Scam Alert! The Securities and Exchange Commission (SEC) to shut down get-rich-quick scams.

These companies are NOT REGISTERED with the Commission or OPERATE WITHOUT THE NECESSARY LICENSE AND/OR AUTHORITY to solicit, accept or take investments/placements from the public nor to issue investment contracts and other forms of securities defined under Section 3 of the Securities Regulation Code (SRC).

Please see the list below of illegal entities:

1. Gasoline Companies

The Commission has received reports that there has been a proliferation of offering and solicitation of investments for the purpose of setting up gasoline stations or investing in already existing small GASOLINE COMPANIES in the guise of a franchise agreement, co-franchisee agreement, partnership agreement, co-ownership contract, and/or other forms of contract that offers to the public an opportunity to invest in their company and earn profit “hassle-free.”

The usual scheme of these small GASOLINE COMPANIES is to lure investors by advertising that they can co-own a gas station for a minimal amount of at least Three Hundred Thousand Pesos (PhP 300,000.00). These GASOLINE COMPANIES usually offers the following:

1. Subscription to the shares of stock of the company;

2. Partnership Agreement, where a gas station will be co-owned by several partners; and

3. Co-Franchisee Contract wherein a single gas station will be franchised and owned by several co-franchisees

In the said offers, the construction, management, and operation of the gas stations will be the responsibility of the company. The investors just have to place their money, sign the contract, then wait for the quarterly distribution of profits. Some would even offer a guaranteed profit by claiming that the loss will be shouldered by the company.

The Commission reminds the public that these kinds of contracts or investment schemes, no matter how they are called, would squarely fall under the definition of an “investment contract” and/or subscription of “shares of stocks.”Therefore, in the eyes of the law, they are considered as securities under the regulatory jurisdiction of the Commission. The public solicitation of securities is mandated by Republic Act No. 8799or the Securities Regulation Code to be registered with the Commission. Thus, any issuance of unregistered securities is illegal. SEC Advisory on Gasoline Companies

2. PHILAZ/PHILAZ INTERNATIONAL TRADE CO. LTD

This ADVISORY is prompted by reports and information gathered by the Commission that individuals or groups of persons representing PHILAZ/PHILAZ INTERNATIONAL TRADE CO. LTD., is enticing the public, through social media platforms or through their own independent websites, to invest in said entity.

According to Philaz.com Facebook page, Philaz International Trade Co. Ltd. was established on August 1,2018. It claims to be a self-service order placement platform for all international e-commerce companies, supporting mainstream e-commerce platforms such as Shoppee, Lazada, Amazon, and Ebay.

As posted on their Website and Facebook Page, you can invest by registering first, then you can choose from any of the six (6) VIP PLANS with corresponding tasks which are:

- VIP1, worth Php1,000.00 (5 tasks)

- VIP2, worth Php3,500.00 (15 tasks)

- VIP3, worth Php8,000.00 (30 tasks)

- VIP4, worth Php20,000.00 (40 tasks)

- VIP5, worth Php40,000.00 (85 tasks) and

- VIP6 worth Php88,000.00 (120 tasks)

Investors can earn Php50.00 to Php3,600.00 daily or up to Php1,500.00 to PHP108,000.00 monthly depending on what plan they avail of.An investor can also earn from 12% recharge commission for direct agency/agent, 10% task commission for direct agency/agent and 5% task commission for in-direct agency/agent.

Based on the Commission’s database, PHILAZ/PHILAZ INTERNATIONAL TRADE CO. LTD., is NOT REGISTERED as a corporation or partnership and OPERATES WITHOUT THE NECESSARY LICENSE AND/OR AUTHORITY to solicit, accept or take investments/placements from the public nor to issue investment contracts and other forms of securities defined under Section 3 of the Securities Regulation Code (SRC).

Further, the scheme employed by PHILAZ/PHILAZ INTERNATIONAL TRADE CO. LTD., shows indication of a possible “Ponzi Scheme” where monies from new investors are used in paying “fake profits” to prior investors and is designed mainly to favor its top recruiters and prior risk takers and is detrimental to subsequent members in case of scarcity of new investors. SEC Advisory on PHILAZ.

3.POGI BREEDS/POGI BREEDS INTERNATIONAL/POGI BREEDS INT’L/COPARTNERS POGIBREEDS

The Securities and Exchange Commission has received information that individuals or groups of persons of person representing POGI BREEDS/POGI BREEDS INTERNATIONAL/POGI BREEDS INT’L/COPARTNERS POGIBREEDS headed by GINO MENDOZA, a.k.a., NIGO TEKASHII have been soliciting investment from the public.

Based on information gathered by the Commission, POGI BREEDS/POGI BREEDS INTERNATIONAL/POGI BREEDS INT’L/COPARTNERS POGIBREEDS area group of persons claiming to be using its client’s money in buying, breeding Axies and playing the AXIE INFINITY game.

Among its activities is to offer its CO-PARTNERSHIP PROGRAM to the public where an investor is enticed to invest an amount ranging from P5,000 up to P250,000 Pesos with promised earnings ranging from P100 to P25,000 daily or 2% daily or 10% or weekly earnings for 45 days or total contract earnings ranging from P4,500.00 up to P225,000.00 or 90% per contract in 45 days.

POGI BREEDS assures its co-partners that the capital will be returned after 59 days or at the end of the contract. It further promises that prospective clients can “Request for profit” and “Cash-Out” during Mondays and Thursdays.

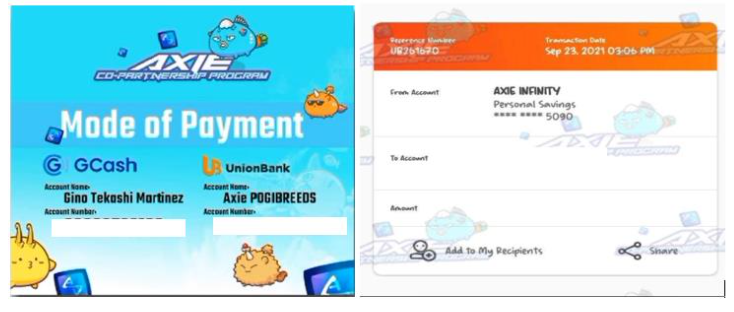

n its “pay-ins” and “pay-outs”, POGI BREEDSusesthe following GCASH and UNION BANK OF THE PHILIPPINES accounts:

The CO-PARTNERSHIP PROGRAM offered by POGI BREEDS clearly falls under the definition of securities in the form of an investment contract which is mandated by Republic Act No. 8799 or the Securities Regulation Code (SRC) to be registered with the Commission before these securities are offered to the public.

Please be informed that POGI BREEDS/POGI BREEDS INTERNATIONAL/POGI BREEDS INT’L/COPARTNERS POGIBREEDS is NOT REGISTERED with the Commission and NOT AUTHORIZED to solicit investments from the public as it did not secure prior registration and/or license to solicit investments from the Commission as prescribed under Section 8 of the Securities Regulation Code.

