Congress Moves Toward Total Ban

As of July 2025, both houses of Congress are showing clear bipartisan momentum toward outlawing online gambling entirely:

- House Bill 1876 (Rep. Benny Abante) calls online gambling “a virus that threatens the soul of the nation.”

- Sen. Raffy Tulfo equates it to a moral epidemic, calling for criminal investigations into government officials involved in the sector.

- Sen. Miguel Zubiri and others want a full ban, arguing that even legal platforms cause widespread harm.

- Sen. Sherwin Gatchalian, meanwhile, supports tighter regulation, such as age limits, ID verification, ad restrictions, and bet size limits.

Even licensed operators under PAGCOR (Philippine Amusement and Gaming Corporation) may be affected. Tulfo wants all ads—including those from accredited operators—removed from billboards, TV, and digital platforms.

Stories That Sparked a Movement

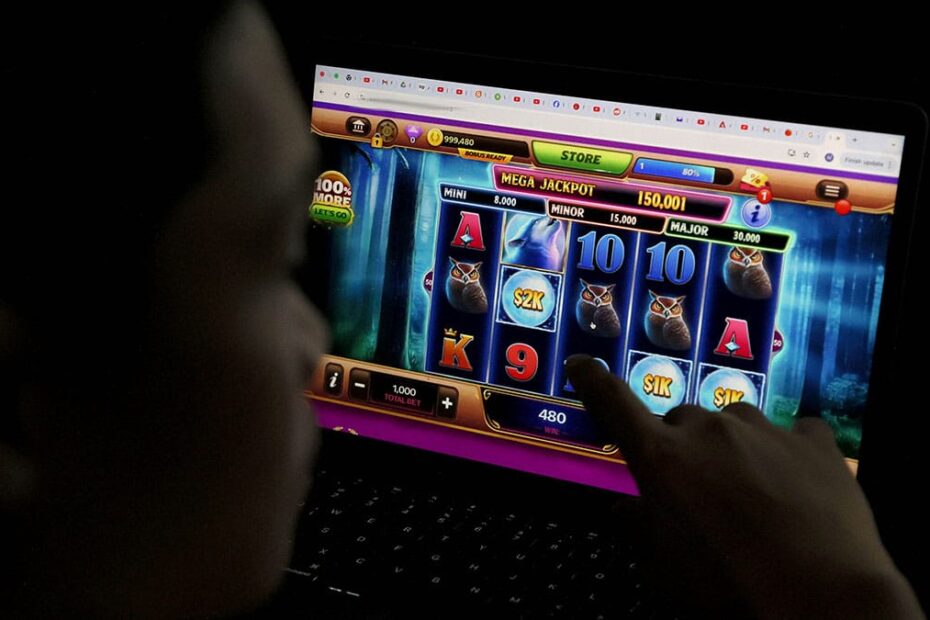

Inquirer’s recent feature told the story of Ana Reyes, a small vendor from Davao del Norte who went from a ₱100 bet to ₱30,000 wins—and then to tens of thousands in losses that nearly ruined her marriage. She’s one of many.

- Rehab centers like Bridges of Hope now report that 70% of their monthly patients suffer from online gambling addiction.

- Students are betting using their parents’ credit cards, while others post suicidal confessions in Facebook groups.

- Cardinal Pablo David, head of the Catholic Bishops’ Conference, called online gambling “a hidden moral pandemic.”

PAGCOR reported ₱51.39 billion in gross online gaming revenues from January to May 2025 alone. In 2024, e-games generated ₱154.51 billion, up from ₱58.16 billion in 2023. A total ban would immediately cut off this funding, which contributes to healthcare, education, and infrastructure.

Fintech & e-Wallets

Platforms like GCash and Maya have started tightening their user authentication systems. FinTech Alliance PH, an association of top digital finance firms, is urging regulation, not prohibition.

“We can improve player safety through identity checks and limits—shutting it all down could push people into dangerous black-market systems,” a spokesperson said.

Government’s Tightrope Walk

President Marcos has remained non-committal. While he acknowledges the risks, he’s also wary of losing billions in revenue. In his July 15 interview, he said:

“We must weigh the benefits and the social consequences… I am carefully studying the situation.”

Meanwhile, PAGCOR has given gaming firms until August 15, 2025, to remove all gambling ads, including those on social media and highways.

