Emerging Markets VS Coronaconomy how strong is the Philippine Economy

COVID-19 continues to spread rapidly around the world. Almost every country has reported cases, but the burden is asymmetrically distributed. In the past weeks, approximately 70% of new confirmed cases have been reported in Europe and in the United States. To an extent, that’s because countries are at different stages of the pandemic. Some that were effective at initial containment, such as Singapore and Hong Kong, has seen a resurgence and are implementing additional measures to address it.

Covid-19 hurts emerging economies in at least three ways: by locking down their populations, damaging their export earnings, and deterring foreign capital. Even if the pandemic fades in the second half of the year, (Gross Domestic Product)GDP in developing countries, measured at purchasing-power parity, will be 6.6% smaller in 2020 than the International Monetary Fund (IMF) had forecast in October.

How about the Philippines? In what state are we when compared to other emerging economies?

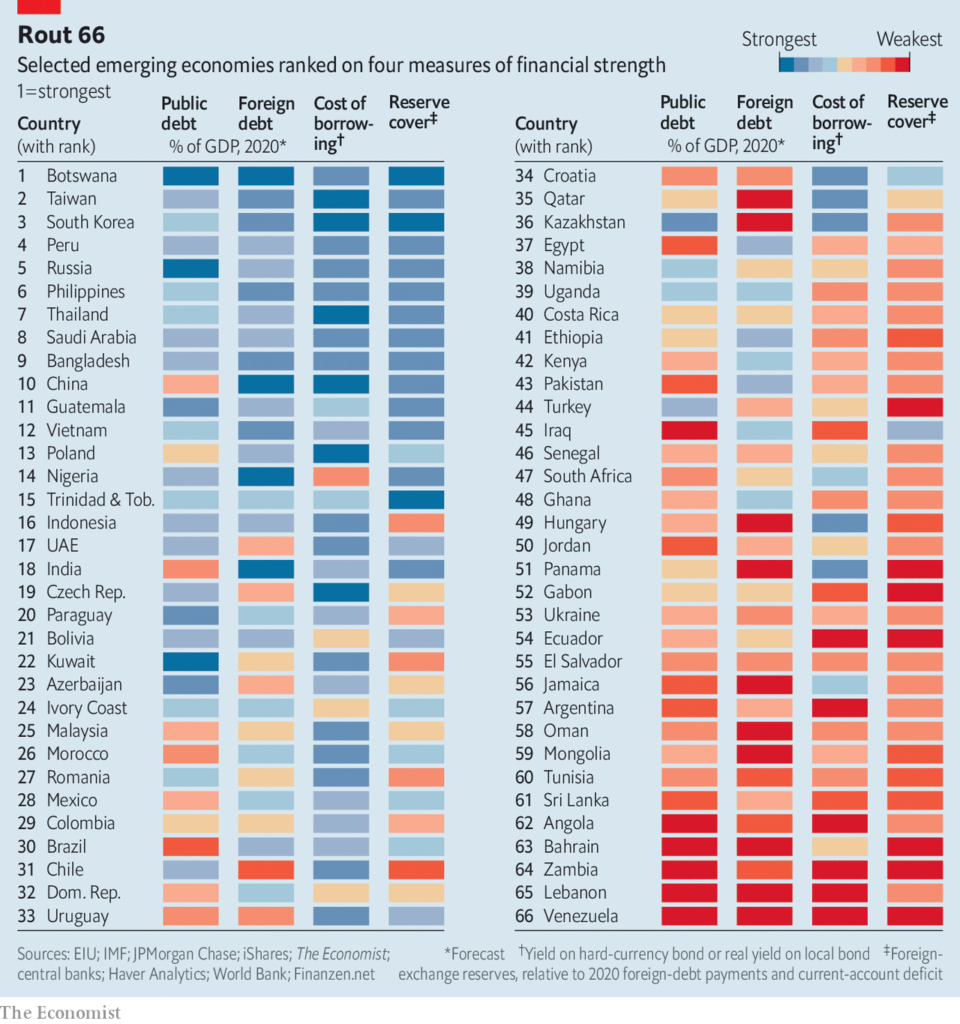

Economist.com, owned by The Economist Group, a multinational media company headquartered in London and best known as the publisher of The Economist newspaper Founded in 1843. The Economist Group specializes in international business and world affairs information. They released the ranking of Financial strength of emerging market economies vs COVID and Philippines Rank 6 of 66.

The Bangko Sentral ng Pilipinas (BSP) on Thursday reported the country’s highest foreign currency reserves amounting to USD88.995 billion as of March 2020. Data released by the central bank showed that the latest gross international reserves (GIR) figure is only preliminary, but this is already higher than the USD88.187 billion as of last February.

The BSP said the latest foreign reserves level of the country is enough to cover 7.9 months’ worth of imports of goods and services and payments of primary income, higher than the international standard of three months’ worth of cover. More..

BSP Governer Benjamin Diokno, in a Viber message to journalists on Friday, said the country’s ranking on the list “is consistent with what we’ve been saying all along: the coronavirus (Covid-19) pandemic hit the Philippines from a position of strength.”

“The Philippines before the Covid-19 crisis was on the road to A-rating. We’re not saying that the Philippines has not suffered from this crisis, together with the rest of the world. But our relative position among emerging economies gives us confidence that the Philippines would have a U-shaped bounce-back once the pandemic fades,” he said.

Argentina has missed a $500m payment on its foreign bonds. If it cannot persuade creditors to swap their securities for less generous ones by May 22nd, it will be in default for the ninth time in its history. Ecuador postponed $800m of bond payments for four months to help it cope with the pandemic; Lebanon, which defaulted on a $1.2bn bond in March; and Venezuela, which owes barrelfuls of cash (and crude oil) to its bondholders, bankers and geopolitical benefactors in China and Russia and more. Other countries are fighting a hefty battle with the Coronaconomy, the Philippine economy has the arsenal to fight it.

Takeaway: The Philippines as among countries with high financial strength validates the authorities’ belief in a robust economic recovery from the pandemic. Once a vaccine is released there is going to be a rally in the global market and that is for sure, the key is to position yourself with this great value stocks. Investors you can sit back and relax if our economy will survive the Coronaconomy.

Related: The Coronaconomy Battle ; Stocks to Buy this Coronaconomy

*The owner of StockBytes PH is a licensed stock broker, contact us if you want to open an account.

Ready to start your financial journey? email us at [email protected] or follow our social media account and join our groups, Cheers!