Successful traders use both Fundamental and Technical Analysis in the stock market to evaluate a stock before they make a move. Fundamental analysis(FA) tells us the right stock to buy and Technical analysis(TA) tells us the right time to buy. However, most traders especially the day traders are more inclined to TA because it helps them to evaluate investments and identify trading opportunities in price trends and patterns seen on charts instead of diving into the deeper ocean of FA.

Technical Analysis is a method used to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. If you want to know the investor’s sentiment on a given stock you should look at the TA. Technical analysts believe past trading activity and price changes of security can be valuable indicators of the security’s future price movements.

Unlike fundamental analysis, which attempts to evaluate a security’s value based on business results such as sales and earnings, technical analysis focuses on the study of price and volume. Technical analysis tools are used to scrutinize the ways supply and demand for security will affect changes in price, volume, and implied volatility.

Technical analysis is often used to generate short-term trading signals from various charting tools, but can also help improve the evaluation of a security’s strength or weakness relative to the broader market or one of its sectors. This information helps analysts improve their overall valuation estimate. Technical and Fundamental analysis reports are often available on the online platform of brokers some also send these reports via email.

There are three main principles of technical analysis:

- Market action discounts everything

It means that over any period of time, all factors – those that have happened, are expected to happen, and could happen – are priced into the market. As things change, such as market risks, the market adjusts along with the prices, reflecting that new information. - Prices move in trends

Technical analysts believe prices move in short-, medium-, and long-term trends. In other words, a stock price is more likely to continue a past trend than move randomly. Most technical trading strategies are based on this assumption. - History repeats itself

Price movements can be attributed to market psychology and market participants react in a consistent manner to market stimuli over time. These price patterns become repetitive over time and across asset classes.

Technical analysis uses market psychology and concepts like herding to explain market sentiment. Trading relies heavily on human behavior and market psychology, which rely on the view that humans react in similar ways to similar situations. This human behavior and tendency to react in similar ways leads to predictable behaviors. These behaviors are seen in the market through market patterns, which is why traders use patterns to project or predict future price action.

There are three main charts that technical analysts use:

While each of the charts above can be important, the line chart and candlestick chart are the most widely used by traders. The line chart is easy to understand, as it simply shows the changes in prices (often times closing prices). Since traders care about both price changes (the opening and closing price of a stock) and the price movement of a stock during a specific timeframe, candlestick charts are often used. Candlestick charts help traders visualize price changes over periods and, since they are a bit more complex, we will discuss candlestick charts below.

Candlestick Charts

The above graphic shows how candlestick charts work. On the left side, you can see the price movements of a stock during a trading day. It shows the opening price, the high, low, and closing price. A candlestick is a powerful tool because it is a way to visualize all four of these points in one small visual. On the right side, you can see the green candlestick. The bottom tail depicts the low for the day, the start of the lower body shows the open for the day, the top of the body shows the close, and the top tail shows the high for the day. The color of the candlestick is important as it depicts a positive or negative day. The colors used here are green (up day) and red (down day).

As you can see, the green candlestick shows a stock that closed at a higher price than it opened. The red candlestick closed at a lower price than it opened. Candlesticks are a great way to visualize the range a stock moves during a specific time period.

To better understand how candlesticks can work with time periods, we can view the below graphic.

As you can see, a candlestick can be visualized as anything from intraday and daily, to weekly and monthly. The candlestick chart time scale you choose may depend on how short or long you hold positions before you sell or your trading style. Between candlestick charts, line charts, and bar charts, you may be wondering which type you should choose. In general, it comes down to personal preference. Traders will sometimes look at both line charts and candlestick charts, or line charts and bar charts. Since bar and candlestick charts show the same general data, you can use whichever chart you prefer.

Chart Patterns

Technical analysts use chart patterns to target potential trades. They can help traders pinpoint potential entry and exit points as well as whether the stock may reverse (reversal pattern) or continue (continuation pattern) its price movement.

There are two main chart patterns. Each of these patterns can be either bullish or bearish.

- Reversals

o Bullish Reversals

o Bearish Reversals

- Continuation Pattern

o Bearish Continuation

o Bullish Continuation

Bullish vs. Bearish Reversal

The below graphic shows a bullish double bottom pattern vs. a bearish double top pattern.

The bottom graphic shows a bullish reversal pattern. This would be a potential bullish trade that could lead to profit. The top graphic shows a bearish reversal pattern. This may signal a price you may not want to buy considering it has the potential to lose value.

