THE MARKET SUMMARY

In May, the equities market experienced significant volatility. Despite ongoing investor optimism regarding the global economic outlook, this was insufficient to sustain risk assets, leading to a 3.99% month-on-month decline in the benchmark index.

The Philippine Stock Exchange index (PSEi) faced a challenging period in the last week of May, suffering a decline over four consecutive sessions and reaching its lowest close of the year at 6,371.75 on May 30. However, it slightly recovered to 6,433.10 by May 31.

The market remains hopeful for rate cuts, although there is a disparity in timing expectations between the US and the domestic front. Anticipation of lower interest rates has benefited growth sectors, which outperformed value sectors. Smallcap stocks also regained some momentum, performing broadly in line with large-cap peers.

Oil prices, which had peaked in April, declined throughout May. Despite this, broader commodity indices continued to deliver positive returns due to sustained global demand and ongoing conflicts in the Middle East and Ukraine.

While the overall economy remains robust, May’s data indicated some moderation, with capital spending remaining flat.

A notable exception was the S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI), which registered at 51.9. Although slightly down from 52.2 in April, it still signaled modest improvement in manufacturing activity.

There are signs of recovery across Asian economies, although these come with certain caveats. Chinese economic data has generally been positive, although the details reveal weaknesses such as low domestic demand, which necessitates reliance on strong export growth. Additionally, challenges in the real estate sector remain unresolved.

Currency depreciation is generally beneficial for export-heavy markets. However, the extreme weakness of the Philippine peso is beginning to affect consumer sentiment negatively, making Philippine stocks among the weakest performers regionally in May.

The increasingly desynchronized nature of regional economies is causing central bank policy expectations to diverge. In the US, disinflationary trends are stalling, particularly with sticky price pressures in service sectors. The latest inflation report showed only a modest slowdown, with year-over-year rates for headline and core inflation at 3.4% and 3.6%, respectively.

The May Federal Open Market Committee (FOMC) meeting minutes reflected concerns about the slow progress in disinflation, diminishing hopes for an imminent rate cut.

Diverging monetary policies and uncertainties about the path of interest rates are likely to continue contributing to equity market volatility.

Overall, the economic data released in May helped alleviate some concerns about the economy, indicating a rebalancing in economic momentum. Corporate fundamentals remain strong, and despite regional differences in timing, the next move for interest rates is expected to be downward. These factors should support risk asset valuations, but investors are increasingly looking for regionally diversified exposures with greater potential for catch-up growth.

THE STORIES THAT SHAPED THE MARKET

April Inflation

Headline inflation picked up for a third straight month in April amid higher food and transport costs, the Philippine Statistics Authority (PSA) reported last month.

While the annual rise was below market expectations, it supports the central bank’s decision to maintain its hawkish pause.

The pickup also underscores the need for vigilance, the National Economic and Development Authority said in a statement.

The consumer price index (CPI) quickened to 3.8% year on year in April from 3.7% in March, preliminary data from the PSA showed. Still, this was slower than the 6.6% print in the same month a year ago.

This was within the central bank’s 3.5-4.3% forecast for April CPI and marked the fifth straight month that inflation settled within the central bank’s 2-4%annual target range.

The April print was also below the 4.1% median estimate in a poll conducted last month.

Month on month, inflation inched down by 0.1%. Stripping out seasonality factors, month-on-month inflation picked up by 0.2%.

For the first four months, headline inflation averaged 3.4%, still below the central bank’s 3.8% full-year forecast.

The inflation outturn is consistent with central bank expectations that inflation could accelerate temporarily above the target range in the next two quarters of the year due to the possible negative impact of adverse weather conditions on domestic agricultural output and positive base effects, the central bank said in a statement.

The Monetary Board considered the latest inflation and Q1 2024 GDP (gross domestic product) outturns, among other information, in its monetary policy meeting on May 16. The central bank also continues to support the National Government’s non-monetary measures to address supply-side pressures on prices and sustain the disinflation process, the central bank added.

The PSA released Q1 GDP data on May 9. Core inflation, which excludes volatile prices of food and fuel, slowed to 3.2% in April from 3.4% in the previous month and 7.9% a year ago.

April inflation was mainly driven by the faster annual increase in the heavily-weighted food and non-alcoholic beverages index.