As the product offered by POGI BREEDS/POGI BREEDS INTERNATIONAL/POGI BREEDS INTL/COPARTNERS POGIBREEDS is the opportunity to earn in the play-to-earn game of AXIE INFINITY, the public is also informed that AXIE INFINITY or its developer, SKY MAVIS are not registered and not licensed to do business in the Philippines as a branch, regional area/operating headquarters or a representative office and they do not possess any secondary license to conduct any regulated activity within the Philippines. SEC Advisory on POGI BREEDS

4. RISING OPPORTUNITY INTERNATIONAL (ROI) BUSINESS/R O I BUSINESS DEVELOPMENT SERVICES

The Securities and Exchange Commission has received information that individuals or groups of persons of person representing RISING OPPORTUNITY INTERNATIONAL (ROI) BUSINESS/RO I BUSINESS DEVELOPMENT SERVICES owned and operated by JAYSON REGAÑON NUEVAESPAÑA, have been soliciting investment from the public.

Based on information gathered by the Commission, RISING OPPORTUNITY INTERNATIONAL (ROI) BUSINESS/ROI BUSINESS DEVELOPMENT SERVICES offers the following compensation plans:

Under ROI’sprogram, a member may invest for as low P500.00 up to 50,000.00 and promises, depending on the selected plan, i.e., Starting Plan, Elite Trading System Plan, Premium Dealer System Plan and Partnership Plan, a return on investment ranging from P600 up to P 90,000or 120% -150% return for 10, 15, 20 or 30 days.

Based on records, RISING OPPORTUNITY INTERNATIONAL (ROI) BUSINESS/ROI BUSINESS DEVELOPMENT SERVICES /ROI SYSTEM is not registered with the Commission as a corporation or partnership. It is not authorized to solicit investments from the public as this entity did not secure prior registration and/or license to solicit investments from the Commission as prescribed under Section 8 of the Securities Regulation Code.

The public is hereby warned that the investment schemes being propagated by RISING OPPORTUNITY INTERNATIONAL (ROI) BUSINESS/ROI BUSINESS DEVELOPMENT SERVICES /ROI SYSTEM are considered as securities in the nature of investment contracts subject to the regulatory authority of this Commission. The offering and selling of securities to the public without a permit or license is a violation of Section 8.1. of the Securities Regulation Code. SEC Advisory on ROI.

5. SPAV SOLUTIONS CORP. DOING BUSINESS UNDER THE NAMES AND STYLES OF EMPORIA INSTITUTE, EMPORIA

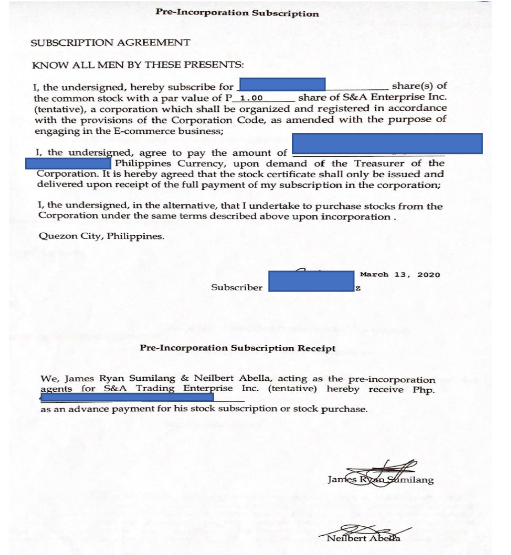

This ADVISORY is prompted by complaints from victims of SPAV SOLUTIONS CORP. DOING BUSINESS UNDER THE NAMES AND STYLES OF EMPORIA INSTITUTE, EMPORIA (FORMERLY SPAV SOLUTIONS CORP.)(“SPAV SOLUTIONS CORP.” for brevity)headed by Mr. James Ryan A. Sumilang and Mr. Neilbert Abella as its Chairman & President and Vice-President respectively.

The public is hereby informed that based on the Commission’s database, SPAV SOLUTIONS CORP. is registered with the Commission with Company Registration No. CS201815812 which authorizes it to engage in the business of a consultancy firm, but it is NOT AUTHORIZED to solicit investments/placements from the public nor to issue investment contracts and other forms of securities since it has not secured prior registration and/or license from the Commission as prescribed under Sections 8 and 28 of the Securities Regulation Code.

SPAV SOLUTIONS CORP., through its officers, James Sumilang and Neilbert Abella, had engaged in the operation of supposed foreign currency exchange trading business and had accepted investments from their colleagues and acquaintances in different accounting firms. Based on the information gathered, SPAV SOLUTIONS CORP. appears to be engaged in investment-taking activities not authorized by the Commission. James Sumilang and Neilbert Abellaenticed the public to invest their money in SPAV SOLUTIONS CORP.with a promise of up to three percent (3%) of the total pool of managed funds or an average of 30% for a three (3) months trading period.

The Commission,to protect the investing public, issues Advisories intended to warn the public on investment scams proliferating in our country and that based on information received by the SEC, there are certain companies, entities and individuals engaged in business operations with apparent indications of illegal investment-solicitation activities.

Do take note that offers of investment opportunities that are in the nature of “investment contracts,” which are classified as “securities” under the Securities Regulation Code needs to be registered with the Commission and that the company and individual representatives thereof offering and selling the same needs to be licensed and registered as a broker in securities and salesmen, respectively.

Thus, we always remind the public to be cautious in investing and to make investment decisions wisely:

- By conducting due diligence as to the actual operation of the company offering the investment to determine the primary sources of its income;

- Avoiding investments offering unrealistic returns; and

- By taking into consideration the compliance with the applicable laws

The public is hereby advised NOT TO INVEST or STOP INVESTING in any investment scheme being offered by any individual or group of persons allegedly for or on behalf of SPAV SOLUTIONS CORP.and to exercise caution in dealing with any individuals or group of persons soliciting investments for and on behalf of said entity. SEC Advisory on SPAV

6. SEAFOOD TRADE.ASIA/SHRIMP FARMING SEAFOOD.ASIA DIGITAL MARKETING SERVICES/ONG SHRIMP FARMING/AQUA IMPORT EXPORT AND PROPERTIES HOLDINGS INC.

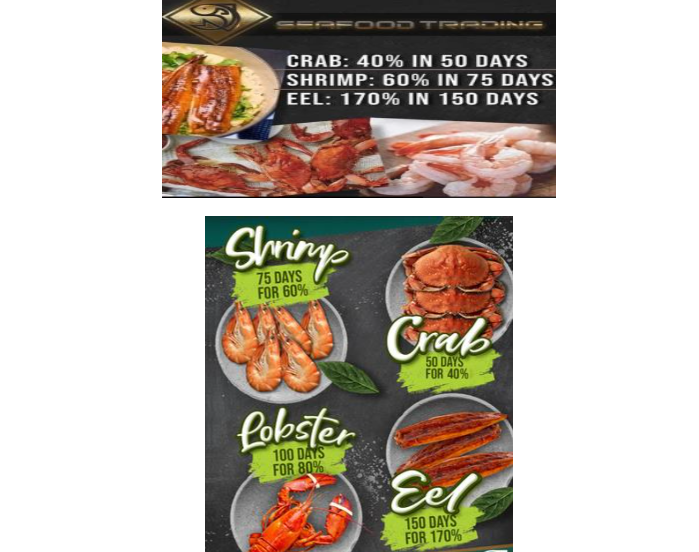

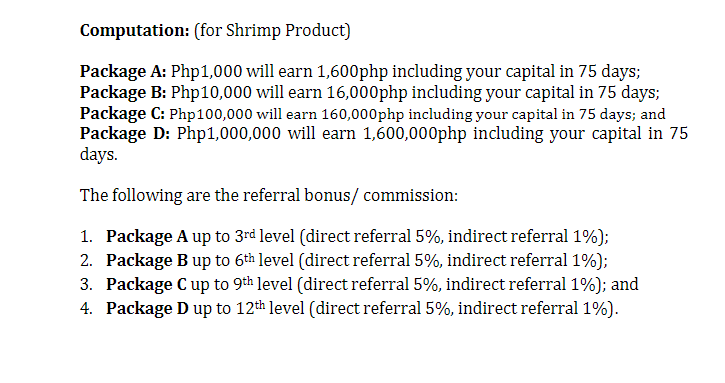

The Commission has received numerous reports regarding the activities of entities named SEAFOOD TRADE.ASIA/SHRIMP FARMING/SEAFOOD.ASIA DIGITAL MARKETING SERVICES/ONG SHRIMP FARMING/AQUA IMPORT EXPORT AND PROPERTIES HOLDINGS INC.owned and operated by Kyle Belo Chan are engaged in investment-taking activities