Bearish Reversal Patterns

There are five main bearish reversal patterns seen above. You may notice that bearish reversal patterns begin with a bearish price movement that reverses to an increase in the stock price. This is because the bearish trend of the stock price is reversing, leading to an uptrend in the stock.

The double bottom (and the triple bottom) are patterns wherein the price of a stock will hit a bottom two (or three) times before leading to a breakout. The double and triple bottom patterns have a neckline that can be drawn from the highest point after the first bottom (and second bottom for triple bottoms).

An inverted head and shoulder resemble an upsidedown head with two shoulders (see below head and shoulders to better see the image of a head with two shoulders). An inverted head and shoulders pattern has the head as the lowest point and two shoulders with a neckline. The height from the neckline to the head is used to create a bullish price target. The distance from the head to the neckline is used as the upward price target.

A falling wedge (also known as a bullish wedge) shows a pattern wherein the distance between the highs and lows are declining, leading to a wedge-like pattern. As the distance between the highs and lows is compacting in a downward pattern, it leads to a consolidation in the price action. Eventually, if the stock breaks the downtrend line (the line on top in the above graphic) the stock can breakout, which is why this is a bearish reversal (the stock is reversing from a bearish pattern to a bullish pattern).

The rounding bottom is a somewhat rare pattern that begins with a bearish trending price. The price enters a prolonged consolidation phase (the bottom) which eventually turns into a bullish trend. The consolidation phase of the rounding bottom can last for weeks or months before the bullish trend begins.

Bullish Reversal Patterns

Similar to the bearish reversals, there are five main bullish reversal patterns seen above. Bullish reversals start with a bullish price movement reverse into a decreasing stock price. This is because the bullish trend of the stock is reversing, leading to a downtrend in the stock.

The double top (and the triple top) are patterns wherein the price of a stock will hit a high two (or three) times before leading to a breakdown. The double and triple top patterns have a neckline that can be drawn from the lowest point after the first top (and second top for triple tops).

The head and shoulders pattern resembles a head (peak) with two shoulders. The head is the highest point with the bottom of the two shoulders being the neckline. The height from the neckline to the head is used to create a bearish price target. The distance from the head to the neckline is used as the downward price target.

A rising wedge (also known as a bearish wedge) shows a pattern wherein the distance between the highs and lows are declining in an upward pattern, leading to a wedge-like pattern. As the distance between the highs and lows is compacting, it leads to a consolidation in the price. Eventually, if the stock breaks the downtrend line (the line on the bottom in the above graphic) the stock can breakdown, which is why this is a bullish reversal (the stock is reversing from a bullish pattern to a bearish pattern).

The rounding top is a somewhat rare pattern that begins with a bullish trending price. The price enters a prolonged consolidation phase (the top) which eventually turns into a bearish trend. The consolidation phase of the rounding bottom can last for weeks or months before the bullish trend begins.

Bullish vs. Bearish Continuation

The below graphic shows a bullish falling wedge and a bearish rising wedge.

Bullish Continuations Patterns

There are five main bullish continuation patterns seen above. As you can see, the prices begin with appreciation, then have a consolidation phase, then a breakout phase. Below you can see more about the five bullish continuations above.

The symmetrical triangle above is a bullish continuation pattern wherein the slope of the triangle is equal or nearly equal. The slopes converge at a point and the above symmetrical triangle is a continuation pattern since it begins with an uptrend and ends with an uptrend.

The above pattern shows a bullish ascending triangle. The ascending triangle includes a flat line on the top connecting the peaks and a line with a slope connecting the troughs.

The bullish flag pattern includes a steep uptrend (known as the flagpole) followed by a slight downtrend channel. The flag pattern above ends with an uptrend in price confirming the bullish pattern.

Similar to the bullish flag, the bullish pennant starts with a flagpole (steep uptrend in price). The difference between the bullish flag and bullish pennant is that the bullish pennant has two converging lines while the bullish flag includes parallel lines creating a channel.

The cup and handle begins with an uptrend in price followed by a longer consolidation phase. The consolidation phase is then followed by an uptrend and then a shorter consolidation phase followed by another breakout.

Bearish Continuations Patterns

There are four main bearish continuation patterns seen above. As you can see, the prices begin with a decline in prices, then a sideways phase, then a breakdown phase. Below you can see more about the four bearish continuations above.

The symmetrical triangle above is a bearish continuation pattern wherein the slope of the triangle is equal or nearly equal. The slopes converge at a point and the above symmetrical triangle is a continuation pattern since it begins with an downtrend and ends with an downtrend.

