Converge ICT is the largest high-speed fixed broadband provider in the Philippines, by high-speed residential fixed broadband subscriptions, with a 54% market share as of 1Q2020. It is considered as the only pure-play high-speed fixed broadband provider, with an exclusive focus on serving the Philippine fixed broadband market. Its public offering will run from Oct. 13 to Oct. 19 2020 with a tentative listing date on Oct. 27, 2020.

The company boasts its fast internet connection with its fiber optic backbone. The satisfaction rate has been quite high and may see some shift from leading telco providers to theirs.

Converge ICT Solutions Inc. has narrowed its initial public offering guidance to a price range that will allow it to raise as much as P32.95 billion. Reuters reported that Converge was looking at selling its shares at P16.50 to P19 each share instead of the P24 a share originally planned.

The stock symbol is TBA in PSE Edge, but according to the company they are planning to use $FIBER or $CICT. Edited Final stock code $CNVRG

The offering involves 480.84 million primary shares and 1.02 billion secondary shares plus an overallotment option of 225.79 million shares. The final offer price will be set on October 9 following a book-building process. The offer period will run from October 13 to 19 while the shares will start trading on the stock exchange on October 27.

Morgan Stanley and UBS AG are the joint global coordinators and joint book-runners. Other international joint bookrunners are Credit Suisse (Singapore) Ltd. and Merrill Lynch (Singapore) while BPI Capital is the sole local coordinator, joint local underwriter, and joint bookrunner alongside BDO Capital. Source.

Subscriber growth backed by proven strong execution

In the first quarter of 2020, Converge ICT continues to be the fastest-growing fixed broadband operator in the country, capturing a 59% market share of total new fixed broadband subscriptions, according to MPA.

This growth was primarily driven by our unique ability to attract customers who are subscribing to fixed broadband services for the first time, with these first-time subscribers comprising the majority of our new gross subscriber additions in 2019.

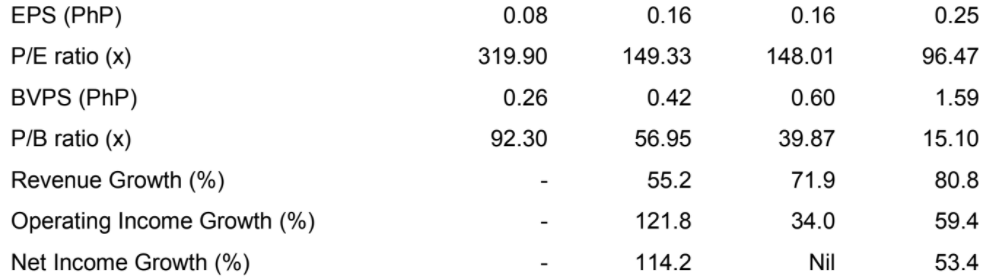

Financial Metrics:

Buy or Pass?

We can see the appetite of the investing public to Internet Service Providers and Telcos with $NOW, $DITO and $C rallying there is one thing for sure, the demand is there, with Converge ICT lowering the price range for the offering, this looks so appealing now to investors. My verdict? Buy.

Here is the Part 1 of the review: Converge ICT IPO Review Part 1

Converge ICT Latest Prospectus Link

How to get shares

The owner Stockbytes is a licensed stockbroker you can message us to open an account, we can reserve shares for you given you have a broker-assisted or online account with us. StockBytes is a registered broker under Globalinks Securities and Stocks Inc.

If you wish to get shares from your broker you can directly message them, please note that shares will only available only on the offer period October 13-19, 2020. Or thru Local Small Investor (LSI) thru PSE Easy which has a limit of P100,000 worth of shares only. Top online brokers like COL financial given the number of their clients sometimes raffle IPO shares, so some clients only get small allocations per account. It is easier to get IPO allocations via Broker-assisted trading.

Learn more about IPO: Complete IPO Guide by StockBytes

*The owner of StockBytes PH is a licensed stockbroker, contact us if you want to open a broker-assisted or online account. Contact us/Services.

Ready to start your financial journey? email us at [email protected] or follow our social media account and join our groups, Cheers!