SEAFOOD TRADE.ASIA/SHRIMP FARMINGSEAFOOD.ASIA DIGITAL MARKETING SERVICES/ONG SHRIMP FARMING/AQUA IMPORT EXPORT AND PROPERTIES HOLDINGS INC. are enticing the public to participate in its aquaculture farming business by offering several packages with 40% to 170% guaranteed Return on Investment (ROI)from the period of 50 to 150 days.

The public is hereby warned that such investment schemes are considered securities subject to the regulatory authority of this Commission. The offering and selling of securities to the public without a permit or license is a violation of Section 8.1. of the Securities Regulation Code.

The public is hereby informed that SEAFOOD TRADE.ASIA/SHRIMP FARMINGSEAFOOD.ASIA DIGITAL MARKETING SERVICES/ONG SHRIMP FARMING are not registered with the Commission as a corporation, partnership or one-person corporation while AQUA IMPORT EXPORT AND PROPERTIES HOLDINGS INC. which is registered with the Commission with Company Registration No. CS20210737 on 09 February 2021.However, all of them are not authorized to solicit investments from the public, not having secured prior registration and/or license to solicit investments as prescribed under Section 8 of the Securities Regulation Code (SRC). SEC Advisory on SEAFOOD TRADE

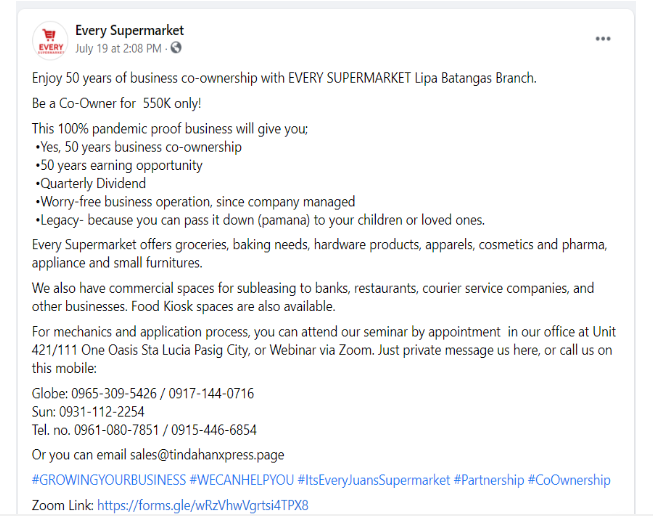

7. EVERY SUPERMARKET

The Securities and Exchange Commission has received information that individuals or groups of persons of person representing EVERY SUPERMARKET have been soliciting investments from the public.

Based on information gathered by the Commission, EVERY SUPERMARKET appears to be the “supermarket brand” of TINDAHAN EXPRESS INC and promoted and marketed by MP SALES INC. Its founder and CEO/President is RAYMOND P. PINEDA, a.k.a “MON PINEDA.”

Under this program, the applicant may invest THREE HUNDRED SEVENTY-EIGHT THOUSAND PESOS or FIVE HUNDRED FIFTY THOUSAND PESOS, depending on the selected plan, projecting an earning opportunity with a “conservative” return of income ranging from “10% to 20% earnings per year.”

According to EVERY SUPERMARKET, the earnings or profits shall be generated from the sale of goods, lease from concessionaires, listing fee, and display allowance in the store.

EVERY SUPERMARKET, TINDAHAN XPRESS INC., MP.SALES INC. are not authorized to solicit investments from the public as they did not secure prior registration and/or license to solicit investments from the Commission as prescribed under Section 8 of the Securities Regulation Code. SEC Advisory on Every Supermarket.

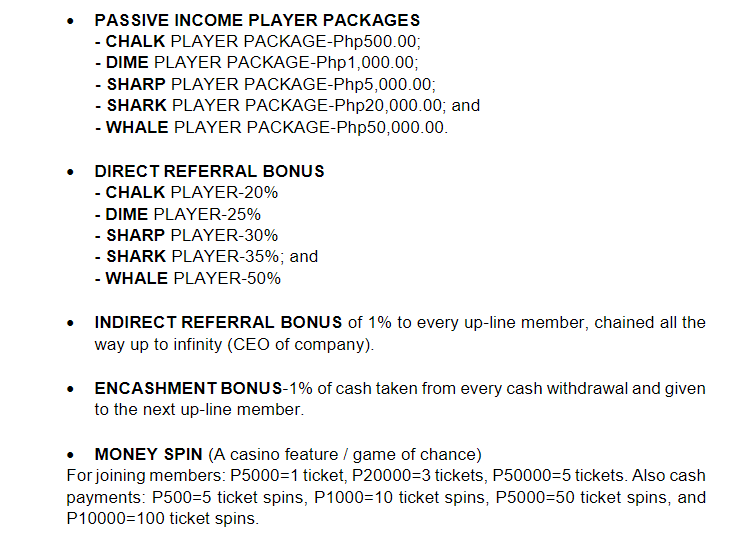

8. MONEY GAME HUB / MGH TRADING OPC (“MGH”)

The Commission has received information that MONEY GAME HUB / MGH TRADING OPC (“MGH”) is engaged in UNAUTHORIZED investment-taking activities. MONEY GAME HUB/ MGH TRADING OPC is allegedly a perfume distribution marketing company and is headed by ALEXANDER LIBRES SALVADOR who entices the public to join the company and invest a minimum of Five Hundred Pesos (Php500.00) and promises seven times (7X) return on investment for a period of 40 days. Hence, an initial investment of Php500.00 will have a return of Php3,500.00 after 40 days as shown in the table below:

The Money Game Hub is designed as a Multi-level marketing platform providing:

The public is hereby informed that MONEY GAME HUB is not registered as a corporation and partnership. However, MGH TRADING OPC is registered with the Commission as a One Person Corporation. Nonetheless, both MONEY GAME HUB / MGH TRADING OPC are not authorized to solicit investments from the public as they did not secure prior registration and/or license to solicit investments from the Commission as prescribed under Section 8 of the Securities and Exchange Commission. SEC Advisory on Money Game Hub.