The above pattern is a bearish descending triangle. The pattern includes a flat line on the bottom connecting the troughs and a line with a slope connecting the peaks. This pattern begins with a downtrend and continues with a downtrend after some consolidation.

The bearish flag pattern includes a steep downtrend (flagpole) followed by a slight uptrend channel. The flag pattern above ends with an downtrend in price confirming the bearish pattern.

Trend Analysis

There are three distinct trends seen in technical analysis:

The above trends show the direction of prices given the trend. The uptrend line show a rising stock price, the downtrend line shows a falling stock price, and the sideways trend shows neutral price movement for a stock over a given timeframe. When it comes to trends, there are three different timeframe classifications.

- Minor trend (<2 or 3 weeks)

- Secondary Trend (3 weeks – several months)

- Major trend (>1 year)

The above graphic shows the three different trends.

- The top chart shows a minor trend (a few weeks).

- The middle chart shows a secondary trend (a few months).

- The bottom chart shows a minor trend (1 year).

Another important trend for traders is support and resistance.

Above you can see a graphic depicting support and resistance. A trader would buy after a breakout of resistance. The trader holds the investment when it’s close to support and sells after a breakdown under the support line. Another important tool for trend analysis is the trend line and channel line.

You can see above an example of the trend line (bottom) and the channel line (top). Like the support and resistance lines, the trendline and channel line can help traders decide where to buy and sell a stock.

If the stock breaks through the channel or the trend line, this could lead to the purchase or sale of the stock. Above you can see the breakout so the trader buys the stock. However, be careful of a throwover, which you can see above did not actually lead to a breakout.

Another important trend is called Fibonacci Retracement. This is a tool applied by traders to project the retracement of a stock price. There are common retracements seen in stock prices and they often fall into the 33%, 50%, and 66% levels. Meaning that a stock may retrace down or up by one of these percentages. Traders will use these retracement levels to plan their entry and exit points.

If you look at the white line above, you will see the retracement is drawn after it hits the 200 price point. The subsequent white line, tan line, and red line, show the potential retracement levels. These are the levels you may use for support lines. While the Fibonacci Retracement above shows a negative retracement, Fibonacci can also be used for a positive retracement. With a positive retracement, you would use the lines as resistance lines instead of support lines.

Other Indicators

While we touched on some tools utilized by traders above, there are a handful of other technical indicators applied by traders. These tools range from trading volume and moving averages, to oscillators.

Volume indicator

The volume is the number of shares traded over a given period, which is crucial information for the selling/buying of stocks. Volume analysis is the technique of assessing the health of a trend based on volume activity. The volume indicator is the most popular indicator used by market technicians.

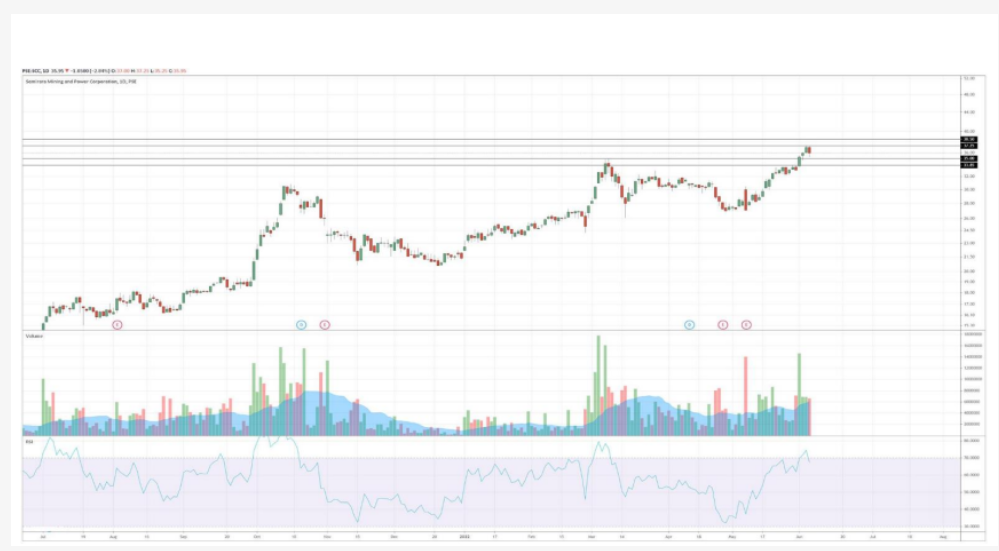

Below shows a stock’s price movement (candlestick chart) and the volume of the stock.

