THE MARKET SUMMARY

April proved to be a challenging period for equity markets, marked by a confluence of factors that stirred concerns among investors. The release of robust US inflation data, coupled with a seemingly lackluster first-quarter US GDP report that nonetheless showcased resilient private demand, intensified apprehensions that central banks might not swiftly implement monetary policy easing as previously anticipated.

This apprehension reflected in the local stock market’s performance, which witnessed a notable decline of 2.94% throughout the month. The impact of shifting interest rates was particularly pronounced in sectors sensitive to interest rate fluctuations, such as small-cap stocks and real estate investment trusts (REITs).

The repercussions of the altered rate outlook were not confined to equity markets alone; fixed-income markets also experienced turbulence. Within April, market sentiment recalibrated, erasing expectations for one-and-a-half rate cuts in the US for the year and postponing the anticipated timing of the first cut.

Concurrently, the global economic landscape exhibited resilience, buoyed by fears of escalating tensions in the Middle East, thereby driving commodity prices upward. This environment, characterized by rising energy costs and reduced sensitivity to interest rate changes, favored the value-oriented segment of the equity market, which notably outperformed

growth-oriented counterparts.

April underscored the persistent threat of inflation, which poses a significant risk capable of disrupting the momentum of risk assets. Consequently, prudent portfolio management mandates careful consideration of diverse scenarios, encompassing both recessionary deflation and enduring inflationary pressures.

In navigating these scenarios, high-quality bonds with moderate to slightly extended maturities can once again emerge as valuable contributors to portfolio returns in the event of a deflationary growth shock. Conversely, the trajectory of 2022 illuminated the potential of alternative investments like infrastructure and transportation to thrive amid a persistently

inflationary environment, owing to their low correlation with traditional bond and equity markets.

THE STORIES THAT SHAPED THE MARKET

Headline inflation quickened for a second straight month in March as prices of rice continued to surge, the Philippine Statistics Authority (PSA) reported.

Preliminary data from the PSA showed the consumer price index (CPI) accelerated to 3.7% year on year in March from 3.4% in February. This was slower than the 7.6%clip in the same month last year.

While inflation settled within the central bank’s 3.4-4.2% forecast for the month, it was slightly below the 3.8% median estimate in a poll.

March marked the fourth straight month that inflation was within the central bank’s 2-4% target range.

Month on month, inflation picked up by 0.1%. Stripping out seasonality factors, month-on-month inflation rose by 0.3%.

For the first quarter, inflation averaged 3.3%. The BSP expects average inflation to settle at 3.6% this year.

Core inflation, which excludes volatile prices of food and fuel, eased to 3.4% in March from 3.6% in February and 8% a year ago. The inflation outturn is consistent with the central bank expectations that inflation will likely remain within the target range in the first quarter of 2024 due largely to negative base effects, the central bank said in a statement.

However, inflation could temporarily accelerate above the target range in the next two quarters of the year due to the possible adverse impact of adverse weather conditions to domestic agricultural output and positive base effects, it added.

National Statistician Claire Dennis S. Mapa said March inflation was mainly driven by the heavily weighted index for food and nonalcoholic beverages, which quickened to 5.6% from 4.6% in the previous month.

However, it was much slower than the 9.3% print in 2023. Food inflation rose to 5.7% in March, its fastest print in four months or since the 5.8% recorded in November 2023. This was also faster than the 4.8%logged in February but slower than the 9.5% in the previous year.

Food inflation shared 55.2%or 2.0%age points (ppt) to the overall inflation in March 2024, the PSA said.

Among the top food groups that contributed to food inflation were cereals and cereal products and meat and other parts of slaughtered land animals, it added.

Cereal and cereal products, which include rice, quickened to 17.3% in March from 17% in the previous month and 5.5% in the same period in 2023.

Rice inflation climbed to 24.4% in March, from 23.7% in February and 2.6% a year ago. This was also its fastest print since the 24.6% in February 2009.

