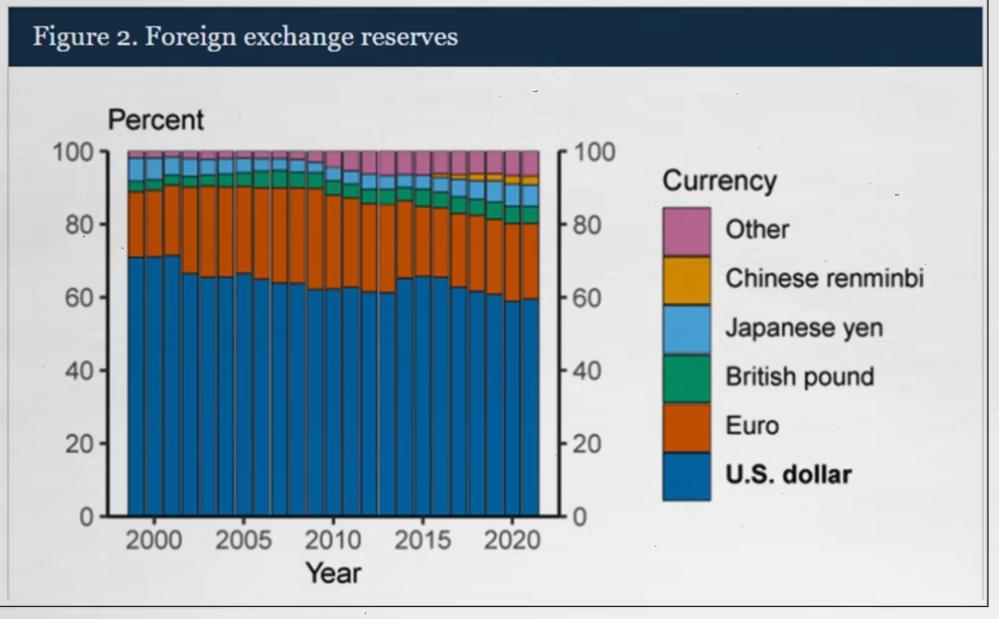

This question refers to the ongoing debate and speculation about the future of the US dollar as the world’s dominant reserve currency. There are various reasons why people are questioning the dollar’s status, including the growing influence of other currencies such as the Chinese yuan, the euro, and cryptocurrencies. It is important to closely monitor global economic trends and geopolitical developments to better understand the potential risks and opportunities for the US dollar and other currencies in the future.

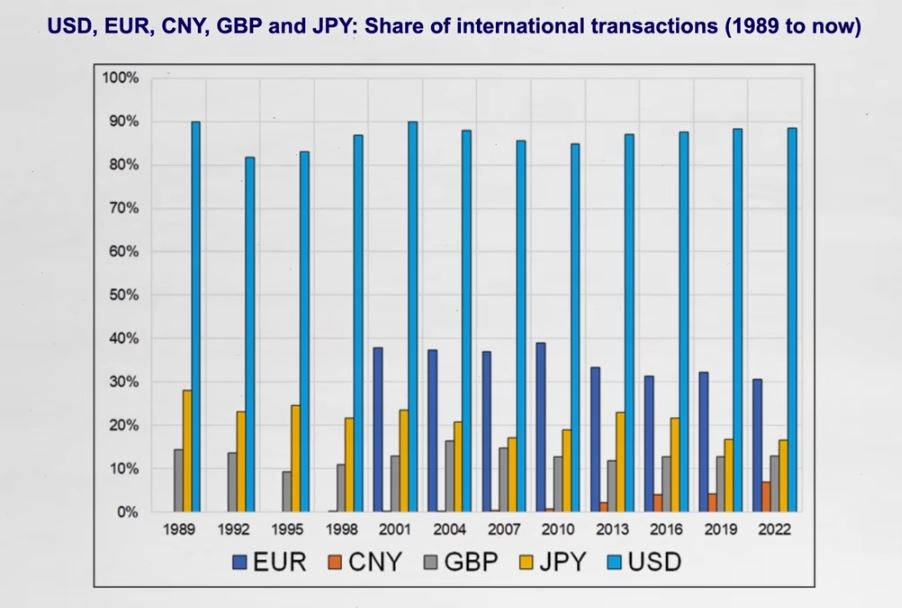

The US dollar has been the dominant currency in the world for decades. It is the currency in which oil is priced, and it is the currency of choice for international transactions. However, in recent years, there has been talk about the decline of the US dollar and the potential rise of other currencies.

