher on a Friday, and Monday would be the best day to buy according to experts. During the course of the week, the markets often experience upward trends that will peak on the final weekday, before they close for the weekend. Due to generally positive feelings prior to a long holiday weekend, the stock markets tend to surge ahead of these observed holidays.

Based on the results, in a bear market, buy on Monday (best in 2007-2009) or Tuesday (best in 2000-2002) and sell on Thursday (best in both bear markets). For a bull market, buy on Friday (best in both bull markets) and sell on Wednesday (best in both periods) or Thursday (best in 2009-2010).

Please note that this is not the same every time, the stock market is not that simple that you buy on Monday and you sell on Friday. There are a lot of factors you need to consider before doing a transaction, these data are only based on patterns on the market and historical data. A snack fact, most traders make money on the first two hours of the trading day.

Best month to Buy Stocks

August, often called the ghost month, August sees stock prices taking a dip especially in the Asian markets. According to Chinese tradition, particularly Buddhists and Taoists, the Festival of the Hungry Ghost the period starts on August 11 and will end on September 9.

Additionally, most American and European global fund managers take their annual vacation during this time too. When wealthy Chinese investors are busy with their tradition and institutional funds become less active in the market, stock prices will have the tendency to have a sideways or downward movement.

For traders, this is a time to be cautious because of thin liquidity in the markets. But for long-term investors, it’s definitely a good time to buy, especially blue chips stocks that went down due to this temporary weakness in the market.

September and October, As the ghost month settles, we then enter the typhoon prone months in the Philippines where most Filipinos stay inside and not spending, crops are affected and infrastructure projects of the government and private sectors are mostly halted. The market is starting to pick up as we enter the Ber’months. It’s the start of the last quarter of the year, and investors are consolidating to maximize their investments before the year ends.

Best month to Sell Stocks

February, the Chinese new year fall this month so Asian markets usually rally during this month, as this is opening month of the year. Companies sometimes announce their plans for the year during the first two months of the year so people buy into the good news.

People also invest their extra cash during from holiday season to the stock market. Having more money means being able to buy more stocks. You can use this opportunity to sell some stocks and take advantage of the high spirits of the market and investors. We might consider January a good month to sell stocks as well particularly the late half of the month.

One of the oldest strategies experienced stock traders use, “Buy on rumor, sell on news”.

Price to earnings ratio.

The P/E ratio helps investors determine the market value of a stock as compared to the company’s earnings. It shows what the market is willing to pay today for a stock based on its past or future earnings. A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued. Conversely, a low P/E might indicate that the current stock price is low relative to earnings.

P/E ratio is kind of confusing at first but it quite simple, say for example you are going to the supermarket and these apples represent a stock that belongs to the same sector.

Apple ‘A’ is fresh and juicy. Apple ‘B’ is clearly dried. Apple ‘A’ costs you P2.00 while Apple ‘B’ costs you only P1.00. This clarifies the fact that a consumer will be paying more for Apple ‘A’ as it is better in taste and quality compared to Apple ‘B’.

The same goes for a stock. Hence, we can say that companies with better fundamentals will command more price as compared to companies with weaker fundamentals. Let’s have another example:

Suppose you have to make a choice between Apple ‘A’ and Apple ‘B’. Both of them are fresh and juicy. However, Apple ‘A’ costs you P2.00, whereas Apple ‘B’ costs you only P1.50. Hence, you choose Apple ‘B’ over Apple ‘A’. But what if apple ‘A’ is owned by a distinguished businessman or conglomerate with a good history of growth? Maybe you wouldn’t mind if it cost a little more and choose ‘A’.

This again can be related to buying a stock. Hence, we can again say that companies that are undervalued and have good fundamentals must be bought compared to overvalued companies with good fundamentals.

Now the important element is to understand in case of stocks as to which stock is overvalued and which is undervalued. For this, we need to understand the formula for PE ratio.

PE ratio= Market Price/ Earnings per share.

In other words, it is nothing but the market price one is ready to pay for every Peso earned by the company per share. Needless to say that a company with a higher PE ratio is more valued compared to a company with a lower PE ratio.

So whether to buy a company with a lower PE multiple or to go with a company with higher PE multiple?

