Warren Buffett is often regarded as the greatest investor of all time. With a net worth exceeding $100 billion and a reputation for wisdom, humility, and long-term thinking, Buffett has inspired generations of investors and entrepreneurs. But his journey to success didn’t begin in a boardroom—it started on the streets of Omaha, Nebraska, where a young boy with an entrepreneurial spirit began his path toward becoming a self-made billionaire. This blog explores Buffett’s life, his investment philosophy, his philanthropic commitments, and the enduring lessons he offers for both business and life.

Early Life and Entrepreneurial Roots

Childhood in Omaha

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska. His father, Howard Buffett, was a stockbroker and U.S. Congressman. From a very early age, Warren displayed a keen interest in business and money. At just six years old, he bought six-packs of Coca-Cola from his grandfather’s grocery store and sold individual bottles for a profit. He also sold chewing gum, magazines, and worked various jobs such as delivering newspapers and washing cars.

By the time he was a teenager, Buffett had already filed his first tax return and purchased farmland using his newspaper delivery earnings. He also operated pinball machines in local barbershops—an endeavor he later sold for a substantial profit. These ventures reflected not only his knack for identifying opportunities but also his deep understanding of reinvestment and compounding—cornerstones of his later investment strategy.

Education and Influences

Buffett attended the Wharton School at the University of Pennsylvania before transferring to the University of Nebraska, where he graduated with a degree in business. He later earned a Master of Science in Economics from Columbia University, studying under the legendary Benjamin Graham, known as the father of value investing.

Buffett’s relationship with Graham was pivotal. Graham’s principles—buying undervalued stocks with a margin of safety and relying on intrinsic value—deeply influenced Buffett. He even worked briefly at Graham-Newman Corp, gaining firsthand experience in disciplined investing. Buffett credits Graham’s book, The Intelligent Investor, as the most important investment guide he ever read.

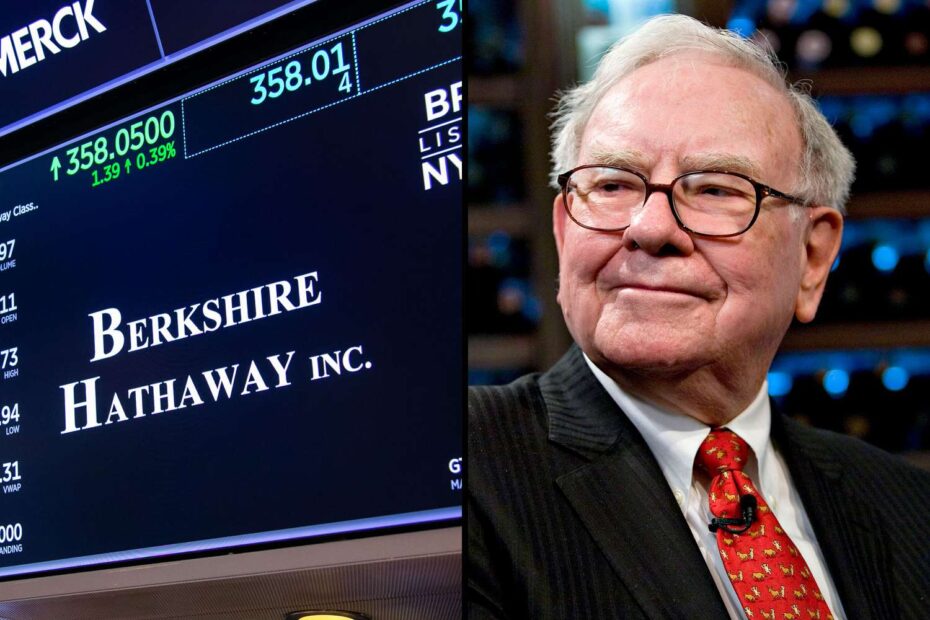

Building the Berkshire Hathaway Empire

Buffett Partnership and the Berkshire Pivot

In 1956, Warren launched Buffett Partnership Ltd. with a modest pool of capital. His exceptional performance—delivering annual returns over 20%—quickly attracted attention. By 1962, he was a millionaire and began acquiring shares in a struggling textile company: Berkshire Hathaway.