Some experts argue that the dollar’s position as the world’s reserve currency is unsustainable in the long run due to factors such as the increasing US debt levels and the Federal Reserve’s monetary policy. Others argue that the dollar’s dominance will continue for the foreseeable future due to the strength of the US economy and the stability of its political institutions.

The World Reserve Currency

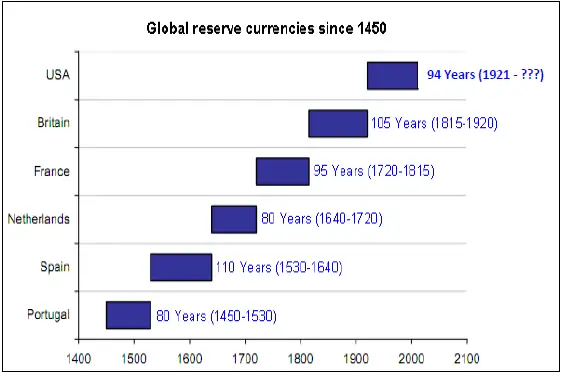

Let’s start with the concept of world reserve currencies and what it actually means to be one. Before the US dominated the world reserve currency status, there were others that eventually ended like France, which held the reserve status from 1720 to 1815, followed by Great Britain from 1815 to 1920. The US dollar became the world reserve currency shortly after that with the creation of what’s called the Bretton Woods Agreement. In other words, the US has held its world reserve currency status for about a hundred years now.

According to billionaire Ray Dalio, who studied this, he says this changes every 94 years or so. So we’re technically past the point of expiration.

Once a currency becomes a global world reserve currency, it usually comes with three new superpowers. Number one is stability. Stability allows for international trade, and if you want to trade with each other, you need a common language and a common money that everyone can agree on.

Most countries just don’t trust each other because they don’t know how much the other country is printing its own monetary supply. So instead, they could use a world reserve currency, knowing that no matter what asset or commodity they trade, it’ll always be backed by something stable and something that has value.

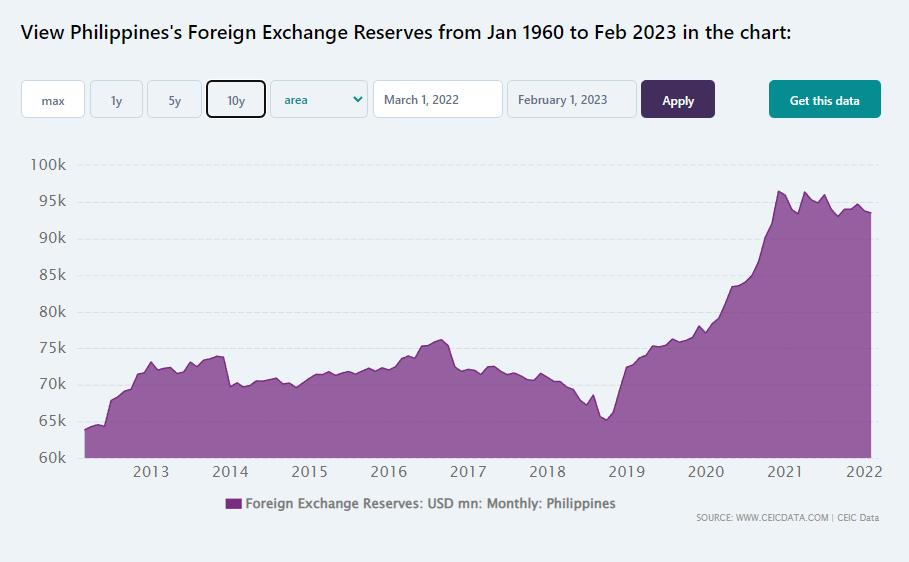

Philippines Foreign Exchange Reserves were measured at 85.4 USD bn in Feb 2023, compared with 86.3 USD bn in the previous month.