Buying a grossly undervalued stock with no fundamentals would make no sense. Buying a great stock that is overvalued again would make no sense. The key lies in choosing the right mixture of great fundamentals and lesser valued stock which has got legs to run.

Stock trading is a different game than simply investing if you want to do stock trading there are tons of things you need to study. Let me just give you a quick checklist of what Brokers and Traders are monitoring before they execute a trade.

Company news

Company news. A press release or reports directly from the listed company. Listed companies are required by the Securities and Exchange Commission (SEC) to disclose all material information to the investing public, it can be accessed by everyone for free so I suggest you bookmark this link as this contains information that can help with your trading and research. The PSE Edge website https://edge.pse.com.ph/ .

Technical and Fundamental Analysis.

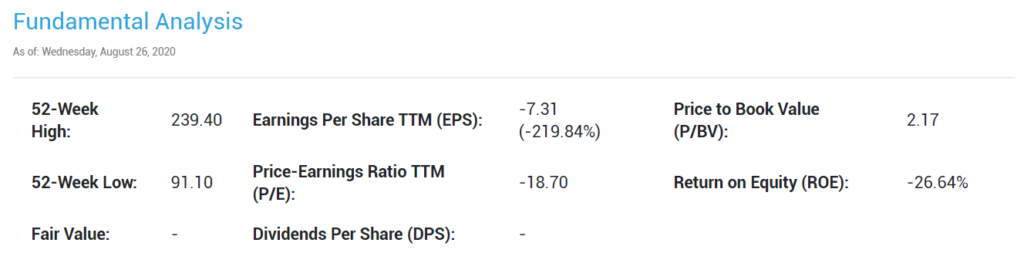

Fundamental analysis (FA) is a method of measuring a security’s intrinsic value by examining related economic and financial factors. Fundamental analysts study anything that can affect the security’s value, from macroeconomic factors such as the state of the economy and industry conditions to microeconomic factors like the effectiveness of the company’s management.

The end goal is to arrive at a number that an investor can compare with a security’s current price in order to see whether the security is undervalued or overvalued.