Rice inflation contributed 1.8 ppt to headline inflation or around 48%of the total.

For the bottom 30% of households, the contribution of rice inflation was at 3.7 ppt or almost 80% of overall inflation for the month.

Rice inflation is expected to remain in the double-digit area over the next few months, the PSA’s Mapa said.

PSA data showed that the average price of a kilogram of regular milled rice increased to P51.11 in March from P50.44 a month ago and P39.90 a year earlier.

Well-milled rice rose to P56.44 per kilogram in March from P55.93 in February and P44.23 in the previous year. Special rice averaged P64.75 per kilogram in March from P64.42 in the previous month and P54 a year ago.

Mr. Mapa also attributed faster rice inflation to elevated world rice prices and higher palay (unmilled rice) prices.

The El Niño weather event has caused dry spells and droughts in parts of the country. Agricultural damage caused by the El Niño has risen to P2.63 billion, with rice being the most affected crop.

Meanwhile, inflation for meat and other parts of slaughtered land animals increased to 2%. This was faster than the 0.7% a month ago but slower than the 4.6% a year earlier.

Mr. Mapa said that prices of meat, particularly pork, increased in March. The average price of a kilogram of pork shoulder (kasim) rose to P329.52 in March from P315.29 a year ago. Prices of pork

belly (liempo) increased to P344.29 per kilo from P327.27 in the previous year; while prices of a kilo of pork meat with bones went up to P297.30 from P286.49 in 2023.

Meanwhile, transport inflation rose to 2.1% in March from 1.2% in the previous month. However, it was slower than the 5.3% a year ago.

In March alone, pump price adjustments stood at a net increase of P2.30 a liter for gasoline, P0.65 a liter each for diesel and kerosene.

Mr. Mapa noted that the higher tricycle fares were largely felt outside of the National Capital Region (NCR).

Data from the PSA showed that the average fare for tricycles outside of NCR rose to P17.80 in March from P17.72 in February and P17.50 a year ago.

Meanwhile, the inflation rate for the bottom 30% of income households rose to 4.6% in March from 4.2% in the previous month. However, it was much slower than the 8.8% clip a year ago.

From January to March, inflation averaged 4.1% for the bottom 30%. In the NCR, inflation averaged 3.3% in March, faster than the 3.2% a month ago but slower than the 7.8% recorded in the

same month in 2023.

Inflation outside of NCR accelerated to 3.8% from 3.5%in February but was slower than the 7.5% in the previous year.

With the recent uptick in March, the central bank said that risks to the inflation outlook remain tilted toward the upside.

The upside risks to the inflation outlook could emanate from higher transport charges, higher prices of food commodities facing supply constraints, increased electricity rates, higher global oil prices, and implementation of a legislated increase in the minimum wage, it added.

El Niño has shown signs of weakening but is still expected to persist until May, according to the state weather bureau.

Monetary Policy

The Philippine central bank left its key rate unchanged at 6.5% for a fourth straight meeting and signaled a possible delay in rate cuts due to inflation risks.

The Monetary Board maintained its target reverse repurchase rate at a near 17-year high, as expected in a poll. Interest rates on the overnight deposit and lending facilities were also left unchanged at 6% and 7%.

This is the fourth straight meeting that the central bank stood pat since its 25-basis-point (bp) off-cycle hike in October.

The latest inflation path has shifted slightly higher but remains within target. Given these considerations, the Monetary Board deems it appropriate to maintain the central bank’s tight monetary policy settings, central bank Governor Eli M. Remolona, Jr. said.

He said upside risks to inflation have “become worse,” citing higher transport fares, elevated food prices, rising electricity and oil prices, and possible wage hikes.

The central bank also raised its risk-adjusted inflation forecast this year to 4% from 3.9%. However, it kept its risk-adjusted forecast for 2025 at 3.5%.

The central bank likewise hiked its baseline inflation forecast to 3.8% for 2024 from 3.6% but maintained its 3.2% forecast for next year.

