THE MARKET SUMMARY

Although the economic momentum from the first quarter of 2024 carried into the second, the equity market experienced volatility. The index plunged to its lowest level in seven months during the penultimate week of the second quarter before rebounding at the end. Initially, investors scaled back expectations for central bank rate cuts due to US overheating concerns, which led to strong April data being poorly received by the markets. However, as the quarter progressed, the

worst of these fears subsided, and hopes for a soft landing were revived.

The sustained economic growth came at the cost of persistent inflation. While investors’ worries at the end of the first quarter were somewhat overblown, services inflation remained stubbornly above the levels targeted by central banks. Consequently, the rates markets continue to anticipate fewer rate cuts than were expected at the beginning of the year.

In this resilient environment, equities delivered a negative total return of -7.12% over the quarter. These losses were mainly seen in larger companies, with rate-sensitive small-cap stocks and REITs suffering due to the higher-for-longer interest rate environment.

After an initial uptick in April, US economic data softened over the quarter, generally coming in below consensus since early May. Despite this, the Federal Reserve maintained a hawkish stance at its June meeting, removing all but one rate cut from its 2024 projections.

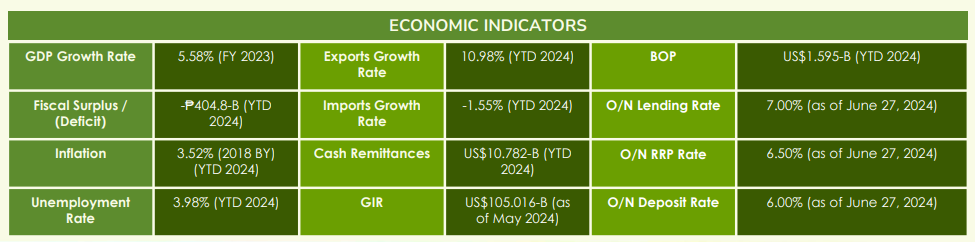

However, weak US consumer data gave investors some hope for policy easing, with rates markets still pointing to two cuts by the end of the year. The Philippine central bank kept its key policy rates unchanged for the sixth consecutive meeting. However, risks to inflation have now shifted to the downside, providing the central bank with room to possibly ease rates in August.

The bank revised its risk-adjusted inflation forecast to 3.1% for 2024 from 3.8% and for 2025 from 3.7%. Additionally, the baseline inflation forecast for the next two years was lowered, now seeing inflation averaging 3.3% this year from 3.5% and 3.1% in 2025 from 3.3%.

Inflation in the Philippines picked up to a six-month high of 3.9% in May, bringing the five-month average to 3.52%, still within the central bank’s 2-4% target range.

Overall, the second quarter built on the successes of the first. Despite some weaknesses in US consumer data towards the end of June, economic momentum remained generally positive, and equity markets were buoyant as valuations stayed high among mega-cap names. While the cost of this economic resilience was primarily felt in core fixed income, multi-asset investors can take comfort in the fact that, despite short-term underperformance, the overheating worries of April

appear to be behind us.

Markets are confident that the next move for central banks will be to ease policy rather than

tighten it, making the medium-term outlook for fixed income still attractive.

THE STORIES THAT SHAPED THE MARKET

May Inflation

Inflation accelerated to a six-month high in May, driven by the faster rise in utility and transport costs, the Philippine Statistics Authority (PSA) said. The consumer price index (CPI) picked up to 3.9% year on year in May from 3.8% in April but slowed from 6.1% in the same

month last year.

It was the fastest inflation since 4.1% in November and matched the 3.9% inflation in December.

May inflation also fell within the central bank’s 3.7-4.5% forecast for the month. However, it was slightly below the 4% median estimate in a poll of analysts.

May also marked the fourth straight month of faster annual inflation, and the sixth straight month that inflation settled within the central bank’s 2-4% target band.

Month on month, inflation inched up by 0.1%. Stripping out seasonality factors, month-on-month inflation picked up by 0.3%.

Core inflation, which excludes volatile prices of food and fuel, slowed to 3.1% in May from 3.2% in April and 7.7% in the same month a year ago.

From January to May, headline inflation averaged 3.52%, matching the central bank’s full-year forecast. The inflation outturn is consistent with central bank expectations that inflation could temporarily accelerate above the target range over the near term due to adverse weather conditions on domestic agricultural output and positive base effects.

National Statistician Claire Dennis S. Mapa said the inflation uptick was driven by the faster increase in the housing, water, electricity, gas and other fuels index. It rose to 0.9% in May from 0.4% in April.

One of the main contributors to the increase in housing, water, electricity, gas, and other fuels was the slower pace of decrease in electricity prices, and the faster rise in prices of liquified petroleum gas (LPG), which had 9.4% inflation.

He also noted that the yellow and red alerts placed on the Luzon and Visayas grids contributed to higher electricity prices. Mr. Mapa also noted the faster annual growth in transport index at 3.5% in May from 2.6% in the previous month and -0.5% in May 2023. This was driven by higher gasoline and diesel prices, as well as rising fares for passenger transport by sea.

Meanwhile, the heavily weighted food and non-alcoholic beverages index was the main contributor to overall headline inflation, accounting for 56.6% or 2.2 percentage points (ppts).

The food index rose to 5.8% in May, slowing from 6% a month ago and 7.4% in May 2023. The cereals and cereal products index, which includes rice, eased to 16.6% from 16.9% in April.