The blue bars at the bottom of the above chart represent the volume. Comparing the volume of trades to certain movements is an important aspect of trading and technical analysis since some predictive patterns and trends may rely on volume.

Volume indications

A rise in volume indicates that

- Market participants are interested in seeing the price go higher in an uptrend and are willing to buy higher in order to participate in upcoming market action.

- Market participants are interested in seeing prices go lower in a downtrend and are willing to sell lower in order to participate in the upcoming market action.

A decline in volume indicates

- Market participants are losing interest in seeing the price go higher in an uptrend and are more willing to buy lower.

- Market participants are losing interest in seeing the price go lower in a downtrend and are more willing to sell higher.

Volume is a very important factor for most trades. Another popular technical tool is called the moving average.

Moving Averages

Moving averages (MA) are widely used indicators used to identify trends, execute trades, and act as support and resistance. MA is the price of a stock averaged out over time, giving a smoother line than the individual prices that are more volatile due to short-term “noise”. Long-term traders often look at the 50-, 100- and 200- day simple moving average (SMA). Short-term traders prefer the 5- and 20-day MA as these represent a week and a month.

3 types of moving averages

- Simple moving average (SMA): The SMA is by far the most common moving average. It simply takes the closing stock price and averages it out over a period of time.

- Weighted moving average (WMA): The WMA puts more weight on the most recent data.

- Exponential moving average (EMA): The EMA places greater weighting on the most recent data but it also considers the data set. This is widely used by more experienced traders.

The above chart shows the price movement of a stock over a ten-year period. As you can see, the red line is the 12-month MA, the blue line is the 24-month MA, and the grey line is the 60-month MA. You may notice that the stock has times when it is trading much higher than the moving averages and times when it’s trading lower than the moving averages. The moving averages can also act as a form of support and resistance for stock prices.

Oscillators

An oscillator is a secondary indicator that varies over time within a band. Oscillators are used to discover short periods of overbought or oversold conditions.

- An oscillator is most useful when its value has reached an extreme reading near the upper or lower end of its boundaries.

- A divergence between the oscillators and the price action when the oscillator is in an extreme position is usually an important indicator.

- Crossing the zero line can be an important trading signal in the direction of the price trend.

Examples of Oscillators:

Relative Strength Index (RSI)

RSI is a measure of the stock’s recent trading strength. When the price moves up very rapidly, at some point it is considered overbought. Likewise, when the price falls very rapidly, at some point it is considered oversold.

Moving Average Convergence Divergence (MACD)

MACD is an indicator using the change in a stock’s underlying price trend. The theory suggests that when a price is trending, it is expected that speculative forces “test” the trend. While the primary function is to identify turning points in a trend, the level at which the signals occur determines the strength of the reading.

When the MACD line falls below the signal line, it leads to a bearish signal (A). When the MACD line passes above the signal line it shows a bullish signal (B). The histogram helps visualize the relationship between the MACD line and the signal line.

Stochastics

The stochastics oscillator is a momentum indicator that uses support and resistance levels. The term stochastic refers to the location of a current price in relation to its price range over a period of time.

This method attempts to predict price turning points by comparing the closing price of a security to its price range. The idea behind this indicator is that prices tend to close near the extremes of the recent range before turning. The signal to act is when you have divergence-convergence, in an extreme area.

Bollinger Bands

Bollinger Bands use the simple moving average along standard deviation to create a “band” in which nearly 90% of stock prices trade within. The use of Bollinger bands is partly reliant on the squeezing together and moving apart of the bands. A squeeze occurs when the upper band and lower band move closer together. A squeeze means lower volatility and can be a signal of future higher volatility for a stock. The moving apart of the bands shows higher volatility and can be a signal of lower volatility in the future.

Trading stocks is not easy. It takes lots of effort, time, and energy to understand the financial markets. You have to read books and attend seminars and conferences.

You have to sift through tons of information to find the few pieces of information that will actually help you succeed. There are far too many technical indicators. There are too many stocks to analyze. There’s no way to know if something works until you try it out.

Technical analysis is not easy, but the good news is there is a lot of free material available on youtube and on social media. Cheers!

Trade Stocks: https://gtrade.ph/

Trade Crypto: https://www.binance.com/en/futures/ref/stockbytesph

Get a 10% discount on Binance trading fees: BNWCMBAU