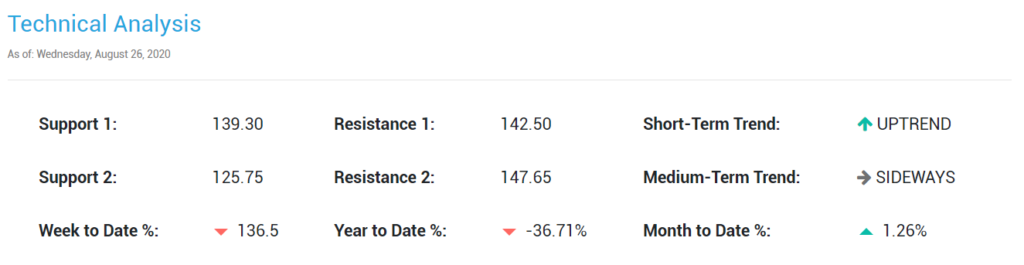

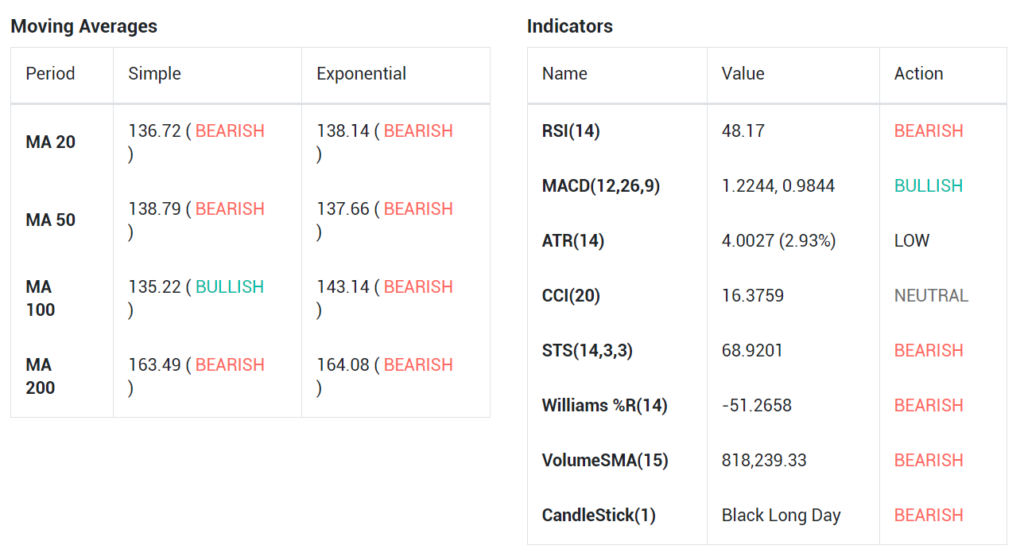

Technical Analysis(TA) is a method used to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. If you want to know the invertors sentiment on a given stock you should look at the TA.

Unlike fundamental analysis, which attempts to evaluate a security’s value based on business results such as sales and earnings, technical analysis focuses on the study of price and volume. Technical analysis tools are used to scrutinize the ways supply and demand for security will affect changes in price, volume, and implied volatility.

Technical analysis is often used to generate short-term trading signals from various charting tools, but can also help improve the evaluation of a security’s strength or weakness relative to the broader market or one of its sectors. This information helps analysts improve their overall valuation estimate. Technical and Fundamental analysis reports are often available on the online platform of brokers some also send these reports via email. The best place to look for TA and FA of a listed company is Investagrams it’s fast and it’s free.

MSCI Rebalancing

The MSCI Emerging Markets Index stands for Morgan Stanley Capital International (MSCI) and is an index used to measure equity market performance in global emerging markets. It is just one index created by MSCI, which has been constructing and maintaining them since the late 1960s.

The MSCI Emerging Markets Index consists of 26 developing economies including Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

Basically, this is when the large basket of stocks move across the global market. The MSCI Emerging Markets Index is reviewed four times a year—February, May, August, and November. During this period we are seeing large foreign flows going in and out of the market and it usually reflects the sentiment of foreign investors and fund managers to the Philippine Market this is a good time to make a quick buck with the high liquidity in the market.

Buy on rumor sell on news

One of the oldest tricks in the book. When you “buy on the rumor” and then “sell on the news,” you stand to make a nice profit on your stocks. Market stock traders buy on the rumor, which means that they treat forecasts prepared by economists and analysts as though the event had already happened precisely as predicted. In other words, they “build in” the forecast to the price, creating the very high on the price bar that the news is supposed to produce.

To sell on the news relates to the event itself. Traders sometimes get the seeming paradox of a price reaching a new high before the event and falling lower immediately after the event, even when the news matches the forecast.

The lower price comes about because the early birds take profit on the up move that they themselves engineered. The new low is usually short-lived. After all, the forecast was for good news and the good news occurred, so the news was properly built-in and the new high is a suitable price.

If the news is much better than forecast, though, traders don’t take profit because better-than-expected news draws in new players and sends the price higher still. Then the early birds are positioned to make even better profits. If the news fails to match expectations, traders and investors alike sell, and the dip may turn into a longer-lasting price drop.

Conclusion

The first thing you need to do is to make strategies that fit you and your goals. There are investors, day trader, and long term trader, you need to know which you are comfortable doing. Day traders will most of the time exit the stock on the same day. While long term traders don’t mind what the stock is doing at any given week.

Traders in the market know these quotes by heart “retreat and live to fight another day” it is more important to cut your loss than actually trying to find the winning stock to make money and don’t give in to FOMO and Hype in social media, always do your own research.

Another thing, do not be greedy, do not approach this like you are gambling where you think you must make up for the loses. My favorite thing to say to my fellow traders “Pag Kita ka na, Benta mo na!” because greed is a psychological thing, we are wired to think this way that is why we must take out your emotions when trading, face the facts and indicators. Follow your trading strategy. Good luck!

-StockBytes PH, August 28, 2020.

Read more: Investopedia

*The owner of StockBytes PH is a licensed stockbroker, contact us if you want to open a broker-assisted or online account. Contact us/Services.

Ready to start your financial journey? email us at [email protected] or follow us on Facebook and Twitter.

When is the best time to Buy and Sell Stocks?