How to Open an account to buy/sell stocks in the Philippine Stock Exchange (PSE) with these 4 Easy Steps

Step 1. Get a Stockbroker

A stockbroker or trading participant is licensed by the Securities and Exchange Commission (SEC) and is entitled to trade at the Exchange. They act as an agent between a buyer and seller of stocks in the market. A stockbroker may also be known as a registered representative, investment adviser, or simply, broker. Stockbrokers are usually associated with a brokerage firm and handle transactions for retail and institutional customers alike.

Brokers or Trading Participants are Individual and Corporate Members of the Exchange immediately prior to demutualization who are granted trading rights. Trading Participants may also be called “Members of the Philippine Stock Exchange, Inc.”.

The PSE originally issued 184 trading rights. To date, the PSE has 133 active stock brokerage houses. You can find the complete list here: Complete Stockbroker Directory.

There are two (2) types of stockbrokers:

Traditional– those who assign a licensed salesman to handle your account and to take your orders via written instruction, Text, Instant Messaging(Viber, Messenger, Telegram, etc.) or a phone call. They execute orders in the market to the greatest possible advantage of their customers, by buying at the lowest possible price or by selling at the highest possible price.

Online – those who have their online trading platform certified with PSE and SEC that requires internet connection where clients; execute their orders and access market information online with minimal supervision from the broker. List of Online Brokers.

There are also brokers that both offer Traditional or Broker-Assisted trading and Online Trading. You need to specify with them to which type of account you want to open.

Traditional or Broker-Assisted vs Online Account

Traditional or Broker-assisted Trading, it is always recommended to open a Traditional account if the investor has no background in Stock Market or Financial Industry, so a licensed salesman can guide and assist them in buying and selling stocks. They can personalize the portfolio of the investor depending on the investment objective of the client and current trends.

Online Trading, is recommended for active investors because they can access their portfolio easily by login into the brokers’ online platform and executing a trade by themselves. This is advisable for investors with a background in the Stock Market and Trading. This is not recommended for long-term investors as some online brokers suspended inactive online accounts. Online trading is reliant on the internet if you don’t have internet you can’t trade. List of Online Brokers.

Related: Trading VS Investing

Step 2. Submit Account Opening Forms

The usual requirements to open an account of the Stockbrokers are the following:

- Client Account Information Form (CAIF) – This form will contain all the details of the client as required by SEC and PSE.

- Data Privacy Form – This form is required by the National Privacy Commission(NPC) for secure data of clients.

- FATCA Form – This form is for foreigners or dual citizens who have bank accounts in the USA.

- Valid IDs (2) – Proof of identity of the client, below are the list of accepted IDs:

- Driver’s License

- Passport

- Senior Citizen’s Card

- Voter’s ID

- Government Office ID

- Postal ID

- Professional Regulations Commission (PRC) ID

- Philhealth Card

- Oversea Filipino Worker(OFW) ID

- Police or NBI Clearance

- Company ID

- Students ID

Step 3. Deposit Minimum Investment

Minimum investment differs per broker, you can find the minimum required deposits on the Trading Participant Directory. Here. This investment will be credited to your account with your selected broker.

*Note: Account opening is free of charge, brokers will get a commission when you execute a trade with them. Also, you can open an account for multiple brokers. It’s ideal to have at least two(2) brokers at least if you are doing online trading so if one brokers platform is down you can still trade with the other.

Step 4. Start Buying and Selling Stocks

So you’ve open an account, Good Job! Now let me give you the basics of Buying and Selling stocks.

Give Order Instructions.

Traditional. Placing an order to buy or sell stocks to your stockbroker can be done in three ways: over the phone (call or text message), online (Viber, Messenger, etc), and face-to-face (walk-in).

Online. Investors with online trading accounts post their buy or sell orders via the Internet using the online trading platform of an online stockbroker. Online trading allows faster posting of orders and settlement at a lower commission rate.

An order is consists of, SIDE: Buy or Sell, STOCK: Name of Company, SHARES: No. of shares you want to buy or sell, and EXPIRY Date: Day, Good ‘Till Cancelled(GTC), Good ‘Till Week (GTW). By default EXPIRY is set to Day, meaning the order you sent will expire after the trading period of the day has ended.