9. FILIPINO FAMILY CLUB INTERNATIONAL INC/ FRANCIS LEO MARCOS FAMILY CLUB INCORPORATED

It has come to the attention of the Commission that the entity operating under the name FILIPINO FAMILY CLUB INTERNATIONAL INC. formerly or a variation of the FRANCIS LEO MARCOS FAMILY CLUB INCORPORATED or FLM FAMILY CLUB, INC.by FRANCIS LEO A. MARCOS or NORMAN A. MANGUSIN is continuously soliciting donations from the public for its dubious humanitarian activities through its supposed officers, namely, EDUVEGES“DONG”BATALAN (President), ALFRED “ALYSSA DEE”DU (Vice President for Finance),LUANNE MARIELEISE PEŇANO (Vice President for Communication), RACHEL “ACEY”GUITERREZ(Vice President for PR and Marketing),JONCHO “YHAMA” TAN(Executive Secretary), BENEDICT BATALAN (MIS Manager), ROMMEL “LEMMOR” LAFUENTE (Media Manager), CESAR DE GUZMAN (Corporate Services Manager), and MARY “VICTORIA” SANVICTORES without prior registration, license and/or accreditation from the Department of Social Welfare and Development (DSWD).

As part of its new scheme, the FILIPINO FAMILY CLUB INTERNATIONAL INC. are offering premium to Econo membership packages ranging from Two Hundred Fifty Pesos (Php 250.00) to Five Thousand Pesos (Php 5,000.00) and are apparently selling merchandise for a cause.

The FILIPINO FAMILY CLUB INTERNATIONAL INC. is NON-COMPLIANT with the “REVISED OMNIBUS RULES AND REGULATIONS ON PUBLIC SOLICITATION” or the “Solicitation Permit Law of the Philippines” (PresidentialDecree No. 1564) which aims to obviate illegal fund drives by promoting transparency and accountability of persons, corporations, organizations, and associations to ensure the efficient management of funds solicited from the public.

It must be emphasized that the issuance of a Certificate of Incorporation only grants an entity a juridical personality but does not constitute an authority or license for the corporation to engage in activities that require a secondary license from the SEC and/or from such other government agencies like the DSWD.In fact, the Certificate of Incorporation issued to FILIPINO FAMILY CLUB INTERNATIONAL INC explicitly states that: “Neither does this Certificate constitute a permit to undertake activities for which other government agencies require a license or permit.

The Commission warns the public against FRANCIS LEO MARCOS and his now FILIPINO FAMILY CLUB INTERNATIONAL INC. and/or in dealing with any individuals or group of persons acting or soliciting donations for or on behalf of FRANCIS LEO MARCOS and/or his pretentious organization.

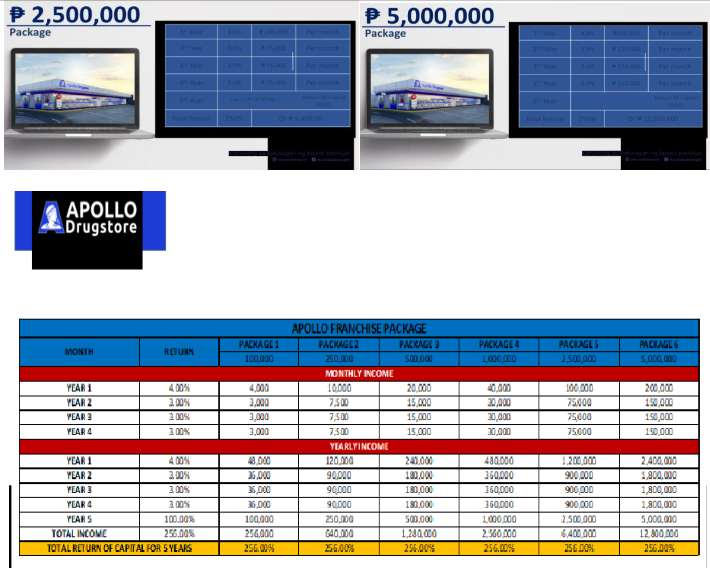

10. APOLLO DRUGSTORE AND DIAGNOSTIC CENTER, INC. (APOLLO DRUGSTORE)

The Commission has received information that an individual or group of persons representing an entity named APOLLO DRUGSTORE AND DIAGNOSTIC CENTER, INC. (APOLLO DRUGSTORE) are enticing the public to invest their money in the said entity with the promise of high monetary rewards or profits.APOLLO DRUGSTOREclaims to be engaged in a drugstore business.

Based on reports and the information gathered and verified by the Commission, APOLLO DRUGSTORE entices the public to invest by offering a “CO-FRANCHISING PROGRAM” starting from Php100,000.00up to Php5,000,000.00that guarantees a passive income of up to Php12,800,000.00 for five (5) years.

As the above-described scheme involves the sale of securities to the public in the form of investment contracts, the Securities Regulation Code (SRC) requires that these securities are duly registered with the Commission and that the concerned entities and/or its agents have appropriate registration and/or license to sell such securities to the public pursuant to Section 8 and 28 of the SRC.

The public is hereby informed that while APOLLO DRUGSTORE AND DIAGNOSTIC CENTER, INC.has been registered with the Commission as a corporation on 03 October 2020 under Company Registration CS202009100, however, it is NOT AUTHORIZED to offer, solicit, sell or distribute any investment/securities to the public. Such activities require a Secondary License from the Commission and the securities or investment product should likewise be registered with the SEC before they can be offered or sold to the public under Sections 8 and 12 of the Securities Regulation Code (SRC). SEC Advisory on APOLLO DRUGSTORE.

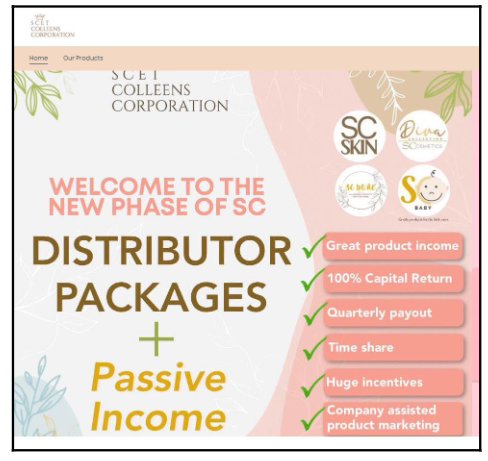

11. SCET COLLEENS CORPORATION

In response to numerous reports and inquiries received by the Commission on SCET COLLEENS CORPORATION(SCET)by SHARA JANE CASAO CHAVEZ, KAY ANNE CUIZON LEYSON, EDITH FRANCISSE VILLEGAS TABLANTE, EARN STA, RITA SAGUINDEL,and ARTEMIO TARONA PONCE,JR.,the Commission wishes to inform the public that SCET COLLEENS CORPORATIONis NOT AUTHORIZED to solicit, accept or take investments/placements from the public nor to issue investment contracts and other forms of securities defined of the Securities Regulation Code (SRC)because it DOES NOT HAVE A SECONDARY LICENSE from the Commission for that purpose contrary to its supposed claim. To wit:

Based on what we have gathered,SCET COLLEENS CORPORATION is offering a number of investment packages and promos ranging from Three Thousand Eight Hundred Pesos (Php 3,800.00) to One Million Eighty Thousand Pesos (Php 1,080,000.00)promising guaranteed lucrative passive returnsof Five to Eight Percent Return of Investment (5-8% ROI) per month and other bonuses with little or no risk. These include the SUB-RESELLER DISTRIBUTOR, RESELLER DISTRIBUTOR, CITY DISTRIBUTOR, PROVINCIAL DISTRIBUTOR, REGIONAL DISTRIBUTOR,STARTER, JUMPSTART, DELUXE, PRO, ELITE, and DIAMONDcompensation plans/packages.

