Investing is one of the best ways to grow your wealth, but it carries the risk of losing money as well – specifically when picking companies to invest in. Picking a stock solely based on social media trends or current events is a losing bet. You can’t be truly confident in your investment without studying the details of a company.

It’s so simple to invest nowadays, the latest technologies enabled us to invest with ease. But if you want to be a successful investor, it can be really tough. Many retail investors lose money every year because they don’t have time to research a large number of stocks, and they don’t have a research team to help with that massive task like institutional investors and market professionals.

What To Look for When Investing in a Company

1. The Chief Executive Officer(CEO)

The “El Capitan” of the company, CEOs are responsible for managing a company’s overall operations. This also includes delegating and directing agendas, driving profitability, managing company organizational structure, strategy, and communicating with the board. Confidence in this business professional can be a very telling sign of the future success of a company. Not only do CEOs help determine the strategic direction of a company, but they can also make or break the business with their decisions.

A CEO should have a track record of savvy business moves under their belt. One of the quickest ways to learn more about a CEO is through the company website and top search engines. Check out their career moves and details of how they helped their previous companies (and current company) grow. Ask yourself how their experience qualifies them to lead this company in the future.

2. Review the business model

How a company makes money is referred to as its “business model.” While there isn’t a single way to run a business, successful companies should be positioning themselves to maximize profits. When researching a company’s business model, learn about its products and services, target market, and industry it’s competing in.

Some companies (such as Amazon) are going after a wider audience with low prices and higher volume sales. Other companies (such as Apple) create exclusive devices that users gladly pay a premium for.

Telco companies, for example, Globe Telecom, and PLDT have evolved during the pandemic because their business model was to benefit from the pandemic because more Filipinos are using their mobile phones and internet service. While business models in the leisure and travel sector are hurt because tourist arrival is pretty much non-existent.

Many business models can be successful, but make sure you understand – and agree with – how the business is run before investing.

3. The Competitive Advantage of the Company

Businesses are set to compete for their customers’ business, and a successful company will often have an advantage over the competition. This is like the Krabby patty “secret formula” of the company or the thing that makes customers choose a particular company over everyone else.

Gcash changed the way Filipinos do business, and this is the harpoon of Globe Telecom in the Technology space that boosted their earnings and in turn sent the stock price of the share in the stock market to all-time-high levels.

A company with an edge over its competition is a promising sign of finding a good stock to invest in.

4. Revenue Trends and Price History

Revenue is the total sales of products and services that a company brings in, usually reported on a quarterly basis. Assessing a company’s revenue history can show you whether the company is growing or in decline.

Another example is Jollibee Foods Corporation whose earnings for 2020 are negative because of the pandemic and recently they announced that their Quarter 4 earnings in 2021 is now back pre-pandemic level.

When reviewing revenue trends, a year-over-year increase is a sign that companies are making the right moves and have strong sales strategies. While increasing revenue each quarter isn’t always realistic, seeing a decline over multiple consecutive quarters may be a troubling sign for investors.

Stock price history is another excellent indicator of company performance. There are always ups and downs with the price of any stock, and historical stock prices are not always a guarantee of future results.

5. Net Income Growth Year to Year

The Net Income is a company’s revenue minus expenses and depreciation. Reviewing the Net Income can also be a useful indicator of company growth. This is the “bottom line” number that reveals whether a company is profitable or not.

If a company has declining net income year-over-year, its growth may not be sustainable. This may be a sign that its expenses are increasing too quickly and business operations are ineffective.

If the net income is rising over time, this is a good sign that the business is operating efficiently and growing. The ultimate goal of any company is to make a profit, and that directly impacts the stock price as well.

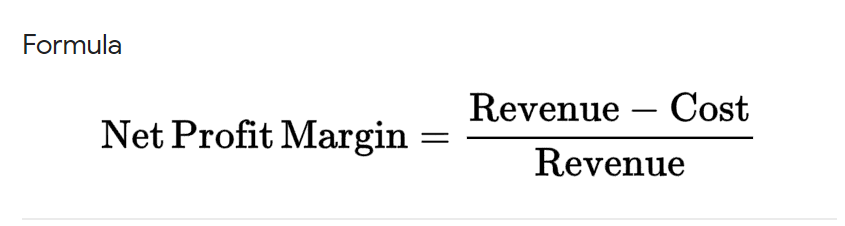

6. Review the Profit Margin

Profit Margin or sometimes referred to as Net Profit Margin, the profit margin is the percentage of revenue that the company takes in as profit (after expenses, interest, and taxes have been paid). A company’s net profit margin is the net income as a percentage of total revenues.

Net profit margin is the ratio of net profit to total revenue expressed as a percentage. To calculate the net profit margin, divide your net income by total revenue and multiply the answer by 100.

Constant and/or growing profit margins are a good sign for investors, as those profits should reward stakeholders with returns. Net profit margin helps investors assess if a company’s management is generating enough profit from its sales and whether operating costs and overhead costs are being contained.

7. Compare Debt-to-Equity Ratio

The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity. It is a standard of the degree to which a company is financing its operations through debt versus wholly-owned funds.

Being over-leveraged can limit a company’s choices in making business decisions. The idea is finding a company that has a 2:1 (or less) ratio, meaning that a company derives 66% or less of its funding from debt and 33% or more from shareholders.

The lower the debt ratio, the more a company can take risks without the worry of defaulting on its large debt load. Debt-to-equity ratios vary by industry, so be sure to research industry standard D/E ratios before judging whether a company is over-leveraged.

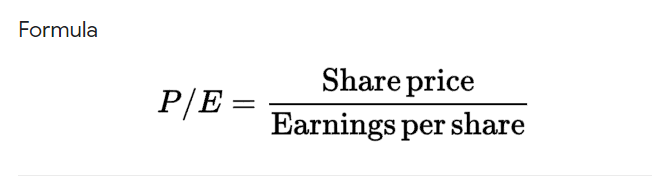

8. Analyze Price-to-Earnings(P/E) ratio

The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS). The price-to-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

P/E Ratio is calculated by dividing the market price of a share by the earnings per share. P/E Ratio is calculated by dividing the market price of a share by the earnings per share. For instance, the market price of a share of the Company ABC is Rs 90 and the earnings per share are Rs 10. P/E = 90 / 9 = 10.

When evaluating any company, compare its P/E ratio to the current industry average. A higher P/E ratio may be a sign that the company is currently overvalued. A lower P/E ratio may be a sign that the company is currently undervalued.

This probably is the most important indicator in finding undervalued companies is what defines a “value investor,” which has historically worked well for investing greats such as Benjamin Graham and Warren Buffett.

*Takeaway For Beginner Stock Picking

Before diving in, researching your investments will help you avoid the pitfalls that less-experienced (and sometimes veteran investors) run into. Find companies that:

You understand and agree, from a leadership and business perspective that operating with strong management and financial health is trading at a good value.

These will be key to your investing success.

Trade Stocks: https://gtrade.ph/

Trade Crypto: https://www.binance.com/en/futures/ref/stockbytesph

Get a 10% discount on Binance trading fees: BNWCMBAU

*The owner of StockBytes PH is a licensed Stockbroker and Financial Advisor, contact us if you want to open an account and start investing in stocks.

Ready to start your financial journey? email us at [email protected] or follow our social media account and join our groups, Cheers!