Sample order instruction: “BUY, Jollibee Foods Corp (JFC), 100 shares at 150php.” *will expire within the day by default.

Get the Confirmation RECEIPT.

Once your order has been carried out, your stockbroker will give you a confirmation invoice showing the details of your transaction.

Deliver/Pay before SETTLEMENT DATE.

The delivery or payment should be before the settlement date. For traditional stockbrokers, settlement of transactions is usually done after three (3) working days from the transaction or T+3. For online stockbrokers, settlement of all transactions is done on the transaction date. Note: Online accounts buying power is limited to their available cash on the account.

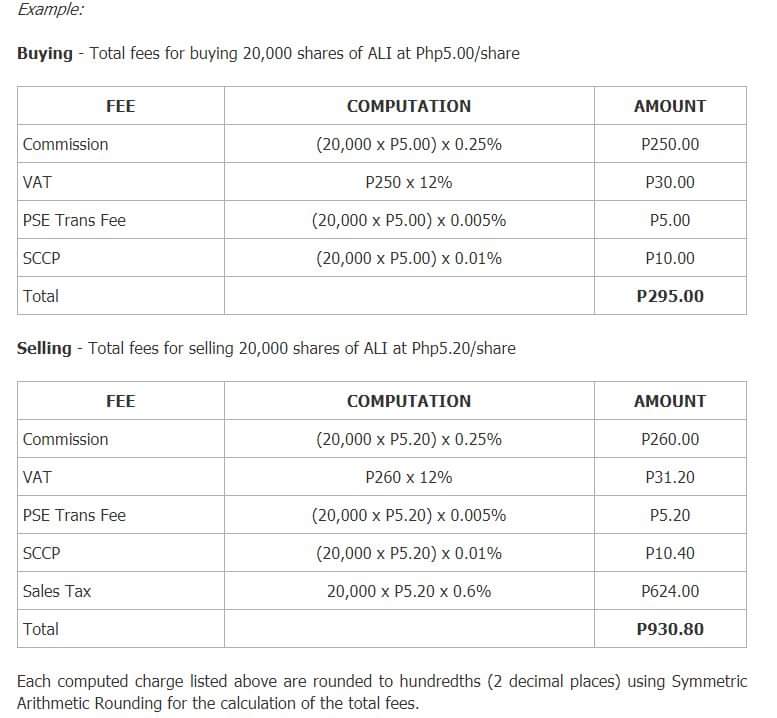

Fees

Commission – is paid to the broker for their services, the default rate for an online account is 0.25% for broker-assisted/traditional account it may range from 0.50%-1.50%. Minimum charges may vary for every broker.

PSE Trans Fee – is charged by the PSE for exchange services.

SCCP – Securities Clearing Corporation of the Philippines is responsible for establishing the cash and securities liabilities and entitlements of its Clearing Members, synchronizing the settlement of funds and the transfer of securities. SCCP is owned by the PSE.

Taxes – VAT for buying and selling and Sales tax for selling transactions.

Tips: I always recommend at least 20k per transaction because if we transact lower the fees will eat up our transaction.

Conclusion

Account opening is as easy as one, two, three. Again opening an account is free, if you are being charged it might be a scam, only transact with registered stockbrokers and licensed salesman. You can always visit PSE Tower at BGC, Taguig Metro Manila the home of the Philippine Stock Exchange and Trading Participants.

Aim to Learn first before you Earn, study the Philippine Market, and investing first. Learn from the mistakes of others, I see a lot of people jumping into the market and losing a lot of money because if misinformation and scams. Let us guide you, contact us if you have more questions. We can also help you with Special Investor’s Resident Visa (SIRV).

- Learn more about Stock Basics: Stocks Basic Knowledge.

- What’s your first purchase? If you are still confused better follow this Link: Rules on Stock Investing

- There are dozens of companies listed in the Philippine Stock Exchange: Complete List of Companies

- PSE Trading Schedule: Trading Schedule and Market Phases; Minimum price per stock: Board Lot table

Updated: June 28, 2020, StockBytes! PH

Ready to start your financial journey? email us at [email protected] or follow our social media account and join our groups, Cheers!