Hence, since the scheme of SCET COLLEENS CORPORATION involves the offering and sale of securities, in the form of investment contracts, to the public where investors are deemed investing in its enterprise and are led to expect profits therefrom even without doing anything, the SRC requires that such securities must be duly registered with the Commission and that SCET COLLEENS CORPORATION must also secure the necessary registration and/or license to offer and/or sell the same as well.

The public is reminded that any offer or promise of ridiculous rates of return with little or no risk similar to what SCET COLLEENS CORPORATION is offering is an indication of a possible Ponzi Scheme where returns to early investors are likely to be paid out from the investments of new investors and not out of the companies’ profits similar to those already flagged by the Commission as scams. SEC Advisory on SCET.

12. FMD LOGISTICS TRUCKING CORPORATION / FMD LOGISTICS INTERNATIONAL CORPORATION

The Commission has received numerous reports and inquiries that FMD LOGISTICS TRUCKING CORPORATION/ FMD LOGISTICS INTERNATIONAL CORPORATION headed by JOHN EDWARD OBATAY VICTORIO, MARK ANTHONY BALLESTEROS, and RONEL JOVEN LAPIRA is engaged in investment-taking activities in the Philippines which is NOT AUTHORIZED by the Commission.

FMD LOGISTICS TRUCKING CORPORATION / FMD LOGISTICS INTERNATIONAL CORPORATION is apparently offering a business opportunity where a prospective investor will make an initial investment of P11,000.00 to P315,000.00 with a promise of profit of up to 55% in just 6 months.

FMD LOGISTICS TRUCKING CORPORATION / FMD LOGISTICS INTERNATIONAL CORPORATIONadvertise their investment-taking scheme through their Facebook page where they offer four types or levels of the initial investment. As each level increases, the amount of initial investment, as well as the promised profit, also increases. To wit:

Based on the foregoing, FMD LOGISTICS TRUCKING CORPORATION’s so-called co-partnership program is an investment contract because it involves the offering and sale of securities to the public where their investors need not exert any effort other than to invest or place money in its scheme in order to earn profit.

FMD LOGISTICS TRUCKING CORPORATIONis NOT REGISTERED with the Commission as a corporation, while FMD LOGISTICS INTERNATIONAL CORPORATION is registered under Company Registration No. 2021010005900-01.NONETHELESS, BOTH OF THEM OPERATE WITHOUT THE NECESSARY LICENSE AND/OR AUTHORITY to solicit, accept or take investments/placements from the public nor to issue investment contracts and other forms of securities defined under Section 3 of the Securities Regulation Code (SRC). SEC Advisory on FMD.

13. DME GRAINS PH / DME GOOD GRAINS OPC

The Commission was made aware of the illegal investment-taking activities of DME GRAINS PH/DME GOOD GRAINS OPC owned and operated by Dan Matthew E. Enteria, a.k.a. Matt Enteria.

Based on the information gathered by the Commission,DME GRAINS PH/DME GOOD GRAINS OPC is propagating several investment-taking schemes which promise high returns.

DME GRAINS PH/DME GOOD GRAINS OPC is enticing the public to invest their monies in exchange for profits by posting an attractive “complan”. For a minimum of Php1,000 entry/purchase you will earn 3.5.% per day up to 10dayswith Direct Referral Bonus and Indirect Referral Bonus, as shown below:

The schemes of DME GRAINS PH/DME GOOD GRAINS OPC involve the offering and sale of securities in the form of Investment Contracts to the public as investors need not exert any effort other than to invest or place monies in DME GRAINS PH/DME GOOD GRAINS OPC in order to generate income.

Per records of the Commission, while DME GOOD GRAINS OPC is registered with this Commission on 10 June 2021 under SEC Registration No. 2021060016227-01, however, it is not authorized to solicit investments from the public as it did not secure prior registration and/or license to solicit investments from the Commission as prescribed under Section 8 of the SRC.

Moreover, DME GRAINS PH/DME GOOD GRAINS OPC is also NOT REGISTERED either as a crowdfunding intermediary or a funding portal under SEC Memorandum Circular No. 14, Series of 2019 or the Rules and Regulations Governing Crowdfunding. SEC Advisory on DME.

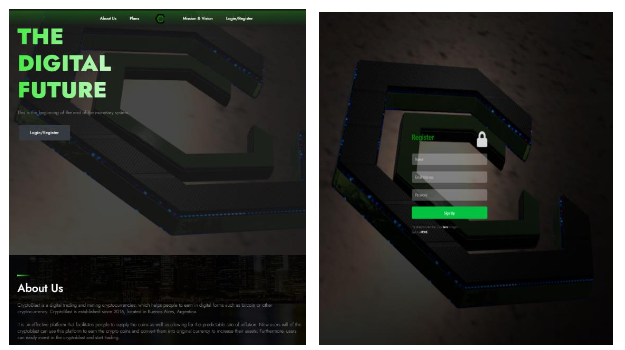

14. CRYPTOBLAST INC./CRYPTOBLAST PHILIPPINES INC.

The Securities and Exchange Commission has received information that individuals or groups of persons are enticing the public to invest in CRYPTOBLAST INC./CRYPTOBLAST PHILIPPINES INC./CRYPTOBLAST.

Information gathered disclosed that CRYPTOBLAST claims to be located in Buenos Aires, Argentina, and is operated by a person claiming to be ALEXANDER LANSER or ALEX LANSER.

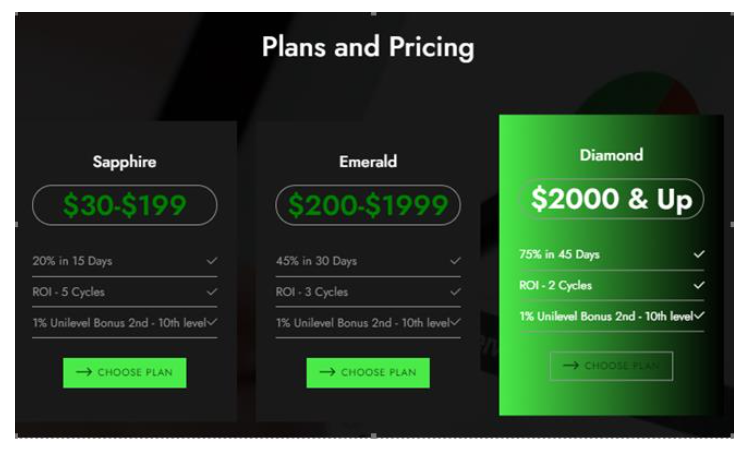

CRYPTOBLAST entices prospective members to invest in their so-called “PLANS” (i.e, SAPPHIRE, EMERALD, and DIAMOND) wherein depending on the plans, an investment of an amount ranging from $30 up to more than $2,000 dollars or P1,500 up to P1,000,000 would generate profit ranging from 20% up to 75%after 15, 30 or 75 days.

Its scheme is to entice would-be clients to register, subscribe and exchange their cash or fiat currency into Bitcoins (BTC) and by using their BTC wallet in Blockchain.com to use, deposit, and transfer these BTCs (i.e., by using the wallet address generated from the CRYPTOBLAST website) to their CRYPTOBLAST account. After the validation of the deposit, these BTCs shall be converted into CRYPTOBLASTCoins (CB Coins).