The index jumped to 6% from 5.6% in the previous month but was slower than 7.9% a year earlier.

Food inflation alone accelerated to 6.3% from 5.7% in March. However, this was slower than the 8% print in the same month in 2023.

One of the primary contributors to faster food inflation was vegetables, tubers, plantains, cooking bananas and pulses, which rose to 4.3%from the 2.5% decline in the previous month.

PSA data showed that the average price of onion was at P126.50 per kilo outside the National Capital Region (NCR) in April. Within the region, it averaged P90.30 per kilo.

The cereals and cereal products index was also a major contributor to food inflation, rising by 16.9% in April. This was slower than 17.3%a month ago but faster than 5.4%a year prior.

Rice inflation surged by 23.9%in April. However, this was slower than 24.4%a month prior.

Rice has a substantial contribution, it contributed around 46.2% to overall inflation. In the 3.8% inflation rate, it contributed around 1.75 percentage points.

The slight easing in rice inflation is attributable to the decline in world rice prices.

PSA data showed that prices of well-milled and special rice saw decreases on a month-on-month basis in April, while regular-milled rice posted an increase.

The average price of a kilo of well-milled rice dropped to P56.42 in April from P56.44 a month ago while special rice averaged P64.68 from P64.75. Meanwhile, regular milled rice rose to P51.25 from P51.11 in the previous month.

April inflation was also driven by faster increases in transport prices, the PSA said.

Transport inflation rose to 2.6% from 2.1% in the previous month and matched the 2.6% print a year ago.

This was primarily due to the faster rise in prices of diesel and gasoline.

Diesel quickened to 4.2%in April from the -0.1% print a month ago while gasoline accelerated to 3.3% from 0.8% in March.

In April, pump price adjustments stood at a net increase of P2.25 a liter for gasoline and P0.50 a liter for diesel.

Meanwhile, the inflation rate for the bottom 30% of income households quickened to 5.2% in April from 4.6% in the previous month. This was slower than the 7.4% print a year ago.

In the first two months, the inflation rate averaged 4.4% for the bottom 30%.

In the NCR, inflation slowed to 2.8% in April from 3.3% in March. Inflation in areas outside NCR accelerated to 4.1% from 3.8%.

The central bank said risks to the inflation outlook remain tilted to the upside.

Possible further price pressures are linked mainly to higher transport charges, elevated food prices, higher electricity rates, and global oil prices. Potential minimum wage adjustments could also give rise to second-round effects, it said.

Still, the central bank said it expects the inflation average to be within its target for this year and next.

Q1 GDP

Philippine economic growth saw an acceleration in Q1 of the year from the three months prior but slowed from the same period in the past year, government data released last month showed.

Data from the Philippine Statistics Authority (PSA) showed that the gross domestic product (GDP) grew by 5.7% in Q1 of the year, which compares with the downward-revised 5.5% in Q4 of 2023 and the 6.4%in January to March of 2023.

The latest reading is lower than the target range of 6.0% to 7.0% set by the inter-agency Development Budget Coordination Committee (DBCC), which was cut short from the prior goal of 6.5% to 7.5% to reflect factors such as global demand, trade growth, oil prices, and inflation trends.

The main contributors to growth were financial and insurance activities at 10.0%, wholesale and retail trade and the repair of motor vehicles and motorcycles at 6.4%, and manufacturing at 4.5%.

All major economic sectors posted annual growths – agriculture, forestry, and fishing (AFF) with 0.4%, industry with 0.4%, and services with 6.9%.

Gross national income (GNI) had an annual growth of 9.7%, while the net primary income (NPI) from the rest of the world expanded by 57.0%.

On the demand side, household final consumption expenditure (HFCE) grew by 4.6%, which was the slowest since Q3 of 2010 amid the country’s elevated inflation and the ongoing El Niño.

Inflation, meanwhile, averaged 3.3%in Q1. It has since clocked in at 3.8%in April, marking the fastest in four months.

The elevated heat levels also affected production, especially construction activities and the services sector.

Government spending grew by 1.7% during the quarter, faster than the 1.0% contraction in Q4 of 2023, but slower than the 6.2% in March last year.

Moving forward, the country is still on track to meet its target this year given the efforts put in place by the government to address the El Niño and the high inflation.

With the heat levels remaining elevated through Q22, the government is taking climate change seriously as it is now tapping stakeholders to join efforts to adapt especially in vulnerable areas such as agriculture.

