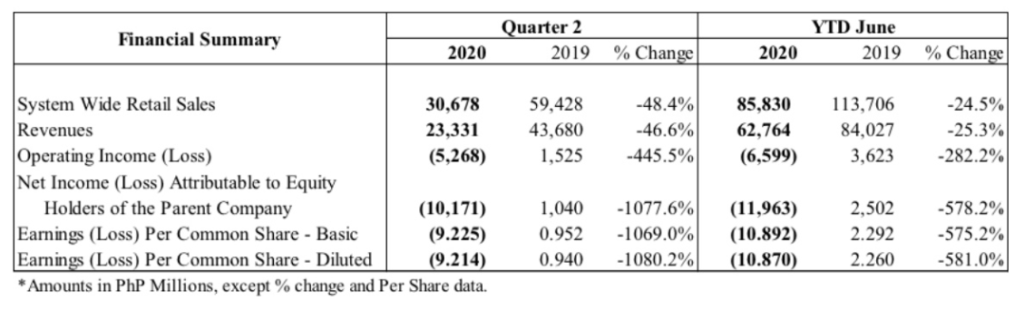

The country’s fast-food giant Jollibee Foods Corp.(JFC) booked a net loss of P10.2 billion in the second quarter of the year, reversing its P1.04-billion profit in the same period last year. The company is bleeding in the second quarter as its businesses across the globe felt the full impact of the coronavirus (COVID-19) pandemic and the consequent lockdown measures.

JFC president Ernesto Tanmantiong in a disclosure to the Philippine Stock Exchange on Wednesday “The business results were very bad but in line with our forecasts. We are now focusing on rebuilding our business moving forward along with implementing major cost improvement under our business transformation program,” he said.

“We expect sales and profit to increase significantly in 2021 to a point closer to the levels of 2019 and grow at least at a historical growth rate of 15 percent annually by 2022,” he added.

JFC will also be closing 255 company-owned stores as part of its transformation, and franchising 95 stores that are originally company-owned. It is paying pre-termination penalties for stores in the US and China, closing supply chain facilities and reducing organization size in other countries.

The company expects its cash flow to get better in the next two quarters as more stores would have reopened with the easing of quarantine protocols. It expects its balance sheet to turn positive by the fourth quarter of 2020, with the Philippines, China, Vietnam, Europe, Middle East, and other parts of Asia projected to generated net operating income, assuming that government restrictions related to COVID-19 restriction will not be re-imposed.

Weak sales led to a 46.6 percent year-on-year drop in second-quarter revenues to P23.33 billion while six-month revenues plunged by 25.3 percent to P62.76 billion.

By the end of 2020, JFC would have reduced its 2019 store count of 5,945 by 416 stores or 7%.

“The cost improvement resulting from the business transformation will be recurring annually with a cash payback of about two years, with full annual impact starting to take effect in 2021,” the company Chief Financial Officer Ysmael B. Baysa said.

“We expect sales and profit to increase significantly in 2021 to a point closer to the levels of 2019 and to grow at least at historical growth rate of 15% annually by 2022,” Mr. Tanmantiong said.

Related : BusinessWorld ; Inquirer ; ManilaTimes

-StockBytes PH, August 6, 2020.

*The owner of StockBytes PH is a licensed stock broker, contact us if you want to a open a broker-assisted or online account.

Ready to start your financial journey? email us at [email protected] or follow us on Facebook and Twitter.