Per records, CRYPTOBLAST INC./CRYPTOBLAST PHILIPPINES INC./CRYPTOBLAST is not registered with the Commission. As an unregistered corporation, it is not allowed to solicit investments from the public and cannot, therefore, secure prior registration and/or license to solicit investments from the Commission as prescribed under Section 8 of the Securities Regulation Code. SEC Advisory on CryptoBlast.

15. TRIPLE G BUSINESS CONSULTANCY SERVICES OPC

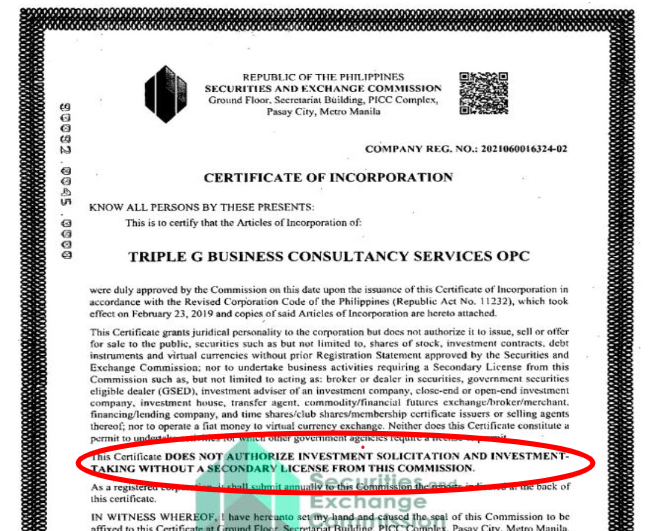

Based on the information gathered by the Commission, a number of individuals or groups of persons claiming to represent TRIPLE G BUSINESS CONSULTANCY SERVICES OPC headed by its CEO, Founder, and President Gerald Gervacio Guevarra are enticing the public to invest their money in said entity.

As posted online, TRIPLE G BUSINESS CONSULTANCY SERVICES OPC is offering the following Plan where an investor shall earn: 100% in just 30 days for Plan A (for investment below Php100,000.00); 240% in just 30 days for Plan B and, 350% in just 45 days for Plan C (both for investment amounting to at least Php100,000.00).

Moreover, it is offering Leadership Bonus and Direct Referrals for its recruitment scheme.

Accordingly, Gerald Gervacio Guevarra, through his company, shall use the investors’ money to trade in a highy-volatile asset class of cryptocurrency from which the supposed guaranteed income shall be derived.

While TRIPLE G BUSINESS CONSULTANCY SERVICES OPC (with Facebook account “TRIPLEG” and website “WWW.TRIPLEGTRADING.COM”) was able to register with this Commission on 11 June 2021 under Company Reg. No. 2021060016324-02.

The public is advised NOT TO INVEST or STOP INVESTING in any investment scheme being offered by any individual or group of persons allegedly for or on behalf of TRIPLE G BUSINESS CONSULTANCY SERVICES OPC and to exercise caution in dealing with any individuals or group of persons soliciting investments for and on behalf of it. SEC Advisor on TripleG

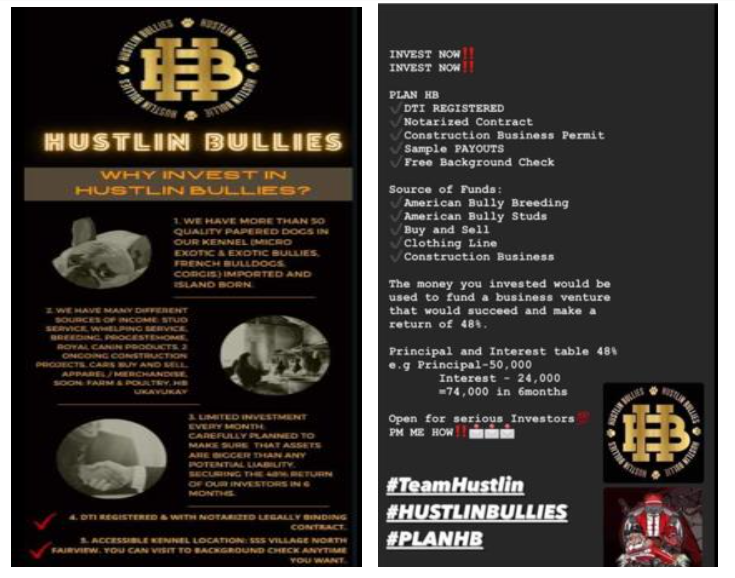

16. HUSTLIN BULLIES

The Commission has received numerous reports regarding the activities of an entity named HUSTLIN BULLIES which is engaged in investment-taking activities.

Based on information gathered by the Commission, HUSTLIN BULLIES is enticing the public to participate in its dog-breeding program, buy and sell program, clothing line program, and construction business program. An investor may opt to invest any amount more than Twenty Thousand Pesos (Php20,000.00)as they do not limit the maximum investment an individual can invest, with 48% guaranteed Return On Investment (ROI) for the period of 6 months.

Based on the Commission’s database, HUSTLIN BULLIES, is NOT REGISTERED as a corporation or partnership and OPERATES WITHOUT THE NECESSARY LICENSE AND/OR AUTHORITY to solicit, accept or take investments/placements from the public nor to issue investment contracts and other forms of securities defined under Section 3 of the Securities Regulation Code (SRC).

Further, the scheme employed by HUSTLIN BULLIES shows indication of a possible “Ponzi Scheme” where monies from new investors are used in paying “fake profits” to prior investors and is designed mainly to favor its top recruiters and prior risk takers and is detrimental to subsequent members in case of scarcity of new investors. SEC Advisory on Hustlin Bullies.

17. THE GREEN SHOP

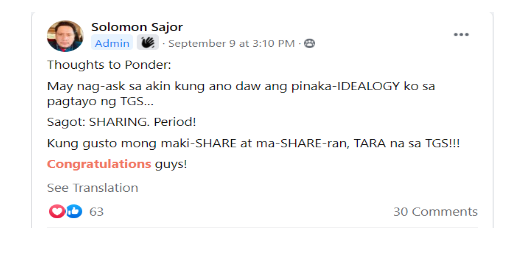

Based on information gathered by the Commission, a number of individuals or groups of persons claiming to represent THE GREEN SHOP headed by its CEO, Founder, and President, SOLOMON SAJOR are enticing the public to invest their money in the said entity.

As posted online, THE GREEN SHOP is enticing the public to invest with a minimum investment of Php 1,000. Likewise, the following are the different ways to earn through THE GREEN SHOP: 1) Passive Income 2) Direct Referral Bonusand3) Product Selling.

According to its founder and CEO, Mr. Sajor, the “ideology”of the compensation plan of the green shop came from the concept of “SHARING”.

In addition, THE GREEN SHOP promises additional income in the recruitment of new investors with the promise of Php 100 for every 1 direct referral, Php 400 for every 2 direct referrals, Php 500 for every 4 direct referrals, Php 600 for 6 direct referrals and Php 1,000 for every 10 direct referrals which qualify you to power leader level.

The records of the Commission show that THE GREEN SHOP is not registered with the Commission as a corporation nor as a partnership. Further, it is not authorized to solicit investments from the public since it has not secured prior registration and/or license from the Commission as prescribed under Section 8 and 28 of the Securities Regulation Code.

The public is reminded that any offer or promise of ridiculous rates of return with little or no risk similar to what THE GREEN SHOP is offering is an indication of a possible Ponzi Scheme where returns to early investors are likely to be paid out from the investment of new investors and not out of the companies’ profits similar to those already flagged by the Commission as scams. SEC Advisory on THE GREEN SHOP.