The second superpower is that the country with the world reserve currency becomes an investing powerhouse because the world likes to use the most stable money, which right now are dollars. The world also has to have a dollar wallet. Those are called foreign exchange reserves, which are partially held in dollars. But just like every other US bank, not every country will use all the money inside its dollar wallet.

So what it doesn’t use, it will then invest into US treasuries and securities. Countries like Japan, China, and the UK are some of the largest holders of US assets through their foreign reserves. And all in all, the US has anywhere between seven to eight trillion dollars worth of foreign investment. Just for context, that amount of money is about the same size as the entire GDP of Germany, the UK, and India combined.

Now the third superpower of the US dollar is the dollar’s exclusive ability to buy oil. Shortly after World War II, since the US was pretty much the only standing superpower left, it created something called the Bretton Woods Agreement, which essentially tied all currencies around the world to the US.

So, is it the end of the US Dollar?

There are several reasons why people are questioning the future of the US dollar. One of the main reasons is the huge amount of debt that the United States has accumulated over the years. The US has a debt-to-GDP ratio of over 100%, which means that it owes more than it produces. This has led some people to believe that the US dollar is in danger of losing its status as the world’s reserve currency.

Another reason why people are questioning the future of the US dollar is the rise of China. China has been growing rapidly over the past few decades, and it is now the world’s second-largest economy. Some experts believe that China’s currency, the yuan, could eventually become the dominant currency in the world, surpassing the US dollar.

In addition to China, other countries are also looking to diversify away from the US dollar. Russia, for example, has been reducing its holdings of US dollars and buying gold instead. Other countries such as Iran and Venezuela have also been moving away from the US dollar and looking for alternative currencies to use in international transactions.

The COVID-19 pandemic has also had an impact on the US dollar. The pandemic has led to a massive increase in government spending, which has added to the already high levels of debt. The US Federal Reserve has also been printing more money in order to support the economy, which has led to concerns about inflation and the value of the US dollar.

Despite these challenges, it is important to remember that the US dollar is still the dominant currency in the world. It is still used for the majority of international transactions, and it is still the currency in which oil is priced. The US also has a very strong economy and a stable political system, which are important factors in maintaining the value of its currency.

Conclusion

The US dollar remains a strong reserve currency due to several factors. Firstly, the US economy is the largest in the world, and the dollar is the most widely traded currency globally. This gives the US a significant advantage in terms of global financial influence. Secondly, the stability of the US political system and its institutions, as well as the country’s history of low inflation and consistent economic growth, make the dollar a reliable currency for international trade and investment. Finally, the US government’s willingness to defend the value of the dollar and maintain its status as a reserve currency also contributes to its continued strength.

Despite challenges such as rising economic competition from China and political polarization within the US, the country remains a superpower due to its military might, technological innovation, and cultural influence. The US military is the most powerful in the world, and its technological capabilities in areas such as artificial intelligence and space exploration are unmatched. Additionally, US popular culture, including movies, music, and television, has a significant global impact. While the US faces both internal and external challenges, its position as a superpower and the strength of the US dollar as a reserve currency are likely to persist in the near future.

While there are certainly challenges facing the US dollar, it is unlikely that it will lose its status as the world’s reserve currency in the near future. However, it is important for the US to address its debt and inflation concerns in order to maintain the strength of its currency. Only time will tell if the US dollar will continue to dominate the world of currency or if other currencies will eventually take its place.