Although the textile business itself was declining, Buffett repurposed Berkshire into a holding company for long-term investments. Over time, Berkshire Hathaway became a conglomerate with wholly owned subsidiaries in insurance (GEICO), retail (Nebraska Furniture Mart), food (See’s Candies), and transportation (BNSF Railway). It also held significant public equity positions in Coca-Cola, Apple, American Express, and Bank of America.

Partnership with Charlie Munger

A key element of Buffett’s success was his enduring partnership with Charlie Munger, Berkshire’s Vice Chairman. Munger helped broaden Buffett’s investment philosophy beyond Graham-style deep value investing. Together, they emphasized quality businesses at fair prices over cheap companies at discounted valuations. Their annual letters and shareholder meetings became legendary for wisdom, wit, and principled capitalism.

Notable Investments

Buffett’s 1988 purchase of Coca-Cola stock is often cited as a classic value investing play. He invested $1 billion in Coca-Cola at a time when the company was undervalued, and he has held the position ever since, earning billions in dividends and unrealized gains. Similarly, Berkshire’s stake in Apple, now worth over $100 billion, reflects Buffett’s evolving openness to tech—so long as the business model is understandable and the brand resilient.

His investment in BNSF Railway in 2010 for $44 billion marked Berkshire’s largest acquisition, providing consistent returns and showcasing Buffett’s confidence in essential, infrastructure-driven businesses.

Investment Philosophy and Business Principles

Long-Term Thinking

Buffett famously said, “Our favorite holding period is forever.” He shuns short-term speculation and encourages looking at stocks as pieces of real businesses. This mindset helped Berkshire navigate market crashes, including the dot-com bubble and the 2008 financial crisis, without panic-selling.

Circle of Competence

Buffett emphasizes investing only in businesses one thoroughly understands. This “circle of competence” limits mistakes and builds conviction. He often passes on investments, saying, “The most important thing to do if you find yourself in a hole is to stop digging.”

Value and Moats

Buffett seeks companies with “economic moats”—durable competitive advantages such as brand, scale, or pricing power. He evaluates intrinsic value using conservative assumptions and only buys when a margin of safety exists between value and price. His discipline in buying great businesses at reasonable prices is a cornerstone of his wealth-building strategy.

Management Matters

Buffett places immense trust in management. He looks for integrity, energy, and intelligence in the leaders of the businesses he acquires. Once acquired, he allows them to operate autonomously, believing that decentralized management preserves innovation and accountability.

Philanthropy and The Giving Pledge

Commitment to Giving Back

Despite being one of the richest people on Earth, Buffett has pledged to give away more than 99% of his wealth. In 2006, he announced a historic donation to the Bill & Melinda Gates Foundation—eventually amounting to tens of billions of dollars.

The Giving Pledge

In 2010, Buffett and Bill Gates co-founded The Giving Pledge, urging billionaires around the world to commit to donating at least half their wealth to charitable causes. The initiative has attracted signatories globally and reshaped expectations of wealth and responsibility among the ultra-rich.

Life and Business Lessons

1. Patience is a Superpower

Buffett’s greatest asset is his ability to wait for the right opportunity and then hold his investments. This long-term perspective is a powerful lesson in a world obsessed with short-term gains.

2. Live Below Your Means

Despite his wealth, Buffett still lives in the same Omaha home he bought in 1958 and drives modest vehicles. His lifestyle underscores that wealth is built through discipline, not extravagance.

3. Reputation is Everything

“It takes 20 years to build a reputation and five minutes to ruin it.” Buffett’s integrity and honesty are cornerstones of his business dealings and personal life.

4. Invest in Yourself

Buffett often says that the best investment you can make is in your own education and skills. His relentless reading habit—often five to six hours a day—shows the importance of continuous learning.

5. Simplicity Over Complexity

Buffett avoids complicated investments and sticks to businesses he understands. This simplicity reduces risk and ensures he invests with conviction.

6. Generosity and Humility

Buffett’s approach to wealth is grounded in humility. He believes that success brings a responsibility to give back. His legacy is not just financial but moral—emphasizing ethical capitalism and stewardship.

Warren Buffett’s story is a masterclass in disciplined investing, ethical business, and living a meaningful life. From selling chewing gum as a child to managing a global investment empire, he has never lost touch with his values. His emphasis on patience, simplicity, and generosity continues to inspire both seasoned investors and young entrepreneurs.

As Buffett wisely said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” His life is a testament to planting deeply rooted values, nourishing them with wisdom, and reaping the long-term rewards—financial, personal, and societal.