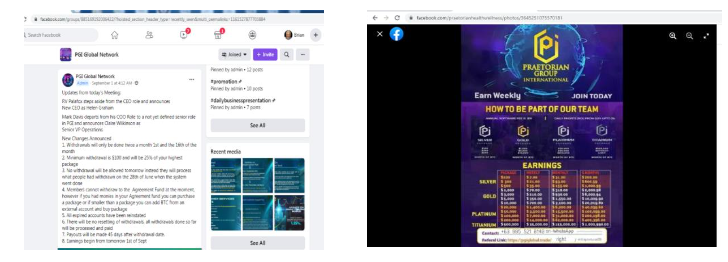

18. PRAETORIAN GROUP INTERNATIONAL TRADING Inc.

This Advisory is prompted by numerous reports and information collated by the Commission, concerning individuals or groups of persons enticing the public via Facebook application to invest in PRAETORIAN GROUP INTERNATIONAL TRADING Inc.

Based on its Certificate of Incorporation, PRAETORIAN GROUP INTERNATIONAL TRADING Inc. (PGI for brevity)was registered on December 9, 2020. As shown above and displayed online by its followers, PGIis engaged in the business of selling, distributing, marketing, import, and export at wholesale and retail as may be permitted by law all kinds of commodities, wares, and merchandise of every kind and description. They also offer cryptocurrency trading and a variety of health products.

RV Palafox, a Filipino, multi-level marketer, and a registered nurse by profession is the founder and former Chief Executive Officer (CEO) of PGI/Praetorian Global Network. On September 1, 2021, due to client withdrawal issues, Palafox claims to have stepped down and Helen L. Grahamtook over PGI’shelm. PGI’s Facebook page is managed by three persons, namely: Claire Wilkinson, Bashir Bala Saulawa and a third person who uses PGI Global Networks his account name. PGI’s main office is allegedly located at London, United Kingdom of Great Britain with other corporate offices situated at USA, Philippines, Singapore, Estonia, Nigeria, and South Africa.

As posted on its Facebook page there are several ways to join and invest with PGI. First, you must attend the scheduled Zoom meeting; Second, contact the person who invited you; Third, get a referral link; Fourth Select a package and purchase the amount that suits your budget; and Fifth; share the opportunity and teach your members to do the same.

Once registered, there are six ways to earn in PGI. To wit: (1) Passive income of 0.5% to 3.0% daily or a 15% to 90% return monthly or 1.080% annually; (2) Direct Referral; (3) Binary Bonus: (4) Boost up Bonus; (5) Renewal Bonus and (6) Career plan. The investment contract shall expire within 365 days or upon achievement of 200% profit whichever comes first, with an option for renewal. To earn more, an investor must upgrade his package. In connection to the aforementioned earnings, PGI charges an annual software fee in the amount of $19 US dollars

The scheme employed by PGI clearly shows indication of a possible “Ponzi Scheme” where monies from new investors are used in paying “fake profits” to prior investors and is designed mainly to favor its top recruiters and prior risk takers and is detrimental to subsequent members in case of scarcity of new investors.

Hence, the public is advised NOT TO INVEST or STOP INVESTING in any scheme offered by PGI or such as other entities engaged in smart contracts and virtual asset trading that are not registered with the Commission and the BSP. SEC Advisory on PGI.

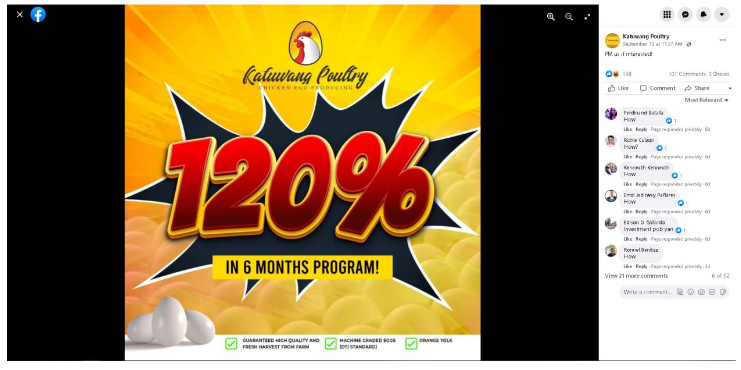

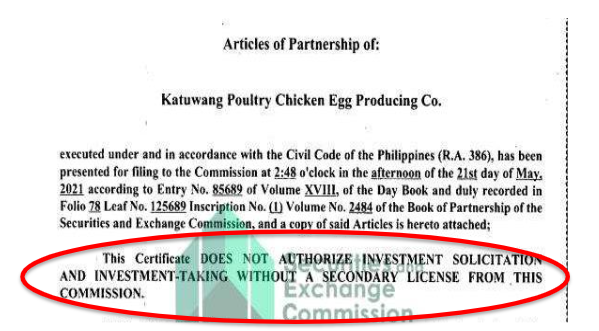

19. KATUWANG POULTRY CHICKEN EGG PRODUCING CO.

Based on numerous reports and information gathered by the Commission, the entity operating under the name KATUWANG POULTRY CHICKEN EGG PRODUCING CO. through its partners,MANNY NUQUE FERNANDEZ, PHILIP L. MERCADO and NESTOR CASTRO is found to be engaged in investment-taking activities in the Philippines which is NOT AUTHORIZED by the Commission.

Based on the information gathered from the said reports, inquiries, and data from open sources such as the social media sites, KATUWANG POULTRY CHICKEN EGG PRODUCING CO. is apparently promising its prospective investors up to 120% in profit in just only six months depending on the amount of the initial investment.

As posted online on its own Facebook page, KATUWANG POULTRY CHICKEN EGG PRODUCING CO. offers four (4) types of investment options or levels, all of which have an option for the investor to earn 10% more in earnings from commissions through referrals. The first package offered starts with an initial investment of P50,000.00 as a minimum with a promised profit of 48% in just six months. The biggest package offered by KATUWANG POULTRY CHICKEN EGG PRODUCING CO. starts with an initial investment of P500,000.00 or more with a promised profit of 120% in just six months To wit:

The lock-in program of six months is basically how the investors earn passive income where the investor need not exert any effort except investing money. Hence, from the promise of 48% to 120% profit in just 6 months without any concrete business plan, it can be inferred that the income of its investors depends on subsequent investors which ultimately defeats sustainability because its whole system depends entirely on the new investors that will be lured in.

Although KATUWANG POULTRY CHICKEN EGG PRODUCINGCO. has been REGISTERED with the Commission as a partnership on 01 June 2021 under Company Registration No. PG202106004, it OPERATES WITHOUT THE NECESSARY LICENSE AND/OR AUTHORITY to solicit, accept or take investments/placements from the public nor to issue investment contracts and other forms of securities defined under Section 3 of the Securities Regulation Code (SRC).

Hence, the public is advised NOT TO INVEST or STOP INVESTING in any scheme offered by KATUWANG POULTRY CHICKEN EGG PRODUCINGCO. or such other entities engaged in investment taking schemes that are not registered with the Commission. SEC Advisory un Katuwang Poultry.

20. AYUDAFORALL COMPUTER TRADING

The Securities and Exchange Commission has received information that individuals or groups of individuals representing AYUDAFORALL COMPUTER TRADING (AFA)/AYUDA FOR ALL led by AIRO JOSHUA REJANO PORTUGAL are enticing the public to invest their money in the said entity with the promise of monetary rewards or profits.