The central bank chief said it would make a case for rate cuts if inflation continues to ease and if economic growth is “not too strong.” Mr. Remolona said elevated rice prices are a key risk to the outlook.

Inflation accelerated for a second straight month to 3.7% in March from 3.4% in February. Rice inflation accelerated to 24.4% in March from 23.7% a month ago, the fastest since 24.6% in February 2009. Rice accounted for almost half of overall inflation for the month.

The central bank earlier said inflation could temporarily breach the 2-4%target over the next two quarters.

Mr. Remolona said policy makers are not considering any rate hikes. Earlier rate hikes continue to affect the economy, Mr. Remolona said.

From May 2022 to October 2023, the Monetary Board raised borrowing costs by 450 bps to tame inflation.

Mr. Remolona said that they expect the economy to grow by about 5.9% this year. This was slightly below the revised 6-7% growth target set by the Development Budget Coordination Committee (DBCC) for 2024.

The country’s gross domestic product (GDP) grew by a revised 5.5% in 2023. The central bank might extend its rate pause until the second half of the year.

With the Fed possibly pushing back the timing of its rate cuts to the second half of the year and Philippine inflation projected to breach the upper end of the central bank’s target in the near term, the central bank will likely extend its hold until the Fed finally cuts its policy rates and headline inflation cools.

Inflation is expected to further accelerate in the coming months but will eventually return to target before the end of the year.

Rate Cut Delays Seen to Slow Growth

Higher for longer interest rates will keep inflation at bay but at the cost of slower economic growth. Central Bank Governor Eli M. Remolona, Jr. signaled the central bank may delay rate cuts amid persistent inflation risks.

The recent statements from Mr. Remolona suggest a cautious approach to monetary policy adjustments. If rate cuts are smaller and delayed, it could imply that the central bank is prioritizing inflation control over stimulating growth.

A delay in rate cuts might slow down economic growth in the short term as higher borrowing costs could persist and reduce investment and consumer spending.

Mr. Remolona said that the “central scenario” would be to ease rates by the fourth quarter, but this could be postponed to the first quarter of 2025 if inflation worsens.

Rate cuts will also not be “huge” and will likely bring the key rate to about 6%, he said. The central bank stood pat for a fourth straight meeting in April, keeping its benchmark rate at a near 17-year high of 6.5%.

From May 2022 to October 2023, the Monetary Board raised borrowing costs by 450 basis points (bps). Mr. Remolona had said that the current rate is already tight and is “already doing its work.”

Comments from the governor reaffirm the fact that the current policy stance is restrictive and is in a position to slow economic activity in an attempt to fend off demand-side pressures.

This goes against some assertions that the current monetary policy stance is normal. When policy rates are in restrictive territory, they go to work by slowing down the economy which in turn can lead to slower inflation as demand falls.

The economy grew by a weaker-than-expected 5.5%in 2023, falling short of the government’s 6-7%target. Economic managers recently lowered the gross domestic product (GDP) growth target to 6-7% this year from 6.5-7.5% previously, taking into consideration persistent inflation and a looming global slowdown.

First-quarter GDP data is set to be released on May 9.

If the central bank believes the current rate is achieving its goals, any easing within the year might be minimal. The extent of easing would likely depend on a range of factors, including inflation trends, economic growth data, and external economic conditions.

Inflation accelerated to 3.7% in March, the second straight month that it quickened on a monthly basis. The central bank earlier said that inflation could temporarily accelerate to above the 2-4% target range over the next two quarters as upside risks remain.

The central bank sees inflation averaging 3.8%this year. The central bank is also focused on maintaining price stability through the foreign exchange market which could help

anchor inflation expectations and prevent an inflationary spiral.

There is no meaningful effect on GDP growth if the central bank continues to keep its policy rate unchanged. Election spending and slower inflation compared with the past two years would still support demand this year.

The risk of a growth impediment could come more from global headwinds that may compel the central bank to hike

some more. But that’s still a low-probability event and not the central scenario.

