We need more licensed stockbrokers to help us lift the market and the economy that is why I encourage fresh graduates and professionals to take the Securities Exam with the SEC. The securities exam is not easy, Anyone can be a Trading Guru but not everyone can be a Stockbroker.

How to be a Stockbroker in the Philippines?

I have been receiving a lot of questions on the Stockbytes PH page on “How to be a Stockbroker in the Philippines” so I decided to make a post about it.

There are more than 100 brokerage houses in the Philippines but we don’t see a lot of stockbrokers in the market as our market is not that developed compared to our neighbor stock exchanges in South East Asia. Roughly 2% of the population of the country invest in the markets as reported by the Philippine Stock Exchange(PSE). Financial Education is still low in many parts of the country. Financial Freedom steps.

Just like in the movies, anyone can actually take the exam but you must equip yourself with the knowledge to pass it. The exam is divided into two parts:

Phase 1: General Securities Exam

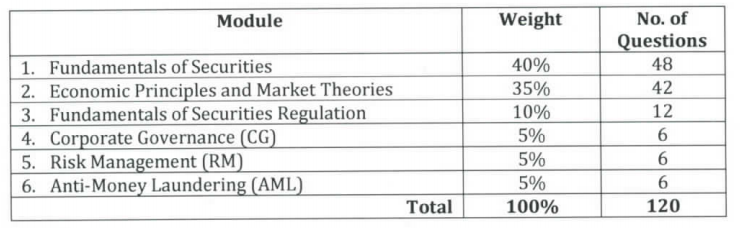

Computerized Exam with Multiple choice question format with 4 choices, exam duration is 3 hours. The passing score for the Phase 1 exam is 65% of the aggregated score with a duration of 3 hours. Exam fee P500.

Phase 2: Specialized Certified Securities Representative Exam

Phase 2 is Module 7, which is composed of five sub-modules, as follows:

Phase 2-7A: Certified Investment Solicitors(CIS)

Phase 2-7B: Equities Securities Salesmen (ESS)

Phase 2-7C: Fixed Income Market Salesmen (FIMS)

Phase 2-7D: Compliance Officers/Associated Persons (CO/AP) for broker-dealers in equities

Phase 2-7E: Proprietary/Non-Proprietary Securities (Timeshares) Salesmen (PNPSS)

Equities Securities Salesmen(ESS) is the one you need to take to become a stockbroker and you are to attend a mandatory certification seminar conducted by the SEC before you can proceed with the Phase 2 exam. The seminar fee is P9,500 (2-days seminar). The passing score for Phase 2 is 75% with 2 hours exam duration.

Venue: SEC Examination Room3/F Secretariat Building, PICC Complex, Roxas Boulevard, Pasay City

Looking forward to taking the exam? follow these links for more info:

SEC Certification Program FAQs

SEC Certification Exam Schedules and Procedures

SEC CERTIFICATION EXAMINATION SCHEDULE FOR THE 4th QUARTER OF 2020

Economic Research and Training Department-Training Division

Securities and Exchange Commission

West Wing, Ground Floor, Secretariat Building, PICC, Roxas Boulevard, Pasay City, 1307

M W F – 8818.7256 | 8818.0921 local 243

T TH – 0998-8413545

[email protected]

Once you got your broker license next is to decide which type of broker you want to be. Find a brokerage house! Philippine Broker Directory – PSE Website.

Note: You can also apply for a vacant position/trainee in a brokerage even if you haven’t completed your license/certification. You can request to have the brokerage firm sponsor you for a broker license afterward. Working in a brokerage firm will greatly help you understand the market.

Tip: Start with a local small brokerage house first and study the field as top brokerage firms have high qualifications. If you have the skills and grit you might be the next master stockbroker of the PSE.

Full-time broker vs Sales Agent

There are two types of stockbrokers in the PSE.

Full-time broker – is Employed by the brokerage house to be part of the firm. The starting salary for a licensed stockbroker/salesman is P20,000/mo this varies per broker. Seasoned broker salary may range from P30,000-P150,000/mo plus commissions. Since full-time brokers are employed they are required to go to the office regularly to do client support, sales calls, and strategy meetings.

Agent broker – has an Agency Contract with the brokerage house and is not directly employed by the broker, therefore not required to go to the office, they are only given a broker trading terminal(brokers and clients’ trading terminals are different). Usually, Sales Agents get higher commissions returns than a full-time broker. Agent brokers usually handle High Net Worth (HNW) clients and handle a large chunk of orders that yield high commission rates, the income range for an Agent broker does not have a limit, depends on how big his transactions are, the sky is the limit.

If the Agent has a monthly transaction(Buy/Sell) worth P15,000,000 with a 1.5% commission rate he could take home P225,000 that month minus broker charges and sales tax/s. The downside of an Agent broker is if he does not have a transaction or trade he will not get paid, unlike a full-time broker who is directly employed by the brokerage house.

There are a lot of trading gurus in social media who charge commission or fees or trade online accounts of online clients. As per SEC, this is illegal, only the person who is named under that account should have access to the online account unless it is a joint account. Only licensed individuals by the SEC can charge trading fees, and give professional advice to investors as per the Securities Regulation Code (SRC).

Search the name of the licensed person or company here: Registered Capital Market Participants , If their name did not appear in the SEC database they are probably a scammer/fake. Deceptive Trading gurus and scamminars.

Why a stockbroker?

Personally, I think it’s one of the coolest jobs in the world, aside from that the Philippines is a developing country we are constantly on the top of the emerging markets category because we generally have a young population with lots of working middle class which is the key for economic growth.

The Philippine stock market has a great growth potential only less than 2% (as of 2020) of the total population of the Philippines invests in the stock market. That is very few!

Very few compared to our neighbor countries. According to 2019 reports, Singapore has roughly 33% of their population participate in their stock market, Malaysia, 18%, and Hong Kong 17%. If only less than 2% participates in the stock exchange, that would also reflect how our country and economy are booming…SLOWLY because not enough Pinoys are into stocks.

That is why the demand for stockbrokers is at an all-time high, we need brokers to educate more Filipinos about the stock market and financial literacy. You might have watched “The Pursuit of Happyness(2006)” or “The Wolf of Wall Street (2013)” and decided to be a stockbroker, let me tell you this, just like in the movies anyone can be a stockbroker too as long as you have the will and knowledge to pass the exam and pursue the career, you become a successful stockbroker too.

*The owner of StockBytes PH is a licensed stockbroker, contact us if you want to open a broker-assisted or online account.

Ready to start your financial journey? email us at [email protected] or follow our social media account and join our groups, Cheers!