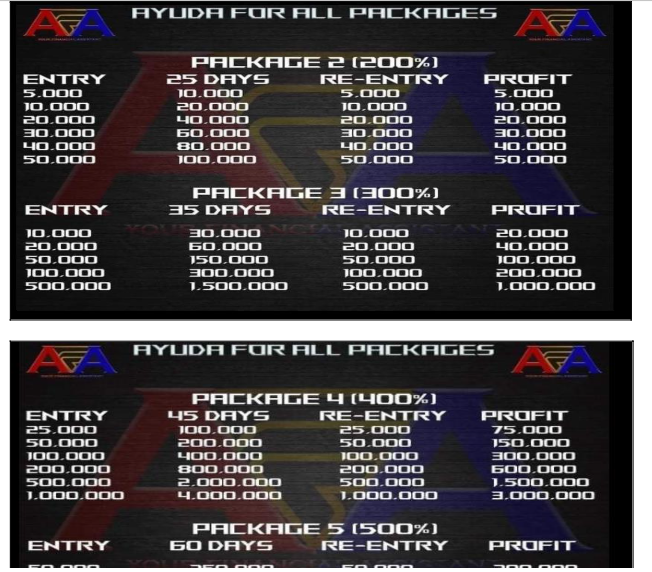

The company is enticing the public to invest in any of the six (6) packages they are offering which would earn an income ranging from 20% in just seven (7) days to as high as 500% for only sixty (60) days.Below are the promised income under the AYUDA FOR ALL PACKAGES:

As the above-described scheme of AYUDAFORALL COMPUTER TRADING/AYUDA FOR ALL(AFA) propagated by AIRO JOSHUA REJANO PORTUGAL involves the offering and sale of securities to the public, the Securities Regulation Code (SRC) requires that these securities are duly registered and that the concerned corporation and/or its agents have the appropriate registration and/or license to sell such securities to the public pursuant to Section 8 of the SRC.

Both AYUDAFORALL COMPUTER TRADING and AYUDA FOR ALL(AFA) are not registered with the Commission either as a corporation or as a partnership.

Having no primary registration and as the scheme it employs indicates a possible “Ponzi Scheme,” where monies from new investors are used in paying “fake profits” to prior investors and is designed mainly to favor its top recruiters and prior risk takers and is detrimental to subsequent members in case of scarcity of new investors, with more reason that it cannot be granted a secondary license that would allow it to solicit investments from the public. SEC Advisory on AyudaForAll

21. ECOMM SHARES/E-COMM SHARES

Based on information gathered by the Commission, a number of individuals or groups of persons claiming to represent ECOMM SHARES/E-COMM SHARES headed by its CEO and founder William Thomas are enticing the public to invest their money in said entity.

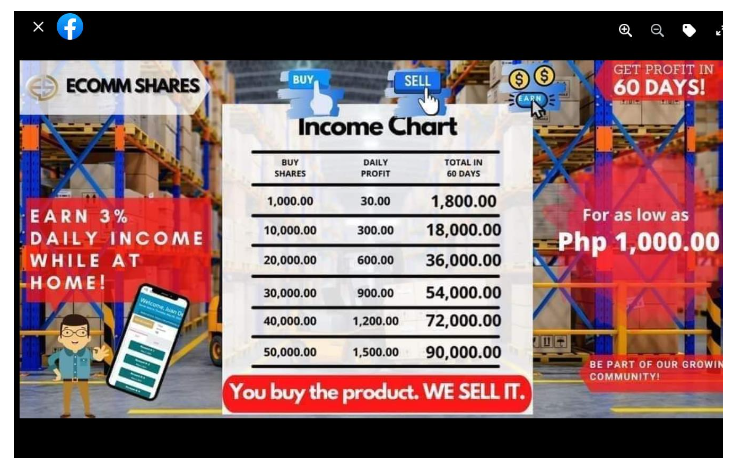

As posted online,ECOMM SHARES/E-COMM SHARES is offering a 3% daily income to its investor by just logging into his/her account and clicking the SELL button for a total of 60 days.

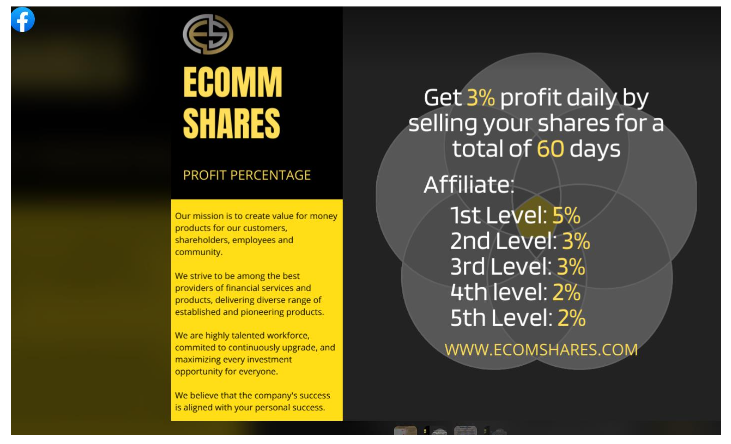

Further, it has a Direct Referral bonus which it calls Affiliate Rewards for its recruitment scheme.

The public is hereby informed that ECOMM SHARES/E-COMM SHARES is not registered with the Commission either as a corporation or as a partnership. Consequently, ECOMM SHARES/E-COMM SHARES is not authorized to solicit investments from the public as it did not secure prior registration and/or license to solicit investments from the Commission as prescribed under Section 8 of the Securities and Exchange Commission. SEC Advisory on ECOMM.

Violators are further warned that aside from the strict penalties imposed by the Commission for violations of the SRC, the Revised Corporation Code of the Philippines, and such other rules and regulations it enforces, the Bayanihan to Heal as One Act (Republic Act No. 11469) also punishes those participating in cyber incidents that make use or take advantage of the current crisis situation to prey on the public through scams, phishing, fraudulent emails, or other similar acts.

Furthermore, the names of all those involved will be reported to the Bureau of Internal Revenue (BIR) so that the appropriate penalties and/or taxes be correspondingly assessed. Selling or convincing people to invest in their investment scheme offered including solicitations and recruitment through the internet may likewise be criminally prosecuted and penalized with a maximum fine of Five Million pesos (P5,000,000.00) or a penalty of Twenty-one (21) years of imprisonment or both pursuant to Sections 28 and 73 of the SRC

In view thereof, the public is hereby advised to exercise caution in dealing with the above-mentioned and any individual or group of persons soliciting investments for and on behalf of the said illegal entities. The public is further advised NOT TO INVEST or to STOP INVESTING in the investment scheme being offered by them or their representatives through the entity.

Should you have any information regarding the operation of the subject entity, please submit your report to the Enforcement and Investor Protection Department at [email protected].

Visit the website of SEC for latest updates.

Trade Stocks: https://gtrade.ph/

Trade Crypto: https://www.binance.com/en/futures/ref/stockbytesph

Get a 10% discount on Binance trading fees: BNWCMBAU

*The owner of StockBytes PH is a licensed Stockbroker and Financial Advisor, contact us if you want to open an account and start investing in stocks.

Ready to start your financial journey? email us at [email protected] or follow our social media account and join our groups, Cheers!