Ready to get started on Basic Rules on Stock Investing? I see a lot of newbie investors lose their money over bad investments, up until now there are still a lot of Filipinos investing in Stocks without even knowing the basics or their goal. These are the proven rules that you need to follow to be a successful stock investor!

Rule #1 Create a Plan

The key to financial security is to have a plan and to take this plan into the heart. You must first identify your current situation, like how much are your liabilities and how much have you saved. Afterward, you define your goals and objectives. Do you want to secure the education of your children, or do you want to have a trip abroad with your loved ones? Once your goals are set, you may figure out what types of stocks to invest, when to enter and exit in the stock market, and how much you’ll need to invest.

Study your own profile as an investor to know how much you can invest. Much will depend on your financial status and what stage of your career you are in. You can afford to be more aggressive if you would not be risking funds for your basic needs, your children’s education, or emergencies.

Rule #2 Educate Yourself

You may learn about the stock investing or the economy in general through the Internet, by watching business news, and by reading books & publications. You may also participate in seminars offered by stockbrokers and by financial organizations like the PSE. You may also ask individuals or colleagues well-versed in the stock market industry. However, the time-tested way to learn about the stock market is to experience first-hand stock market trading. As the adage says, “experience is the best teacher”.

Rule #3 Know the Company before you Invest

You may learn about the stock market or the economy in general through the Internet, by watching business news, and by reading books & publications. You may also participate in seminars offered by stockbrokers and by financial organizations like the PSE. You may also ask individuals or colleagues well-versed in the stock market industry. However, the time-tested way to learn about the stock market is to experience first-hand stock market trading. As the adage says, “experience is the best teacher”.

To see the publicly listed Companies in the Philippine Stock Exchange: Follow this Link!

Rule #4 Save and Invest While You’re Young

UTILIZE TIME in your favor to take advantage of the income-generating potential of your investment, otherwise known as “compounding”. Let’s assume that you wish to invest PHP 10,000.00, and your investment grows by 10% annually. If you reach 60 years old, your investment will be worth:

It is also advisable that you allocate AT LEAST A PORTION OF YOUR MONTHLY INCOME OR SAVINGS for stock investing. Many experts recommend putting not more than 25% of your savings to be safe. If you are near retiring, then you must be very conservative and not put in more than 10% of your available resources. Do not risk what you cannot afford to lose.

Let’s assume that you wish to invest PHP 2,000.00, allowing your investment to grow 10% annually, and adding another PHP 2,000.00 every month until you retire. If you reach 60 years old, your investment will be worth:

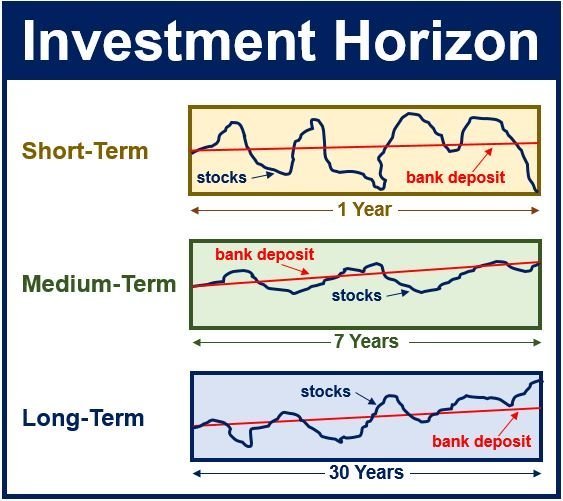

Rule #5 Think Long Term

Stocks are volatile in nature especially in the short-term. Market prices tend to fluctuate and may rise and fall depending on various market factors. Although experienced professionals may “time” the market, most individuals are unable to constantly monitor stock price movements. Therefore, long-term investing helps you in weathering these disturbances and gives you convenience by relying on your sound investments to grow over time.

Rule #6 Diversify your Investments

“Do not put all your eggs in one basket.” Diversifying investments is a risk control measure wherein investments are segregated across different companies and sectors and not solely on a stock or a sector. This ensures that the risk is spread across your investments.

Investing can and should be fun. It can be educational, informative, and rewarding. By taking a disciplined approach and using diversification, buy-and-hold, and dollar-cost averaging strategies, you may find investing rewarding even in the worst of times.

Financial Freedom 101, Follow this Link: Financial Freedom

How to Open an account? Follow this link: Account Opening

Ready to start your financial journey? email us at [email protected] or follow our social media account and join our groups, Cheers!

Basic Rules on Stock Investing