Rice inflation eased to 23% from 23.9% a month earlier. May marked the second straight month of slower rice inflation. PSA data showed that the average price of a kilo of well-milled rice declined to P56.06 in May from P56.42 in April while special rice dropped to P64.41 from P64.68 per kilo.

Mr. Mapa noted that rice prices continue to see “incremental decreases” as global rice prices are also going down. He also cited faster inflation in the ready-made and other food products, particularly ginger. The average price of a kilo of ginger rose to P148.72 in May from P127.66 in April.

Meanwhile, the inflation rate for the bottom 30% of income households settled at 5.3% in May, the same as a month ago but slower than 6.7% a year earlier.

In the first five months, the inflation rate averaged 4.6% for the bottom 30%. In the National Capital Region (NCR), inflation quickened to 3.1% from 2.8% in April. Inflation in areas outside NCR averaged 4.1%, unchanged from the previous month.

Meanwhile, the central bank said that risks to the inflation outlook continue to tilt toward the upside. Possible further price pressures are linked mainly to higher transport charges, elevated food prices, higher electricity rates, and increase in global oil prices, it said. However, the central bank said it still expects average inflation to return to the target range for both 2024 and 2025.

PSA’s Mr. Mapa said that inflation could ease further after the National Economic and Development Authority (NEDA) Board recently approved a medium-term plan to reduce tariffs on key agricultural and industrial products. Tariffs for rice imports will be slashed to 15% from 35% previously until 2028.

NEDA Secretary Arsenio M. Balisacan said in a statement on Wednesday that the tariff reduction will help manage food inflation, promote policy stability and investment planning, and enhance food security.

Monetary Policy

The Philippine central bank kept interest rates steady for a sixth straight meeting but signaled that a rate cut at its next meeting in August is somewhat more likely than before, with up to 50 basis points (bps) in easing likely this year.

The Monetary Board on Thursday left its target reverse repurchase rate unchanged at 6.5%, the highest in over 17 years. This was in line with the expectations of all analysts in a poll.

Interest rates on the overnight deposit and lending facilities were also maintained at 6% and 7%, respectively.

Central bank Governor Eli M. Remolona, Jr. said he expects inflation to further ease in the second semester with the implementation of lower tariffs on rice. The balance of risks to the inflation outlook has shifted to the downside for 2024 and 2025 due largely to the impact of

lower import tariffs on rice under Executive Order (EO) No. 62, he said.

If sustained, an improvement in the inflation outlook would allow more scope to consider a less restrictive monetary policy stance.

President Ferdinand R. Marcos, Jr. earlier this month signed EO 62 which slashed tariffs on rice imports to 15% until 2028 to tame rice prices.

Mr. Remolona said that inflation is moving closer to the midpoint of its 2-4% target, adding that expectations are still well-anchored.

The central bank slashed its risk-adjusted inflation forecast for this year to 3.1% from 3.8% previously. It also cut its risk-adjusted estimate for 2025 to 3.1% from 3.7% earlier.

Meanwhile, it lowered its average baseline inflation forecast for 2024 and 2025 to 3.3% and 3.1%, respectively, from 3.5% and 3.3%, previously.

Nonetheless, higher prices of food items other than rice, transport charges, and electricity rates continue to pose upside risks to inflation, Mr. Remolona said. Meanwhile, prospects for domestic output growth remain in line with medium-term trends amid favorable labor market conditions and strong net exports.

He said the Monetary Board is on track to cut rates when it next meets on Aug. 15. This will likely be ahead of the US Federal Reserve which earlier signaled it may start easing in December.

The central bank could cut rates by 25 basis points (bps) in the third quarter and by another 25 bps in the fourth quarter, he added.

The Monetary Board’s Aug. 15 review is its only meeting in the third quarter. Meanwhile, its last two reviews for the year will be held in the fourth quarter and are scheduled on Oct. 17 and Dec. 19.

Analysts noted the more dovish signals from the central bank compared with its previous meetings.

Tellingly, the read-out this time didn’t contain any language about how policy needs to be “sufficiently tight,” saying instead that an improvement in the inflation outlook going forward would allow for some scope for policy to be “less restrictive.”

The central bank’s tone is perhaps slightly more dovish, not closing the possibility of it cutting ahead of the Fed. The central bank was even more confident than last time, reflecting the fact that monetary policy in the Philippines may be becoming more independent from the Fed, even if partially.

However, August may still be too soon to loosen policy reins. It is unlikely that inflation will be soft enough by the August meeting with the rice tariff rate cut needing time to work its way

in reducing prices.

It may be too early to cut rates as inflation is still hovering near the upper bound of the 2-4% target as upside risks from food prices continue to linger.

The central bank may be expected to start cutting rates in early 2025 if inflation consistently moves towards the midpoint of the official target range in the first quarter of 2024. The core view still is that the Monetary Board will start a gradual normalization of policy in August with a 25-bp rate cut, following this on with similar-sized reductions in the October and December meetings.

Meanwhile, Mr. Remolona said the central bank is occasionally intervening in the peso.

However, Mr. Remolona said that the peso’s effect on inflation is not very large, estimating it at 0.36% per 1% depreciation of the peso. Since the beginning of the year, the peso has depreciated by 5.7%. So, 5.7% against 0.36%, that adds up to a total about 0.2% in inflation.

Mr. Remolona said that the central bank is active in intervening when it senses stress in the market, coming in only to slow down the tendency of the peso to depreciate sharply.

The Development Budget Coordination Committee raised its foreign exchange rate assumption to a range of P56-P58 this year, a higher band than its P55-P57 range previously.

This Market Recap is provided by Globalinks Securities and Stocks Inc.