Monetary Policy

The Philippine central bank’s Monetary Board (MB) has once again retained its target reverse repurchase rate at 6.5%.

This has been the fifth time the MB kept the interest rate since its off-cycle policy rate hike in October 2023 to mitigate supply-side inflation pressures.

The MB that it retained its policy rates as inflation outlook continues to lean on the upside.

It attributed the potential price pressures to higher transport charges, food prices, electricity rates and global oil prices.

For two-consecutive months, the country’s inflation rate has ballooned due to high food and transport costs.

The inflation rate in March was 3.7%, rising to 3.8% in April.

With the MB’s retention, interest rates on overnight deposit and lending facilities remained unchanged at 6.0% and 7.0%, respectively.

Based on the latest GDP data, the expected path for domestic output growth over the medium term remains largely intact, even as recent indicators point to continued moderation under tight financial conditions, the central bank said.

Central bank Governor Eli Remolona, Jr. said that the MB is now “less hawkish”.

He also said that the central bank might cut rates in August, ahead of major central banks, including the US Federal Reserve.

Finance Secretary Ralph Recto, meanwhile, said that the central bank could likely cut rates by 150 basis points in the next two years with inflation expected to slow down.

According to Recto, a rate cut in Q3 is very much possible, with a reduction of 150 basis points in the next two years, with inflation expected to slow to within the government’s target range of 2.0%to 4.0%this year and the next.

According to central bank senior assistant governor Iluminada Sicat, inflation is expected to be elevated in May and July but will return to the target range by the end of the year.

BEL / PLC

Belle Corporation, the parent company of Premium Leisure Corp (PLC), has successfully completed a tender offer for the voluntary delisting of its subsidiary from the Philippine Stock Exchange (PSE).

According to a filing, Premium Leisure Corp, listed in the Philippines, has submitted a petition for the voluntary delisting of its shares from the main board of the Philippine Stock Exchange, effective July 9th.

PLC is an investor in City of Dreams Manila, a casino resort in the Philippine capital operated by a unit of Melco Resorts & Entertainment Ltd., earning a share of the gaming revenue generated there through one of its units.

The intention of voluntary delisting was firstly announced in March. Belle Corp has set the price for a tender offer for all outstanding common shares of Premium Leisure at PHP0.85 each.

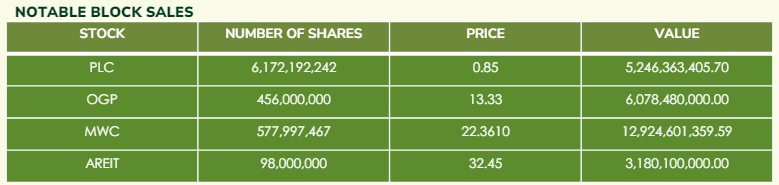

According to the filing, the tender offer was concluded on May 9 th. The parent company paid an aggregate amount of nearly PHP5.25 billion ($90.7 million) for slightly over 6.17 billion shares, constituting about 19.77 percent of Premium Leisure’s total issued and outstanding common stock. Consequently, Belle now holds a 99.55 percent stake in Premium Leisure.

In Q1 of 2024, Premium Leisure recorded net income of nearly PHP279.5 million ($4.83 million), marking a 55.3 percent decrease from the previous year.

The company’s gaming revenue share from City of Dreams Manila during the same period amounted to approximately PHP401.2 million ($6.93 million), reflecting a decline of 43.9 percent compared to the corresponding period last year.

OGP

OceanaGold Corp.’s subsidiary, OceanaGold Philippines, Inc. (OGPI) completed an initial public offering (IPO) of 20% of its outstanding common shares on the Philippines Stock Exchange (PSE). The shares are listed under the ticker OGP, and trading began on May 13, 2024.

OGPI holds OceanaGold’s interest in the Didipio mine. In July 2021, the company renewed the Didipio Mine Financial or Technical Assistance Agreement (FTAA) with the Philippine Government for an additional 25-year period. The term of the agreement began on June 19, 2019. With an agreement in place, OceanaGold restarted operations, which was suspended during 2019.

Located in Luzon, Philippines, the Didipio mine produced 138.5 million oz of gold and 14.2 metric tons of copper in 2023 from open-pit and underground operations.