Mr. Remolona said that the Monetary Board will only consider raising rates if inflation expectations are de-anchored.

The central bank last adjusted rates in October when it delivered a 25-bp rate hike in an off-cycle move.

The governor is correct to say that 6.5% policy rate is already doing its work and further tightening may only be necessary if headline inflation starts climbing towards the 6% level which is still highly unlikely at this point.

Furthermore, Mr. Remolona’s indication that he is not in favor of hiking simply indicates that rate hikes harm growth and that further rate hikes would do even more damage to growth.

DMC / CHP

Consunji family-led DMCI Holdings Inc., Dacon Corp. and Semirara Mining and Power Corp. will acquire Cemex Asian South East Corp. (Casec) for $305.6 million in a bid to expand to cement manufacturing and generate more revenues.

In a stock exchange filing, the Consunji companies confirmed they had signed a share purchase agreement with Cemex Asia BV to acquire all 42.14 million of the latter’s shares in Casec.

Of this, DMCI will acquire 56.75% (23.92 million shares); Dacon, 32.12% (13.54 million shares); and Semirara, 11.13% (4.69 million shares).

Casec owns 89.86%of Cemex Holdings Philippines Inc., the country’s fourth-largest cement manufacturer.

According to the companies, the price is still subject to “customary closing adjustments” based on Cemex Philippines’ estimated working capital, cash, and debt levels.

The transaction is expected to close within the year, they said. Coal, one of the core businesses of Semirara, is used in cement making as a source of heat.

BLOOM

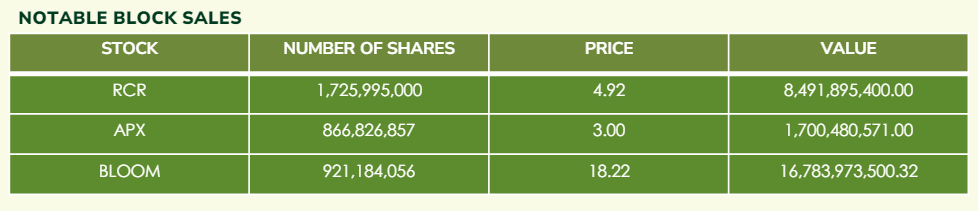

Razon-led Bloomberry Resorts Corp. completed its settlement agreement with casino management company Global Gaming Asset Management LLC (GGAM) after executing a P16.78-billion block sale on Tuesday.

On April 30, Sureste Properties, Inc. (SPI) purchased 921,184,056 Bloomberry shares from GGAM at a purchase price of P18.22 per share through a special block sale through the Philippine Stock Exchange pursuant to the settlement agreement, Bloomberry said in a regulatory filing.

he settlement agreement is therefore completed, it added.

In March, Bloomberry announced that its subsidiaries SPI and Bloomberry Resorts and Hotels, Inc. (BRHI) settled the

decade-long dispute with GGAM. The settlement agreement required SPI to purchase shares in Bloomberry held by GGAM.

The agreement comprised of a universal agreement covering all pending cases involving the parties.

GGAM was the former partner of Bloomberry in managing Solaire Resort Entertainment City in Parañaque.

In 2013, Bloomberry ended its management deal after the Razon-led company claimed that GGAM was unable to deliver on the terms specified in the contract.

In 2019, a Singapore arbitration court mandated Bloomberry to pay $296 million to GGAM, which was disputed by the listed integrated resort operator.

Bloomberry also owns and manages Solaire Resort North in Quezon City and Jeju Sun Hotel & Casino in South Korea, alongside Solare Resort Entertainment City.

Enrique K. Razon, Jr., Bloomberry’s chairman and chief executive officer, previously said that the operations of Solaire Resort North are expected to be fully scaled up by 2026, two years after its opening on May 25.

Solaire Resort North is a $1-billion integrated resort that has 526 guest rooms and suites, 2,669 electronic gaming machines, and 163 tables across four casino levels.

This Market Recap is provided by Globalinks Securities and Stocks Inc.