The Philippines is facing a decision that will shape its social fabric, economic outlook, and international reputation for years to come. While a full ban may address moral and public health concerns, the economic blow will be significant—especially for stakeholders in real estate, tech, gaming, and retail.

For stocks like BLOOM and PLUS, the market is now entering a “wait and see” phase, with investors demanding clarity before re-entering positions.

What To Watch Next

- July 28: President Marcos’ State of the Nation Address (SONA)—expected to address the gambling issue directly.

- Q3 2025: Expected filing of bills for either regulation or full prohibition.

- August 15, 2025: Deadline for billboard and ad takedown under PAGCOR memo.“These e-games teach you how to lie, how to hurt your family. So I completely support all efforts of our government now to stop it.”

📍 DigiPlus Interactive Corp. (PLUS)

Formerly: Leisure & Resorts World Corporation

Ticker: $PLUS

Sector: Digital Gaming & Entertainment

As of July 2025, DigiPlus Interactive Corp. is doubling down on its identity as a tech-driven digital entertainment giant, with plans to expand its online gaming portfolio in the second half of 2025.

🔹 Business Expansion Highlights:

- PLUS announced in early July its intention to launch new game formats and platforms tailored to Filipino audiences, including “social gaming” experiences that blend video content and gameplay.

- It aims to diversify beyond gambling, positioning itself as the Philippines’ “top digital entertainment hub”, according to CEO Andy Tsui.

- As of Q2 2025, DigiPlus reported solid user growth across its BingoPlus and ArenaPlus platforms—two of the country’s leading online gaming and sports entertainment portals.

🔹 Revenue Outlook & Risks:

- PLUS’s FY2024 net income grew by ~38% YoY, backed by digital adoption, but faces regulatory headwinds if a nationwide ban materializes.

- A Senate bill filed in July aims to outlaw even licensed digital platforms. If passed, PLUS’s core gaming revenue could collapse by up to 70%, unless it pivots swiftly.

🔹 Market Sentiment:

- Stock Price (as of July 16, 2025): ₱3.47 (↓5.6% month-to-date)

- Investor stance: Cautious-to-defensive. Analysts are monitoring PLUS’s ability to pivot from gambling to diversified digital services.

Key Insight: If DigiPlus can successfully transition into a broader digital entertainment company—focusing on casual gaming, e-sports, and streaming—it may weather the storm. Otherwise, its exposure to online gambling could be a major liability in Q3 and Q4 2025.

📍 Bloomberry Resorts Corp. (BLOOM)

Ticker: $BLOOM

Sector: Integrated Resorts & Casinos

Bloomberry, the owner and operator of Solaire Resort & Casino, maintains a strong foothold in the physical gaming and hospitality space. However, its modest online ventures are now facing uncertainty amid government clampdowns.

🔹 Business Performance:

- In Q2 2025, BLOOM reported a 12% increase in gross gaming revenue (GGR) driven by VIP tables and hotel occupancy surging post-pandemic.

- Solaire’s online platform remains compliant with PAGCOR rules, but any broad policy change could affect its digital extensions.

🔹 Strategic Moves:

- BLOOM is investing in Solaire North, set to open in 2026, which will reduce reliance on online revenue.

- It is also expanding into luxury real estate and event hosting, signaling diversification efforts to cushion market risk.

🔹 Market Behavior:

- Stock Price (as of July 16, 2025): ₱10.85 (↓4.2% in the last 30 days)

- Dividend Yield: ~2.8%

- Analysts rate BLOOM as “Hold” with downside risk limited due to its asset-heavy portfolio and solid EBITDA from land-based operations.

Key Insight: Unlike PLUS, BLOOM’s fortunes are still heavily tied to physical assets and tourism, making it better insulated if online gambling is banned outright. However, its online footprint may still face legal constraints by Q4.

BLOOM may survive a total online gambling ban thanks to its core casino and hotel business, but its growth outlook is muted unless it diversifies digitally into legal verticals like hospitality tech or digital tourism platforms.

📉 Investment Outlook

|

Company |

Focus |

Risk (Regulatory) |

Recovery Path |

|

PLUS |

Digital/Online Gaming |

🔴 High |

Digital media, social gaming |

|

BLOOM |

Integrated Casino/Resort |

🟡 Moderate |

Real estate, luxury events |