The FTAA among other things called for the listing of at least 10% of the common shares in OGPI on the PSE within three years. The final offering price was ₱13.33 per share for 456 million common shares of OGPI and gross proceeds totaling ₱6.08B (approximately $106 million) were raised. The company said the proceeds from the IPO will be applied to OceanaGold’s $160 million debt.

OGPI, the market’s IPO curtain raiser this year, marked the first public listing of a mining firm in the Philippine Stock Exchange (PSE) in more than a decade.

It also becomes the first mining firm that holds a financial or technical assistance agreement (FTAA) to be listed in the PSE. The local mining industry has a vast potential that can fuel economic growth.

The listing comes at a time when prospects for the mining sector are favorable. The government is looking to revitalize the mining industry to boost its potential contribution to the economy.

AC/MWC

Conglomerate Ayala Corp. has completed one of its major divestment plans for the year, selling its remaining stake in its East Zone water business to ports and power tycoon Enrique Razon for P14.5 billion.

The divestment of Ayala’s interest in Manila Water Co. Inc. is part of the conglomerate‘s rationalization strategy to slash its debt and prepare for future investments.

The transactions are aligned with AC’s strategy to rationalize its portfolio and raise P50 billion in proceeds. With these transactions, the total proceeds raised from AC’s portfolio rationalization initiatives will be P51.5 billion, Ayala Corp. said in a disclosure to the Philippine Stock Exchange.

Manila Water is the government’s concessionaire for managing the water services in the East Zone of Metro Manila, catering to more than seven million residents in 24 cities and municipalities.

It entered into a concession agreement with Metropolitan Waterworks and Sewerage System in August 1997 following a historic water privatization bidding by the Philippine government.

Ayala and its two wholly-owned units sold 1.45 billion in combined common and preferred shares in the water firm – representing a 23.6 percent stake – to Trident Water Co. Holdings Inc., a subsidiary of the Razon Group’s Prime Infrastructure Holdings Inc.

Ayala and its subsidiary Michigan Holdings Inc. executed a special block sale with Trident covering 578 million common shares priced at P22.361 each.

The pricing was based on a 30-day volume-weighted average price as of May 16, 2024, less a 7.2 percent block discount.

Philwater Holdings Co. Inc., another subsidiary of Ayala Corp., sold its 872 million preferred shares in Manila Water to Trident through the execution of a deed of absolute sale. The preferred shares were sold at a negotiated price of P1.844 apiece.

Ayala said the sale of the common shares would yield P12.9 billion while the preferred shares would raise P1.6 billion, for a total of P14.5 billion.

The payment for the preferred shares would be on a staggered basis spread over 2024 to 2029, the firm added.

After the transactions, the Ayalas will no longer hold even a single common share in Manila Water, and it will lose its voting stake in the company.

However, Ayala Corp. would retain a 12.08 percent economic stake in the water business through the preferred shares. Once the preferred shares have been fully paid for in 2029, Ayala’s economic stake in Manila Water will drop to zero, it said.

At the end of 2023, Trident Water held an economic and voting stakes of 36.92 percent and 58.32 percent, respectively, in Manila Water.

Two years ago, Ayala Corp. announced its plan to divest assets which it no longer controls to raise $1 billion, now equivalent to roughly P57 billion at the prevailing exchange rate.

The sale of non-core assets is meant to recycle capital to focus on the expansion of its core business such as power, banking and telecommunications while developing healthcare and logistics.

ALI / AREIT

Property giant Ayala Land Inc. (ALI) and its wholly-owned subsidiary, Westview Commercial Ventures Corp., sold P3.18 billion worth of shares in a well-received private placement.

Property giant Ayala Land Inc (ALI) and its unit Westview Commercial Ventures Corp (WCV) sold 98 million common shares of AREIT for P3.18 billion in a private placement.

The deal, priced at P32.45 per share, was two times subscribed and attracted high-quality institutional investors from the Philippines and the United States, ALI said in a regulatory filing Tuesday.

BPI Capital Corporation and UBS AG Singapore branch acted as placement agents for the transaction, which is related to ALI’s property-for-share swap deal with AREIT.

ALI and WCV will submit a reinvestment plan detailing the use of proceeds from the sale in due course.

This Market Recap is provided by Globalinks Securities and Stocks Inc.